Music royalties platforms offer investors a unique opportunity to earn passive income through rights to song revenues, providing a steady cash flow tied to music consumption trends. Startup equity crowdfunding allows individuals to acquire ownership stakes in early-stage companies, potentially yielding high returns but with increased risk due to business volatility. Explore the distinctive benefits and risks between these investment options to make informed financial decisions.

Why it is important

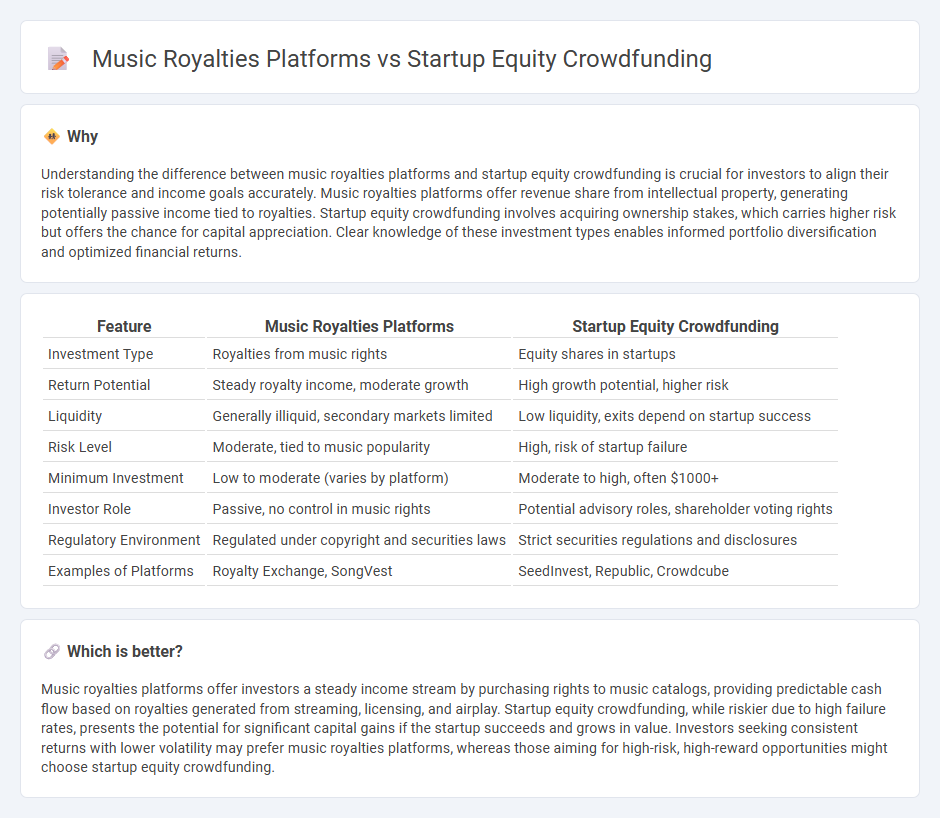

Understanding the difference between music royalties platforms and startup equity crowdfunding is crucial for investors to align their risk tolerance and income goals accurately. Music royalties platforms offer revenue share from intellectual property, generating potentially passive income tied to royalties. Startup equity crowdfunding involves acquiring ownership stakes, which carries higher risk but offers the chance for capital appreciation. Clear knowledge of these investment types enables informed portfolio diversification and optimized financial returns.

Comparison Table

| Feature | Music Royalties Platforms | Startup Equity Crowdfunding |

|---|---|---|

| Investment Type | Royalties from music rights | Equity shares in startups |

| Return Potential | Steady royalty income, moderate growth | High growth potential, higher risk |

| Liquidity | Generally illiquid, secondary markets limited | Low liquidity, exits depend on startup success |

| Risk Level | Moderate, tied to music popularity | High, risk of startup failure |

| Minimum Investment | Low to moderate (varies by platform) | Moderate to high, often $1000+ |

| Investor Role | Passive, no control in music rights | Potential advisory roles, shareholder voting rights |

| Regulatory Environment | Regulated under copyright and securities laws | Strict securities regulations and disclosures |

| Examples of Platforms | Royalty Exchange, SongVest | SeedInvest, Republic, Crowdcube |

Which is better?

Music royalties platforms offer investors a steady income stream by purchasing rights to music catalogs, providing predictable cash flow based on royalties generated from streaming, licensing, and airplay. Startup equity crowdfunding, while riskier due to high failure rates, presents the potential for significant capital gains if the startup succeeds and grows in value. Investors seeking consistent returns with lower volatility may prefer music royalties platforms, whereas those aiming for high-risk, high-reward opportunities might choose startup equity crowdfunding.

Connection

Music royalties platforms enable investors to purchase shares in royalty income, providing a steady cash flow, while startup equity crowdfunding allows individuals to acquire equity stakes in emerging music tech companies. Both investment avenues democratize access by leveraging digital platforms to connect creators and investors, fostering innovation within the music industry. The synergy between these models enhances liquidity and diversification, attracting a broader base of investors seeking exposure to the growing music economy.

Key Terms

Startup equity crowdfunding:

Startup equity crowdfunding enables investors to acquire shares in emerging companies, providing early access to high-growth potential ventures. Platforms like SeedInvest and Republic facilitate regulatory-compliant investments, democratizing access to startup equity traditionally reserved for venture capitalists. Explore how equity crowdfunding can diversify your investment portfolio and support innovation by learning more about its benefits and risks.

Valuation

Startup equity crowdfunding platforms often base valuation on market potential, revenue projections, and investor demand, providing equity stakes proportional to investment. Music royalties platforms value assets by projecting future royalty income streams, factoring in catalog size, streaming statistics, and historical earnings. Explore detailed comparisons to understand which model aligns best with your investment goals.

Equity ownership

Equity ownership in startup equity crowdfunding offers investors a direct stake in the company, granting voting rights and potential dividends tied to the business's success. In contrast, music royalties platforms provide investors with a share of future royalty income streams without ownership or control over the artist's brand or career decisions. Explore detailed comparisons on how equity ownership impacts financial returns and investor influence in these two investment types.

Source and External Links

Equity Crowdfunding: Pros & Cons of Funding Options - Nav - Equity crowdfunding allows startups to raise capital from individual and institutional investors in exchange for equity, without repayment obligations, making it an attractive option for those who don't qualify for traditional loans or venture capital.

What is crowdfunding? Here are four types for startups to know - Stripe - Equity-based crowdfunding offers startups potential for large capital raises and long-term investor relationships but comes with challenges such as ownership dilution, regulatory complexity, and increased reporting requirements.

Crowdfunding a Startup: Types, Strategies and Benefits - J.P. Morgan - Equity crowdfunding trades ownership shares for funds, best suited for startups seeking substantial capital, with regulatory limits currently allowing up to $5 million raised annually to fuel growth at various company stages.

dowidth.com

dowidth.com