Fractionalized art investment enables individuals to own shares of high-value artworks, diversifying portfolios with tangible assets while lowering entry barriers compared to traditional art acquisition. Peer-to-peer lending connects borrowers directly with investors, offering potentially higher returns through loan interest but exposing participants to credit risk and liquidity challenges. Explore the nuances of these innovative investment models to enhance your financial strategy.

Why it is important

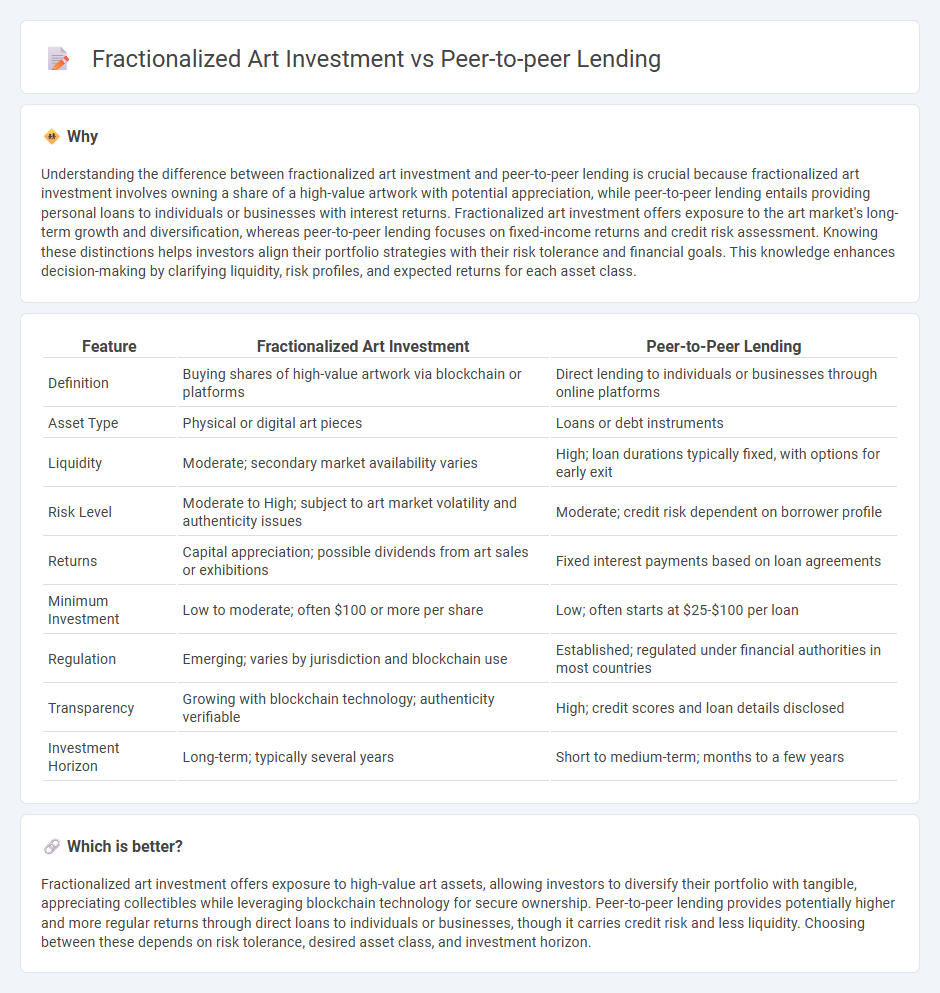

Understanding the difference between fractionalized art investment and peer-to-peer lending is crucial because fractionalized art investment involves owning a share of a high-value artwork with potential appreciation, while peer-to-peer lending entails providing personal loans to individuals or businesses with interest returns. Fractionalized art investment offers exposure to the art market's long-term growth and diversification, whereas peer-to-peer lending focuses on fixed-income returns and credit risk assessment. Knowing these distinctions helps investors align their portfolio strategies with their risk tolerance and financial goals. This knowledge enhances decision-making by clarifying liquidity, risk profiles, and expected returns for each asset class.

Comparison Table

| Feature | Fractionalized Art Investment | Peer-to-Peer Lending |

|---|---|---|

| Definition | Buying shares of high-value artwork via blockchain or platforms | Direct lending to individuals or businesses through online platforms |

| Asset Type | Physical or digital art pieces | Loans or debt instruments |

| Liquidity | Moderate; secondary market availability varies | High; loan durations typically fixed, with options for early exit |

| Risk Level | Moderate to High; subject to art market volatility and authenticity issues | Moderate; credit risk dependent on borrower profile |

| Returns | Capital appreciation; possible dividends from art sales or exhibitions | Fixed interest payments based on loan agreements |

| Minimum Investment | Low to moderate; often $100 or more per share | Low; often starts at $25-$100 per loan |

| Regulation | Emerging; varies by jurisdiction and blockchain use | Established; regulated under financial authorities in most countries |

| Transparency | Growing with blockchain technology; authenticity verifiable | High; credit scores and loan details disclosed |

| Investment Horizon | Long-term; typically several years | Short to medium-term; months to a few years |

Which is better?

Fractionalized art investment offers exposure to high-value art assets, allowing investors to diversify their portfolio with tangible, appreciating collectibles while leveraging blockchain technology for secure ownership. Peer-to-peer lending provides potentially higher and more regular returns through direct loans to individuals or businesses, though it carries credit risk and less liquidity. Choosing between these depends on risk tolerance, desired asset class, and investment horizon.

Connection

Fractionalized art investment allows multiple investors to own a portion of high-value artworks, increasing liquidity and accessibility in the art market. Peer-to-peer lending platforms facilitate direct borrowing and lending among individuals, offering alternative financing methods for purchasing fractional art shares. Both models leverage technology to democratize investment opportunities, reduce barriers to entry, and enhance portfolio diversification.

Key Terms

Risk diversification

Peer-to-peer lending offers risk diversification by spreading investments across multiple borrowers, reducing exposure to any single default. Fractionalized art investment diversifies risk through ownership of partial shares in various artworks, mitigating the impact of individual art asset depreciation. Explore more to understand which investment suits your risk tolerance and portfolio goals.

Liquidity

Peer-to-peer lending platforms typically offer moderate liquidity with borrowers repaying loans over set terms, enabling investors to recover funds within predictable timeframes. Fractionalized art investments often lack immediate liquidity due to the niche market and dependency on third-party sales to other investors, potentially extending holding periods. Explore these liquidity dynamics in greater depth to determine which investment aligns best with your financial goals.

Return profiles

Peer-to-peer lending typically offers fixed interest returns with moderate risk, often ranging from 5% to 12% annually depending on borrower creditworthiness and loan terms. Fractionalized art investment involves shared ownership of high-value artworks, combining the potential for significant capital appreciation with market volatility and lower liquidity compared to traditional assets. Explore detailed analyses to understand the distinct return profiles and risks associated with each investment model.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer lending (P2P) allows borrowers to obtain loans from individual investors through specialized online platforms, offering flexible terms and potentially lower eligibility requirements than banks, while lenders earn interest on their loans but face higher risks.

Peer-to-peer lending - Wikipedia - P2P lending is an online financial service matching lenders and borrowers without traditional institutions, characterized by intermediation via platforms that handle credit checks, loan servicing, and payments, often involving unsecured loans and a higher risk profile.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending connects individuals who want to lend money with borrowers via websites acting as marketplaces, offering higher interest rates than savings accounts but with greater risk, and sometimes allows lenders to diversify by lending to multiple borrowers.

dowidth.com

dowidth.com