Farmland crowdfunding allows investors to pool resources and gain direct exposure to agricultural real estate, offering potential income through crop yields and land appreciation. Municipal bonds provide tax-exempt income by funding public projects, often ensuring lower risk and steady returns backed by government entities. Explore the distinct advantages and risks of both to make informed investment decisions.

Why it is important

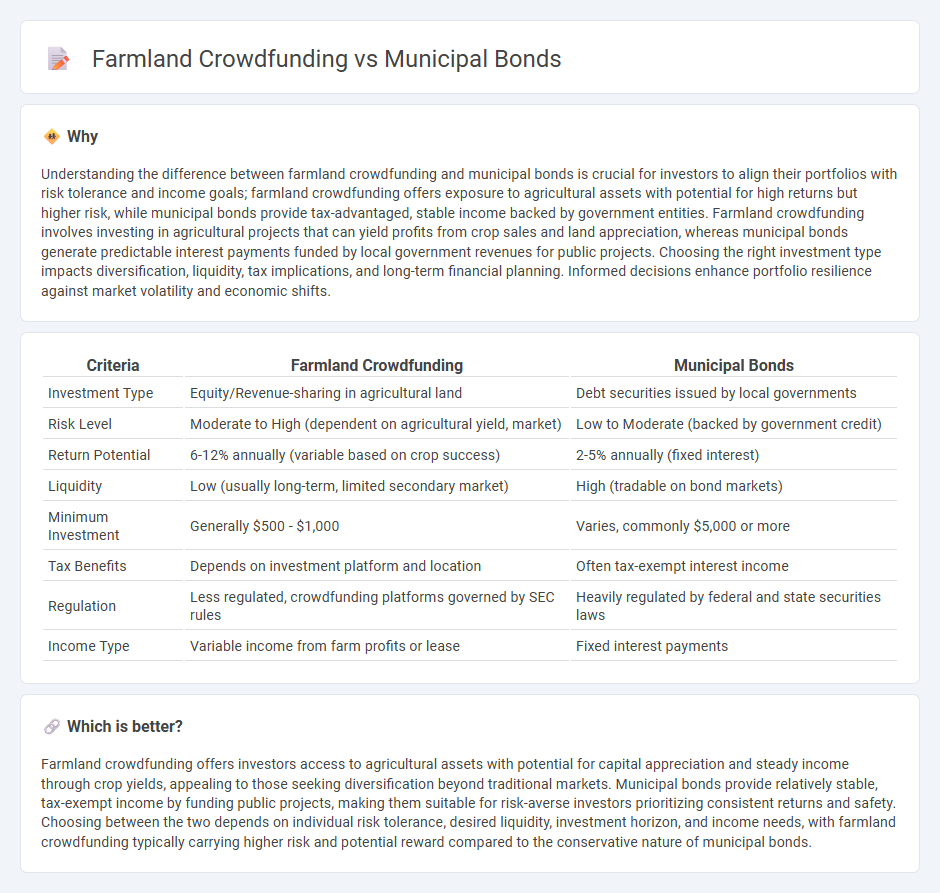

Understanding the difference between farmland crowdfunding and municipal bonds is crucial for investors to align their portfolios with risk tolerance and income goals; farmland crowdfunding offers exposure to agricultural assets with potential for high returns but higher risk, while municipal bonds provide tax-advantaged, stable income backed by government entities. Farmland crowdfunding involves investing in agricultural projects that can yield profits from crop sales and land appreciation, whereas municipal bonds generate predictable interest payments funded by local government revenues for public projects. Choosing the right investment type impacts diversification, liquidity, tax implications, and long-term financial planning. Informed decisions enhance portfolio resilience against market volatility and economic shifts.

Comparison Table

| Criteria | Farmland Crowdfunding | Municipal Bonds |

|---|---|---|

| Investment Type | Equity/Revenue-sharing in agricultural land | Debt securities issued by local governments |

| Risk Level | Moderate to High (dependent on agricultural yield, market) | Low to Moderate (backed by government credit) |

| Return Potential | 6-12% annually (variable based on crop success) | 2-5% annually (fixed interest) |

| Liquidity | Low (usually long-term, limited secondary market) | High (tradable on bond markets) |

| Minimum Investment | Generally $500 - $1,000 | Varies, commonly $5,000 or more |

| Tax Benefits | Depends on investment platform and location | Often tax-exempt interest income |

| Regulation | Less regulated, crowdfunding platforms governed by SEC rules | Heavily regulated by federal and state securities laws |

| Income Type | Variable income from farm profits or lease | Fixed interest payments |

Which is better?

Farmland crowdfunding offers investors access to agricultural assets with potential for capital appreciation and steady income through crop yields, appealing to those seeking diversification beyond traditional markets. Municipal bonds provide relatively stable, tax-exempt income by funding public projects, making them suitable for risk-averse investors prioritizing consistent returns and safety. Choosing between the two depends on individual risk tolerance, desired liquidity, investment horizon, and income needs, with farmland crowdfunding typically carrying higher risk and potential reward compared to the conservative nature of municipal bonds.

Connection

Farmland crowdfunding platforms enable individual investors to pool funds and finance agricultural projects, offering diversification and stable returns tied to land productivity. Municipal bonds, issued by local governments, finance infrastructure and community development, indirectly supporting rural areas and agricultural economies. Both investment types provide opportunities for investors seeking steady income streams linked to tangible assets and community growth.

Key Terms

Tax-exempt interest

Municipal bonds offer tax-exempt interest, making them a preferred choice for investors seeking income free from federal and often state taxes. Farmland crowdfunding platforms typically provide taxable returns, which might not offer the same immediate tax benefits but can yield attractive diversification and growth opportunities. Discover how these contrasting tax implications impact your investment strategy and portfolio by exploring further insights.

Agricultural yield

Municipal bonds provide steady, tax-exempt income with low risk, but they lack direct exposure to agricultural yield fluctuations. Farmland crowdfunding platforms offer investors the opportunity to participate in the profitability of agricultural land, directly linking returns to crop yields and market prices. Discover how agricultural yield impacts investment outcomes in these asset classes to make informed decisions.

Default risk

Municipal bonds generally exhibit lower default risk due to their backing by government entities with taxing authority, making them a relatively secure investment. Farmland crowdfunding, while offering diversification and potential for high returns, carries higher default risk as it depends on the successful management of agricultural projects and market conditions. Explore detailed risk assessments and compare default probabilities to make informed investment decisions.

Source and External Links

Municipal bond - A municipal bond, or muni, is a debt issued by state or local governments or their entities to finance public projects, primarily classified as general obligation bonds backed by taxing power or revenue bonds backed by specific income streams like tolls or utilities.

Municipal Bonds - Municipal bonds are public debt used to fund projects such as schools and hospitals, categorized mainly as general obligation bonds secured by taxing authority, or revenue bonds backed by project income, and sometimes subject to different tax treatments.

Municipal Bonds for America - Municipal bonds are vital for U.S. infrastructure, financing around 75% of it, and efforts are ongoing to defend the federal tax exemption on muni bond interest to support continued investment in public infrastructure.

dowidth.com

dowidth.com