Wine futures offer investors the opportunity to purchase wine before its release, potentially capturing value appreciation as the wine matures, while hedge funds employ diverse strategies to maximize returns and mitigate risks across various asset classes. Both investment options appeal to those seeking portfolio diversification beyond traditional stocks and bonds. Explore the nuanced benefits and risks of wine futures versus hedge funds to determine the optimal investment strategy for your financial goals.

Why it is important

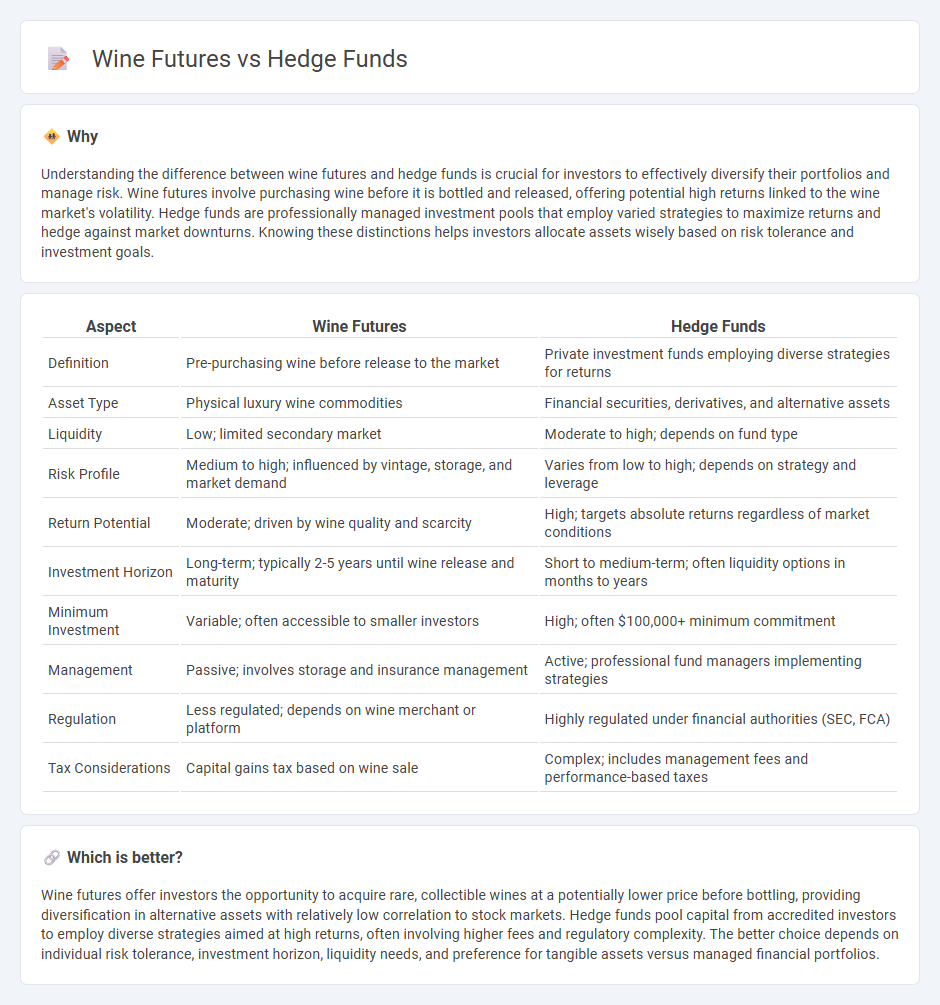

Understanding the difference between wine futures and hedge funds is crucial for investors to effectively diversify their portfolios and manage risk. Wine futures involve purchasing wine before it is bottled and released, offering potential high returns linked to the wine market's volatility. Hedge funds are professionally managed investment pools that employ varied strategies to maximize returns and hedge against market downturns. Knowing these distinctions helps investors allocate assets wisely based on risk tolerance and investment goals.

