Fractional ownership real estate allows multiple investors to buy shares of a specific property, providing direct asset control and proportional returns, while real estate syndication pools investor capital to purchase properties managed by professional sponsors, often enabling access to larger, diversified portfolios. Both strategies offer distinct benefits in terms of risk management, liquidity, and investment scale tailored to different investor goals. Explore our detailed comparison to understand which model aligns best with your investment strategy.

Why it is important

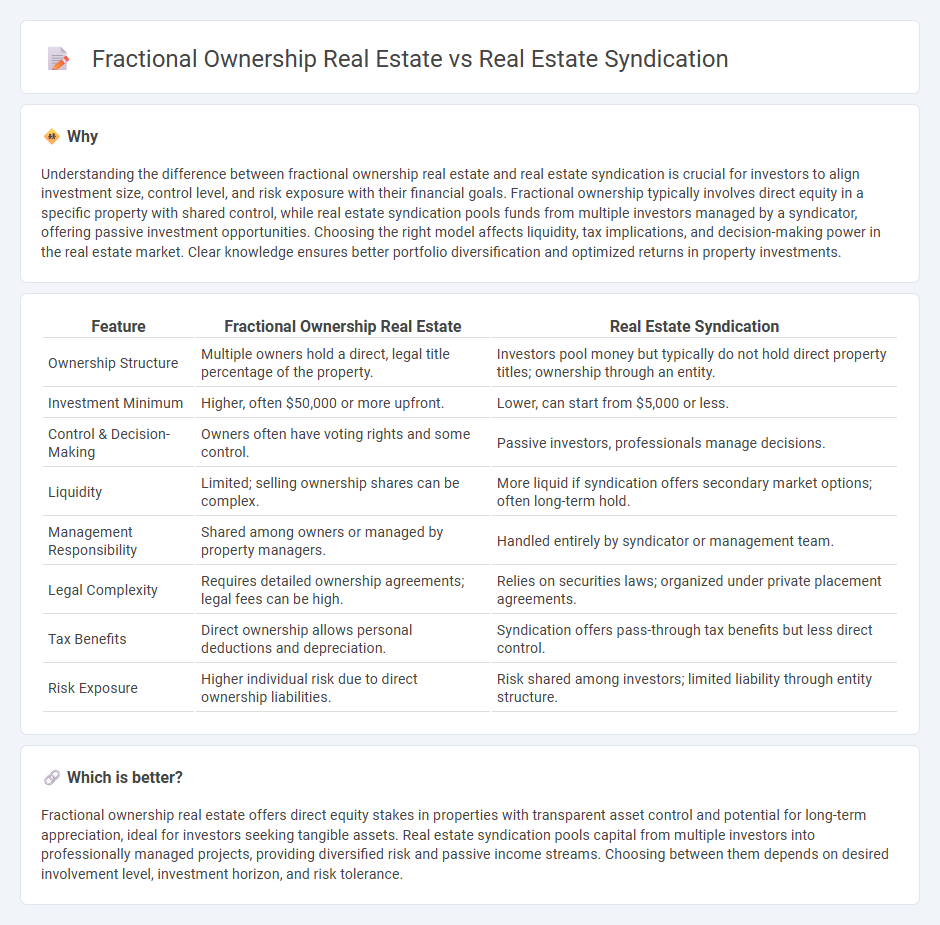

Understanding the difference between fractional ownership real estate and real estate syndication is crucial for investors to align investment size, control level, and risk exposure with their financial goals. Fractional ownership typically involves direct equity in a specific property with shared control, while real estate syndication pools funds from multiple investors managed by a syndicator, offering passive investment opportunities. Choosing the right model affects liquidity, tax implications, and decision-making power in the real estate market. Clear knowledge ensures better portfolio diversification and optimized returns in property investments.

Comparison Table

| Feature | Fractional Ownership Real Estate | Real Estate Syndication |

|---|---|---|

| Ownership Structure | Multiple owners hold a direct, legal title percentage of the property. | Investors pool money but typically do not hold direct property titles; ownership through an entity. |

| Investment Minimum | Higher, often $50,000 or more upfront. | Lower, can start from $5,000 or less. |

| Control & Decision-Making | Owners often have voting rights and some control. | Passive investors, professionals manage decisions. |

| Liquidity | Limited; selling ownership shares can be complex. | More liquid if syndication offers secondary market options; often long-term hold. |

| Management Responsibility | Shared among owners or managed by property managers. | Handled entirely by syndicator or management team. |

| Legal Complexity | Requires detailed ownership agreements; legal fees can be high. | Relies on securities laws; organized under private placement agreements. |

| Tax Benefits | Direct ownership allows personal deductions and depreciation. | Syndication offers pass-through tax benefits but less direct control. |

| Risk Exposure | Higher individual risk due to direct ownership liabilities. | Risk shared among investors; limited liability through entity structure. |

Which is better?

Fractional ownership real estate offers direct equity stakes in properties with transparent asset control and potential for long-term appreciation, ideal for investors seeking tangible assets. Real estate syndication pools capital from multiple investors into professionally managed projects, providing diversified risk and passive income streams. Choosing between them depends on desired involvement level, investment horizon, and risk tolerance.

Connection

Fractional ownership real estate and real estate syndication both enable multiple investors to pool capital for property acquisition, reducing individual financial burden while increasing access to high-value assets. Fractional ownership divides a property into shares owned by investors, whereas real estate syndication structures a partnership or company to collectively purchase and manage properties. These models enhance real estate investment diversification, liquidity, and risk-sharing among investors.

Key Terms

Ownership Structure

Real estate syndication involves multiple investors pooling funds into a single property, typically managed by a syndicator who oversees operations and decisions. Fractional ownership divides a property into distinct shares, allowing investors to own a percentage with equal rights and often direct usage or rental income benefits. Explore detailed comparisons on ownership rights, management roles, and investment returns to determine which structure suits your portfolio best.

Liquidity

Real estate syndication typically involves pooling funds from multiple investors to purchase large properties, offering limited liquidity since shares are often held until the property's sale or refinancing. Fractional ownership allows investors to acquire a share of a property with more flexible exit strategies, often providing better liquidity through predefined resale mechanisms or secondary markets. Explore detailed comparisons to understand which investment aligns best with your liquidity needs.

Investor Control

Real estate syndication allows passive investors limited control as decisions are typically managed by the syndicator or general partner. Fractional ownership grants investors direct control over their property share, enabling active participation in management decisions and property use. Explore the nuances of investor control in these models to determine which suits your investment style best.

Source and External Links

14. Real Estate Syndicates and Investment Trusts - Real estate syndication pools capital from individual investors managed by a sponsor, following a three-phase process: origination, operation, and eventually asset disposition or refinancing.

AN INTRODUCTION TO REAL ESTATE SYNDICATION - Real estate syndication involves pooling capital from multiple investors to invest in specific real estate projects, typically organized by an experienced sponsor and structured as LLCs or limited partnerships.

Real Estate Syndication - RealtyMogul - In real estate syndication, a sponsor manages property acquisition and operation while investors (limited partners) provide capital and share ownership without handling daily management.

dowidth.com

dowidth.com