Sports card fractionalization offers investors access to high-value collectibles by dividing ownership into smaller, tradable shares, enabling diversification and liquidity in the niche market. Film production shares provide opportunities to participate in the entertainment industry's potential profits, with investment returns linked to box office performance and distribution revenues. Discover how these innovative investment models can complement your portfolio and optimize growth.

Why it is important

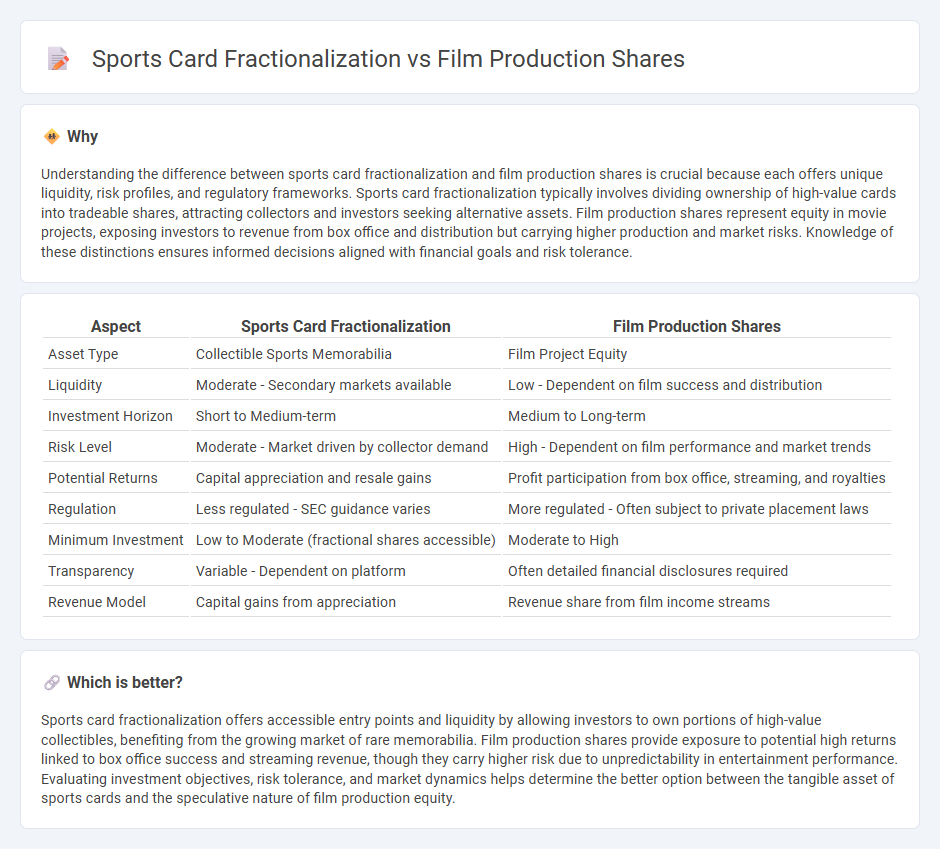

Understanding the difference between sports card fractionalization and film production shares is crucial because each offers unique liquidity, risk profiles, and regulatory frameworks. Sports card fractionalization typically involves dividing ownership of high-value cards into tradeable shares, attracting collectors and investors seeking alternative assets. Film production shares represent equity in movie projects, exposing investors to revenue from box office and distribution but carrying higher production and market risks. Knowledge of these distinctions ensures informed decisions aligned with financial goals and risk tolerance.

Comparison Table

| Aspect | Sports Card Fractionalization | Film Production Shares |

|---|---|---|

| Asset Type | Collectible Sports Memorabilia | Film Project Equity |

| Liquidity | Moderate - Secondary markets available | Low - Dependent on film success and distribution |

| Investment Horizon | Short to Medium-term | Medium to Long-term |

| Risk Level | Moderate - Market driven by collector demand | High - Dependent on film performance and market trends |

| Potential Returns | Capital appreciation and resale gains | Profit participation from box office, streaming, and royalties |

| Regulation | Less regulated - SEC guidance varies | More regulated - Often subject to private placement laws |

| Minimum Investment | Low to Moderate (fractional shares accessible) | Moderate to High |

| Transparency | Variable - Dependent on platform | Often detailed financial disclosures required |

| Revenue Model | Capital gains from appreciation | Revenue share from film income streams |

Which is better?

Sports card fractionalization offers accessible entry points and liquidity by allowing investors to own portions of high-value collectibles, benefiting from the growing market of rare memorabilia. Film production shares provide exposure to potential high returns linked to box office success and streaming revenue, though they carry higher risk due to unpredictability in entertainment performance. Evaluating investment objectives, risk tolerance, and market dynamics helps determine the better option between the tangible asset of sports cards and the speculative nature of film production equity.

Connection

Sports card fractionalization and film production shares both utilize blockchain technology to democratize investment opportunities by dividing high-value assets into smaller, tradable fractions. This approach increases market liquidity and allows a broader range of investors to participate in markets traditionally reserved for wealthy individuals. Tokenization platforms facilitate the seamless buying, selling, and ownership tracking of these fractional shares, enhancing transparency and security in alternative asset investments.

Key Terms

Ownership Structure

Film production shares often represent equity stakes in movie projects, granting investors proportional ownership and potential profit shares from box office and ancillary revenues. Sports card fractionalization involves dividing high-value collectible cards into digital shares, enabling partial ownership and trading without full card possession. Explore deeper insights into these ownership structures to understand their investment implications and market dynamics.

Liquidity

Film production shares often face limited liquidity due to niche investor interest and lengthy project timelines, impacting the ease of buying and selling shares. Sports card fractionalization leverages a broader collector base and digital marketplaces that enhance liquidity by enabling quick trades of fractional ownership. Explore how liquidity dynamics vary between these asset classes and impact investor strategies.

Valuation Methods

Film production shares utilize discounted cash flow (DCF) and revenue participant models to estimate future box office earnings and ancillary revenue, emphasizing script quality, cast, and distribution agreements for valuation. Sports card fractionalization relies on market comparables, historical sales data, and player performance metrics to determine the fraction's worth, often factoring in scarcity and collectible demand. Explore detailed valuation frameworks to understand how unique asset characteristics influence investment decisions.

Source and External Links

3 Film & Television Production Stocks to Buy on Solid Industry Trends - Highlights key film and television production stocks like Live Nation Entertainment, TKO Group Holdings, and News Corporation, driven by rising demand for digital entertainment and streaming content, despite rising content costs impacting profitability.

Entertainment and Media Stocks: TV, Film, and Music Stock - Lists popular film production stocks such as Disney, AMC Entertainment, IMAX, and Twenty-First Century Fox, and analyzes factors affecting share prices including content quality, new technology adoption, mergers, and regulations.

Publicly Traded Movie Production and Distribution Companies - Provides a list of major publicly traded companies in the film production sector like Comcast (owner of Universal Pictures) and others, offering insights into large-cap stock options in movie production and distribution.

dowidth.com

dowidth.com