Music royalties provide a steady income stream based on intellectual property rights, offering long-term financial stability and protection against market volatility. Cryptocurrency investments, characterized by high liquidity and significant price fluctuations, appeal to those seeking rapid gains but involve greater risk and regulatory uncertainties. Explore deeper insights to understand which investment aligns best with your financial goals.

Why it is important

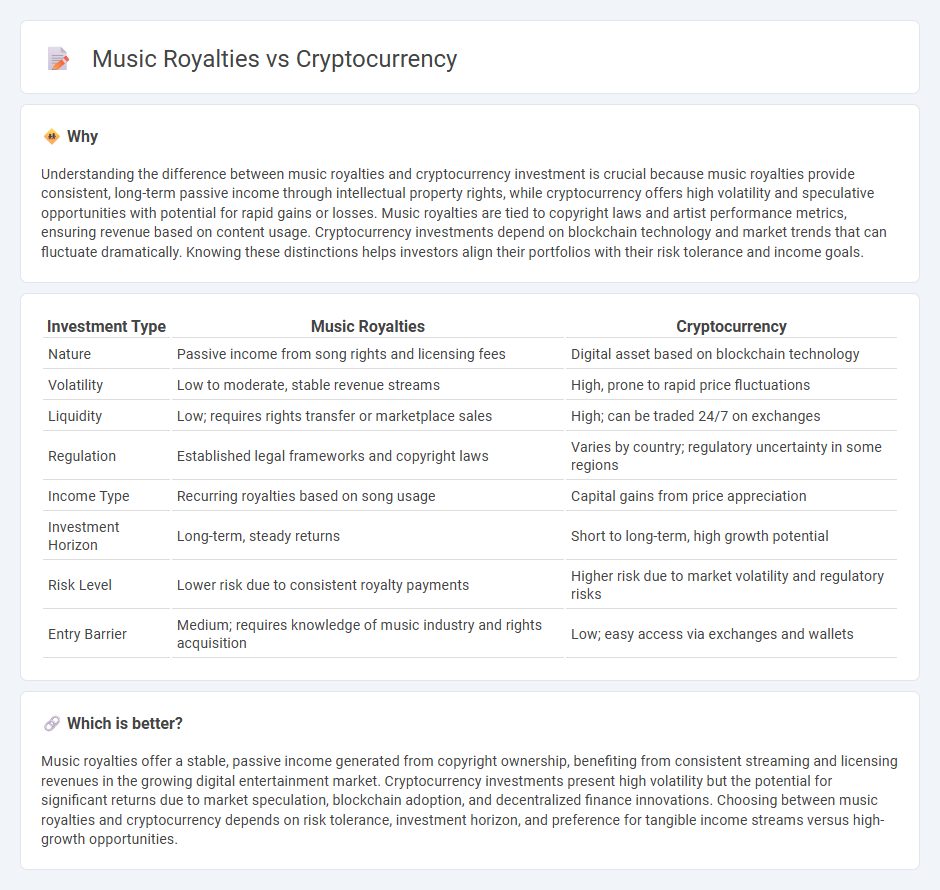

Understanding the difference between music royalties and cryptocurrency investment is crucial because music royalties provide consistent, long-term passive income through intellectual property rights, while cryptocurrency offers high volatility and speculative opportunities with potential for rapid gains or losses. Music royalties are tied to copyright laws and artist performance metrics, ensuring revenue based on content usage. Cryptocurrency investments depend on blockchain technology and market trends that can fluctuate dramatically. Knowing these distinctions helps investors align their portfolios with their risk tolerance and income goals.

Comparison Table

| Investment Type | Music Royalties | Cryptocurrency |

|---|---|---|

| Nature | Passive income from song rights and licensing fees | Digital asset based on blockchain technology |

| Volatility | Low to moderate, stable revenue streams | High, prone to rapid price fluctuations |

| Liquidity | Low; requires rights transfer or marketplace sales | High; can be traded 24/7 on exchanges |

| Regulation | Established legal frameworks and copyright laws | Varies by country; regulatory uncertainty in some regions |

| Income Type | Recurring royalties based on song usage | Capital gains from price appreciation |

| Investment Horizon | Long-term, steady returns | Short to long-term, high growth potential |

| Risk Level | Lower risk due to consistent royalty payments | Higher risk due to market volatility and regulatory risks |

| Entry Barrier | Medium; requires knowledge of music industry and rights acquisition | Low; easy access via exchanges and wallets |

Which is better?

Music royalties offer a stable, passive income generated from copyright ownership, benefiting from consistent streaming and licensing revenues in the growing digital entertainment market. Cryptocurrency investments present high volatility but the potential for significant returns due to market speculation, blockchain adoption, and decentralized finance innovations. Choosing between music royalties and cryptocurrency depends on risk tolerance, investment horizon, and preference for tangible income streams versus high-growth opportunities.

Connection

Music royalties have emerged as a unique investment asset within the cryptocurrency ecosystem through the use of blockchain technology and non-fungible tokens (NFTs). Blockchain platforms enable transparent and immutable tracking of royalty rights, allowing investors to securely trade and monetize music royalties as digital assets. This fusion of music royalties and cryptocurrency opens new avenues for fractional ownership, liquidity, and democratization of income streams in the music industry.

Key Terms

Blockchain

Blockchain technology revolutionizes both cryptocurrency and music royalties by providing transparent, immutable ledgers that enhance security and trust. In the music industry, blockchain ensures precise royalty tracking and direct payments to artists, eliminating intermediaries and reducing delays. Explore how blockchain reshapes financial ecosystems and creative rights management for deeper insights.

Tokenization

Tokenization transforms music royalties into tradeable digital assets on blockchain platforms, increasing liquidity and accessibility for artists and investors. Cryptocurrency facilitates secure, transparent transactions, reducing intermediaries and accelerating royalty payments. Discover how tokenization revolutionizes music royalties and investment opportunities.

Intellectual Property

Cryptocurrency technology enables decentralized ownership and transparent tracking of intellectual property rights, revolutionizing the management of music royalties by ensuring direct and real-time payments to artists. Smart contracts built on blockchain streamline royalty distribution, eliminate intermediaries, and reduce disputes over intellectual property claims. Explore how integrating cryptocurrency with music royalties can transform intellectual property management in the entertainment industry.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a decentralized digital currency that uses cryptography to secure transactions and operates on a blockchain, allowing peer-to-peer payments without banks or central authorities, first exemplified by Bitcoin in 2009.

Cryptocurrency - Wikipedia - A cryptocurrency is a digital asset designed to work through a decentralized computer network without central authority, recorded on a blockchain using consensus mechanisms, with Bitcoin as the first and over 25,000 others existing as of 2023.

Digital Currencies | Explainer | Education - Reserve Bank of Australia - Cryptocurrencies are digital tokens enabling direct online payments between users, characterized by market-driven value and significant price volatility, with skepticism about their potential to replace traditional money.

dowidth.com

dowidth.com