Litigation finance involves funding legal cases in exchange for a portion of the settlement or judgment, offering investors diversified risk exposure tied to legal outcomes. Direct lending provides capital directly to businesses, bypassing traditional banks, and typically yields steady income through interest payments. Explore detailed comparisons to understand which investment aligns with your financial goals.

Why it is important

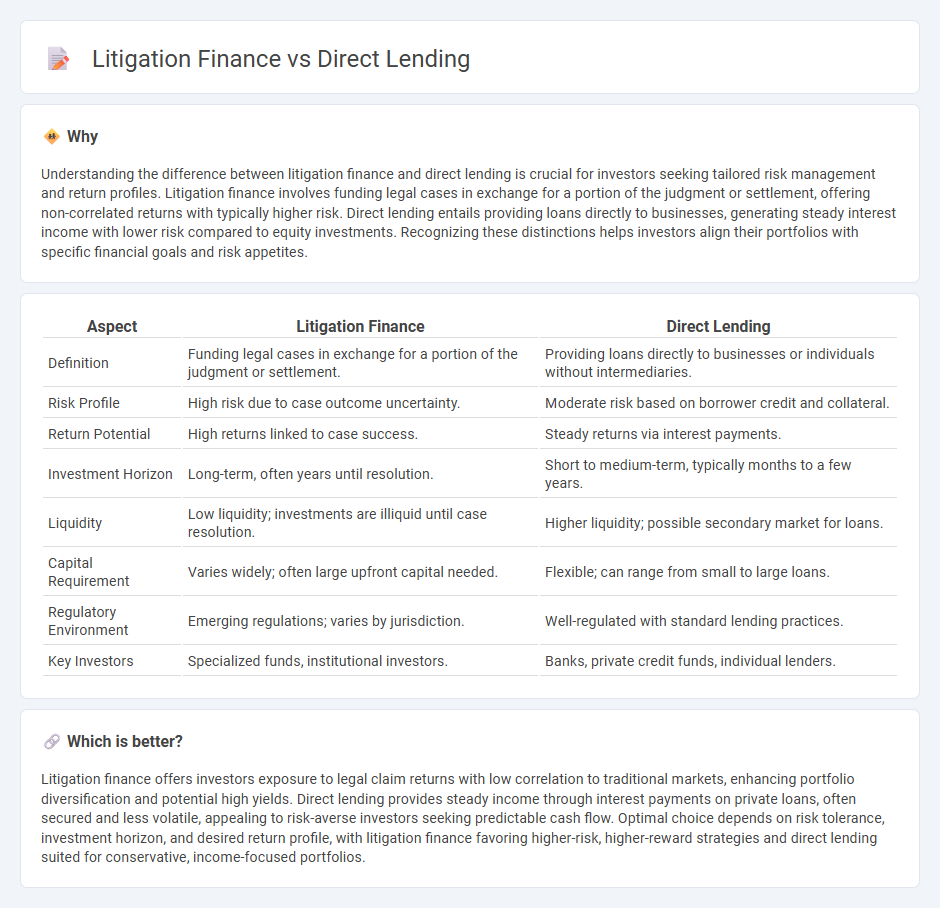

Understanding the difference between litigation finance and direct lending is crucial for investors seeking tailored risk management and return profiles. Litigation finance involves funding legal cases in exchange for a portion of the judgment or settlement, offering non-correlated returns with typically higher risk. Direct lending entails providing loans directly to businesses, generating steady interest income with lower risk compared to equity investments. Recognizing these distinctions helps investors align their portfolios with specific financial goals and risk appetites.

Comparison Table

| Aspect | Litigation Finance | Direct Lending |

|---|---|---|

| Definition | Funding legal cases in exchange for a portion of the judgment or settlement. | Providing loans directly to businesses or individuals without intermediaries. |

| Risk Profile | High risk due to case outcome uncertainty. | Moderate risk based on borrower credit and collateral. |

| Return Potential | High returns linked to case success. | Steady returns via interest payments. |

| Investment Horizon | Long-term, often years until resolution. | Short to medium-term, typically months to a few years. |

| Liquidity | Low liquidity; investments are illiquid until case resolution. | Higher liquidity; possible secondary market for loans. |

| Capital Requirement | Varies widely; often large upfront capital needed. | Flexible; can range from small to large loans. |

| Regulatory Environment | Emerging regulations; varies by jurisdiction. | Well-regulated with standard lending practices. |

| Key Investors | Specialized funds, institutional investors. | Banks, private credit funds, individual lenders. |

Which is better?

Litigation finance offers investors exposure to legal claim returns with low correlation to traditional markets, enhancing portfolio diversification and potential high yields. Direct lending provides steady income through interest payments on private loans, often secured and less volatile, appealing to risk-averse investors seeking predictable cash flow. Optimal choice depends on risk tolerance, investment horizon, and desired return profile, with litigation finance favoring higher-risk, higher-reward strategies and direct lending suited for conservative, income-focused portfolios.

Connection

Litigation finance and direct lending intersect as alternative investment strategies providing non-traditional capital to underserved markets. Both involve deploying capital with a risk-return profile distinct from conventional financing, where litigation finance funds legal cases in exchange for a portion of the proceeds, and direct lending offers private loans to businesses bypassing traditional banks. Their connection lies in attracting investors seeking diversification, higher yields, and uncorrelated assets within alternative investments.

Key Terms

Credit Risk (Direct Lending)

Direct lending involves extending loans directly to businesses, emphasizing thorough credit risk assessment to mitigate default potential by analyzing borrower financial health, cash flow stability, and collateral value. Litigation finance, on the other hand, shifts risk to the outcome of legal disputes, with less focus on traditional credit metrics and more on case merits and legal expertise. Explore comprehensive insights on credit risk strategies in direct lending to enhance your investment decisions.

Legal Claims (Litigation Finance)

Legal claims in litigation finance provide investors with exposure to high-return opportunities by funding plaintiff lawsuits in exchange for a portion of the settlement or judgment. Direct lending involves providing loans to businesses or individuals, often secured by collateral, with predictable returns but lower risk compared to litigation finance. Explore the key factors and benefits distinguishing these financing models for strategic investment decisions.

Return Profile

Direct lending typically offers fixed interest returns with predictable cash flows, appealing to investors seeking steady income. Litigation finance involves funding legal claims with potentially high, but uncertain, returns contingent on case outcomes and settlements. Explore detailed comparisons to understand how return profiles align with your investment strategy.

Source and External Links

Direct lending - Wikipedia - Direct lending is a form of corporate debt where non-bank lenders directly provide loans to smaller or mid-sized companies without intermediaries, often focusing on senior secured debt like first lien or unitranche loans, and has grown significantly in assets under management over the past decade.

Direct Lending Evolution: Driving Force of Private Credit Market - Direct lending is a private credit strategy making illiquid direct loans to middle-market companies, which banks have mostly exited due to regulatory constraints, and the sector strongly benefits from demand driven by refinancing needs and private equity dry powder.

Direct lending: benefits, risks and opportunities (Oaktree Capital) - Direct lending involves non-bank creditors providing loans to middle-market companies (typically $50 million to $1 billion revenue), used for LBOs, M&A, and growth, covering first lien, mezzanine, second lien, and unitranche debt, representing a large market vital to the economy.

dowidth.com

dowidth.com