NFT domain names represent a unique digital asset class offering decentralized ownership and potential for high returns through blockchain technology, distinct from traditional financial instruments. Exchange-traded funds (ETFs) provide diversified exposure to stocks, bonds, or commodities with lower risk and regulatory oversight, allowing investors to benefit from market trends without managing individual assets. Explore the advantages and risks of both NFT domain names and ETFs to refine your investment strategy.

Why it is important

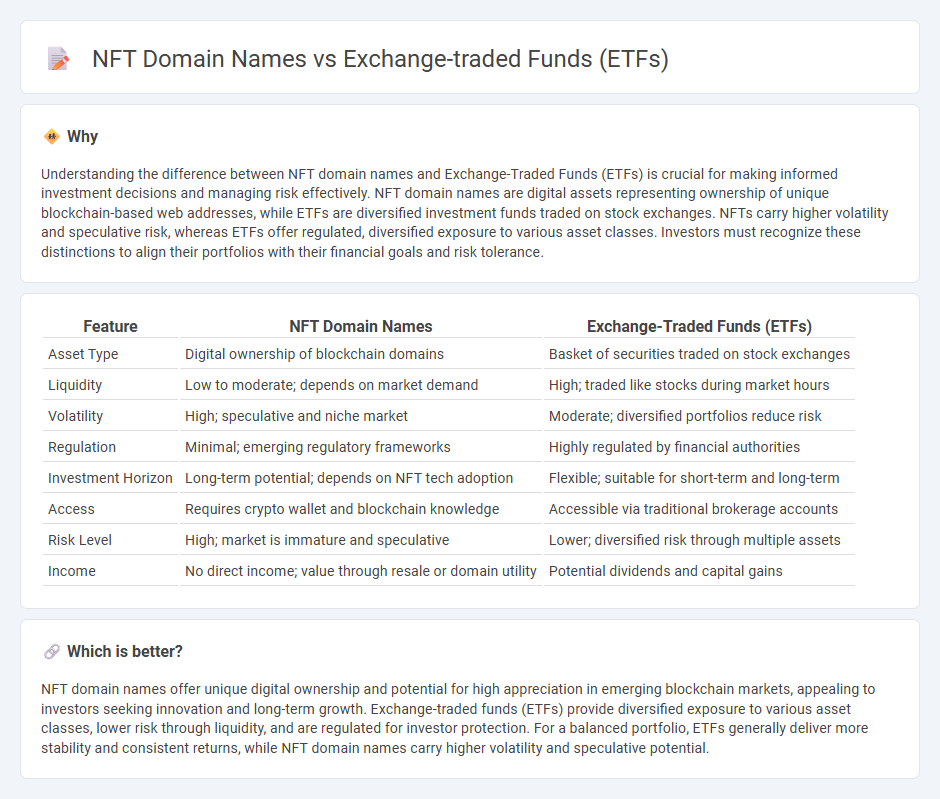

Understanding the difference between NFT domain names and Exchange-Traded Funds (ETFs) is crucial for making informed investment decisions and managing risk effectively. NFT domain names are digital assets representing ownership of unique blockchain-based web addresses, while ETFs are diversified investment funds traded on stock exchanges. NFTs carry higher volatility and speculative risk, whereas ETFs offer regulated, diversified exposure to various asset classes. Investors must recognize these distinctions to align their portfolios with their financial goals and risk tolerance.

Comparison Table

| Feature | NFT Domain Names | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Asset Type | Digital ownership of blockchain domains | Basket of securities traded on stock exchanges |

| Liquidity | Low to moderate; depends on market demand | High; traded like stocks during market hours |

| Volatility | High; speculative and niche market | Moderate; diversified portfolios reduce risk |

| Regulation | Minimal; emerging regulatory frameworks | Highly regulated by financial authorities |

| Investment Horizon | Long-term potential; depends on NFT tech adoption | Flexible; suitable for short-term and long-term |

| Access | Requires crypto wallet and blockchain knowledge | Accessible via traditional brokerage accounts |

| Risk Level | High; market is immature and speculative | Lower; diversified risk through multiple assets |

| Income | No direct income; value through resale or domain utility | Potential dividends and capital gains |

Which is better?

NFT domain names offer unique digital ownership and potential for high appreciation in emerging blockchain markets, appealing to investors seeking innovation and long-term growth. Exchange-traded funds (ETFs) provide diversified exposure to various asset classes, lower risk through liquidity, and are regulated for investor protection. For a balanced portfolio, ETFs generally deliver more stability and consistent returns, while NFT domain names carry higher volatility and speculative potential.

Connection

NFT domain names represent a novel digital asset class that can be tokenized and traded on blockchain platforms, allowing investors to diversify their portfolios beyond traditional equities. Exchange-traded funds (ETFs) increasingly include holdings related to blockchain technology and digital assets, enabling indirect exposure to NFTs and their underlying domains within regulated market structures. This integration bridges the emerging NFT ecosystem with mainstream investment vehicles, enhancing liquidity and accessibility for institutional and retail investors.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity, enabling investors to buy and sell shares easily on stock exchanges with minimal price impact. NFT domain names, while gaining popularity, typically exhibit lower liquidity due to niche market and fewer active buyers. Explore further to understand liquidity nuances between these investment vehicles.

Ownership

Exchange-traded funds (ETFs) represent collective ownership of a diversified portfolio of assets, providing investors with shares that track the performance of financial indices. NFT domain names grant exclusive, blockchain-verified ownership of unique digital assets, ensuring security and control over online identity and content. Explore the distinct ownership benefits of ETFs and NFT domain names to enhance your investment and digital asset strategies.

Regulation

Exchange-traded funds (ETFs) operate under stringent regulatory frameworks established by entities like the SEC, ensuring investor protection through transparent disclosure and market oversight. NFT domain names, representing decentralized digital assets on blockchain networks, currently experience limited regulation, raising concerns about consumer security and legal clarity. Explore the evolving regulatory landscape to understand the implications for both ETF investments and NFT domain ownership.

Source and External Links

Exchange-Traded Fund (ETF) - An ETF is a registered investment company that trades on stock exchanges, allowing investors to buy and sell shares throughout the day, similar to stocks but with the diversified portfolio benefits of mutual funds.

What is an ETF (Exchange-Traded Fund)? - Combining the flexibility of stocks and the portfolio diversity of mutual funds, ETFs offer an affordable way to access various asset classes while potentially lowering risk and enhancing portfolio diversification.

Exchange-Traded Funds and Products - ETFs are pooled investments traded on exchanges, offering baskets of stocks, bonds, and other assets, with a unique share issuance and redemption process involving authorized participants.

dowidth.com

dowidth.com