Rare whisky bottles trading offers tangible asset ownership with historical value and limited supply, appealing to collectors who appreciate craftsmanship and aging potential. NFTs represent digital scarcity and provenance, enabling seamless ownership transfer and access to exclusive communities in the virtual space. Explore the unique investment dynamics of rare whisky and NFTs to discover which asset aligns with your portfolio goals.

Why it is important

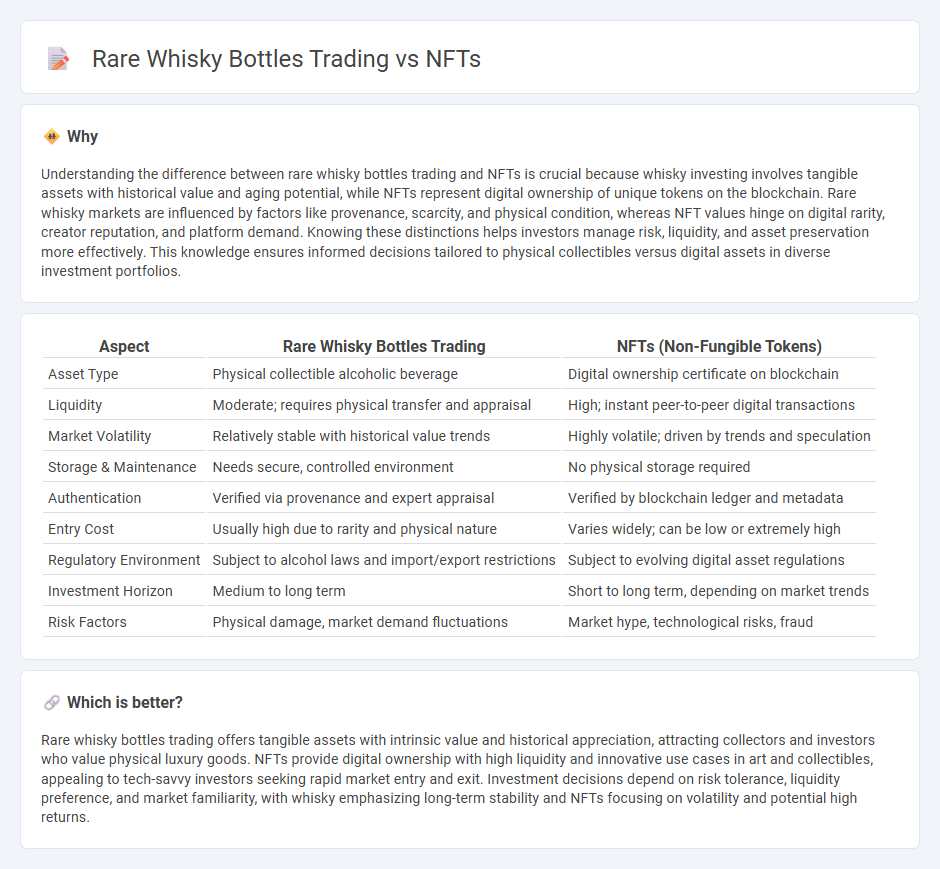

Understanding the difference between rare whisky bottles trading and NFTs is crucial because whisky investing involves tangible assets with historical value and aging potential, while NFTs represent digital ownership of unique tokens on the blockchain. Rare whisky markets are influenced by factors like provenance, scarcity, and physical condition, whereas NFT values hinge on digital rarity, creator reputation, and platform demand. Knowing these distinctions helps investors manage risk, liquidity, and asset preservation more effectively. This knowledge ensures informed decisions tailored to physical collectibles versus digital assets in diverse investment portfolios.

Comparison Table

| Aspect | Rare Whisky Bottles Trading | NFTs (Non-Fungible Tokens) |

|---|---|---|

| Asset Type | Physical collectible alcoholic beverage | Digital ownership certificate on blockchain |

| Liquidity | Moderate; requires physical transfer and appraisal | High; instant peer-to-peer digital transactions |

| Market Volatility | Relatively stable with historical value trends | Highly volatile; driven by trends and speculation |

| Storage & Maintenance | Needs secure, controlled environment | No physical storage required |

| Authentication | Verified via provenance and expert appraisal | Verified by blockchain ledger and metadata |

| Entry Cost | Usually high due to rarity and physical nature | Varies widely; can be low or extremely high |

| Regulatory Environment | Subject to alcohol laws and import/export restrictions | Subject to evolving digital asset regulations |

| Investment Horizon | Medium to long term | Short to long term, depending on market trends |

| Risk Factors | Physical damage, market demand fluctuations | Market hype, technological risks, fraud |

Which is better?

Rare whisky bottles trading offers tangible assets with intrinsic value and historical appreciation, attracting collectors and investors who value physical luxury goods. NFTs provide digital ownership with high liquidity and innovative use cases in art and collectibles, appealing to tech-savvy investors seeking rapid market entry and exit. Investment decisions depend on risk tolerance, liquidity preference, and market familiarity, with whisky emphasizing long-term stability and NFTs focusing on volatility and potential high returns.

Connection

Rare whisky bottles trading and NFTs intersect through the digitization of asset ownership, allowing collectors to buy, sell, and authenticate whisky investments on blockchain platforms. NFTs provide provable scarcity and provenance for rare whisky editions, enhancing market transparency and value preservation. This fusion creates a decentralized marketplace where traditional whisky assets gain liquidity alongside digital collectibles.

Key Terms

Provenance

Provenance plays a critical role in both NFTs and rare whisky bottles trading, ensuring the authenticity and historical significance of assets. Blockchain technology verifies the origin and ownership of NFTs, while rare whisky bottles rely on documented lineage and expert validation to confirm their uniqueness. Explore how provenance enhances value across these markets and discover strategies for secure investment.

Liquidity

NFTs offer high liquidity through digital marketplaces enabling instant buying and selling of rare digital assets, whereas rare whisky bottles often require specialized auction houses or private sales, making transactions slower and less frequent. The blockchain technology behind NFTs provides transparent ownership and transferability, enhancing liquidity compared to physical collectibles that may take weeks or months to resell. Explore how liquidity dynamics impact investment strategies in both NFTs and rare whisky markets for deeper insights.

Volatility

NFTs exhibit high volatility with price fluctuations driven by market speculation, rarity, and digital trends, often leading to rapid gains or losses within short timeframes. Rare whisky bottles demonstrate more stable value appreciation influenced by age, provenance, and limited supply, resulting in lower but steady price variations over time. Explore detailed comparisons to understand volatility patterns in NFTs and rare whisky investments.

dowidth.com

dowidth.com