Comparison Table

| Aspect | Wine Futures | Hedge Funds |

|---|---|---|

| Definition | Pre-purchasing wine before release to the market | Private investment funds employing diverse strategies for returns |

| Asset Type | Physical luxury wine commodities | Financial securities, derivatives, and alternative assets |

| Liquidity | Low; limited secondary market | Moderate to high; depends on fund type |

| Risk Profile | Medium to high; influenced by vintage, storage, and market demand | Varies from low to high; depends on strategy and leverage |

| Return Potential | Moderate; driven by wine quality and scarcity | High; targets absolute returns regardless of market conditions |

| Investment Horizon | Long-term; typically 2-5 years until wine release and maturity | Short to medium-term; often liquidity options in months to years |

| Minimum Investment | Variable; often accessible to smaller investors | High; often $100,000+ minimum commitment |

| Management | Passive; involves storage and insurance management | Active; professional fund managers implementing strategies |

| Regulation | Less regulated; depends on wine merchant or platform | Highly regulated under financial authorities (SEC, FCA) |

| Tax Considerations | Capital gains tax based on wine sale | Complex; includes management fees and performance-based taxes |

Which is better?

Wine futures offer investors the opportunity to acquire rare, collectible wines at a potentially lower price before bottling, providing diversification in alternative assets with relatively low correlation to stock markets. Hedge funds pool capital from accredited investors to employ diverse strategies aimed at high returns, often involving higher fees and regulatory complexity. The better choice depends on individual risk tolerance, investment horizon, liquidity needs, and preference for tangible assets versus managed financial portfolios.

Connection

Wine futures provide hedge funds with alternative investment opportunities by allowing them to purchase rare wines before they are bottled and released, potentially yielding high returns as wine ages and appreciates in value. Hedge funds leverage this market inefficiency and price volatility to diversify portfolios and manage risk beyond traditional assets like stocks and bonds. Strategic investment in wine futures aligns with hedge funds' goals of capital preservation and alpha generation in non-correlated asset classes.

Key Terms

Leverage (Hedge funds)

Hedge funds utilize leverage to amplify returns by borrowing capital, often employing ratios ranging from 2:1 up to 10:1 depending on their risk profile and strategy, which increases both potential gains and losses. In contrast, wine futures trading involves significantly lower leverage, generally relying on partial payment upfront for future delivery, reducing financial risk compared to hedge fund leverage practices. Explore the nuanced differences in leverage strategies between hedge funds and wine futures for a deeper understanding of investment risk management.

En Primeur (Wine futures)

Hedge funds leverage complex financial strategies involving derivatives and leveraged positions to generate high returns, often with significant risk exposure. En Primeur wine futures allow investors to purchase wines while still in the barrel, securing lower prices and potential appreciation as the wine matures and gains market value. Explore the dynamics of wine futures investment and its comparison with hedge fund tactics to deepen your understanding of these alternative assets.

Liquidity

Hedge funds typically offer high liquidity, allowing investors to buy or sell assets quickly due to their focus on liquid securities and active trading strategies. In contrast, wine futures are less liquid, with transactions often requiring longer holding periods and involving niche markets where sales depend on wine release schedules. Explore the nuances of liquidity in hedge funds versus wine futures to optimize investment decisions.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms that raise capital from institutional and accredited investors to invest in diverse, often alternative strategies aimed at achieving absolute returns, such as short-selling, derivatives, or event-driven investments, differentiating them from mutual funds that focus on relative returns.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment funds pooling money from sophisticated investors to pursue flexible strategies that often carry higher risks and are less regulated than mutual funds or ETFs, typically inaccessible to retail investors.

Hedge fund - Wikipedia - Hedge funds use complex trading and risk management techniques, charge management and performance fees, and while initially designed to hedge market risks, now employ a variety of strategies that can contribute to systemic risk, especially in stressed market conditions.

dowidth.com

dowidth.com