Psychedelic stocks represent a niche sector focused on companies developing therapies derived from psychedelic compounds, showing rapid growth potential due to increasing research and regulatory acceptance. Growth stocks, on the other hand, belong to companies with above-average earnings growth, often in technology or innovative industries, attracting investors prioritizing long-term capital appreciation. Explore the distinctive risks and opportunities to determine which investment aligns best with your portfolio goals.

Why it is important

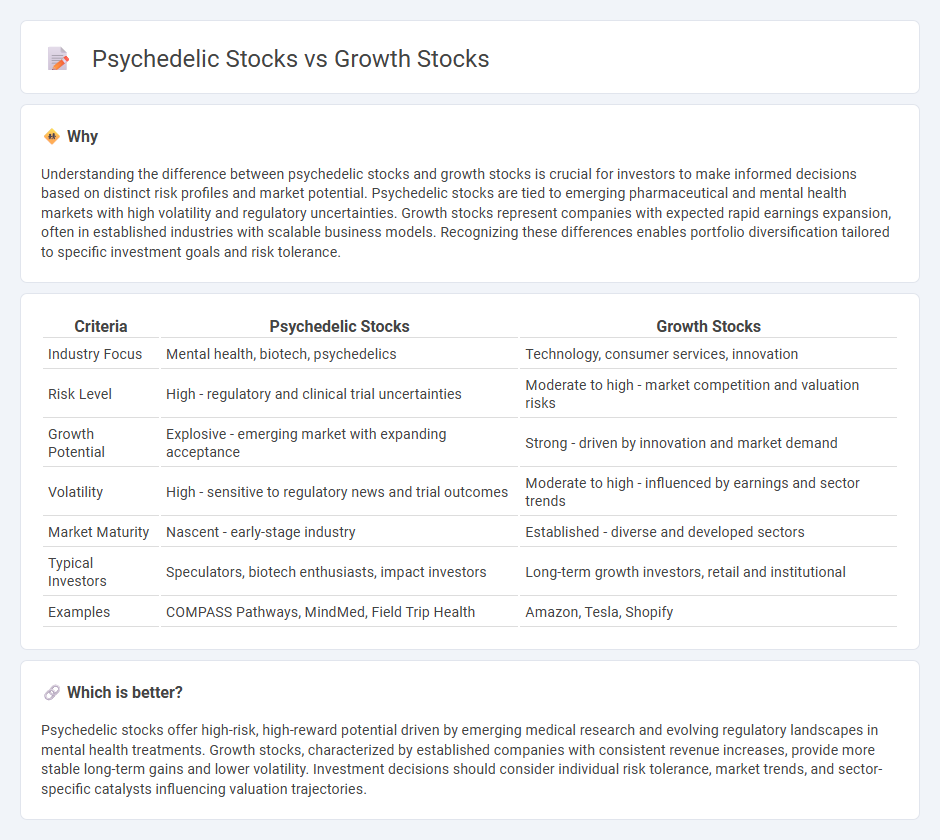

Understanding the difference between psychedelic stocks and growth stocks is crucial for investors to make informed decisions based on distinct risk profiles and market potential. Psychedelic stocks are tied to emerging pharmaceutical and mental health markets with high volatility and regulatory uncertainties. Growth stocks represent companies with expected rapid earnings expansion, often in established industries with scalable business models. Recognizing these differences enables portfolio diversification tailored to specific investment goals and risk tolerance.

Comparison Table

| Criteria | Psychedelic Stocks | Growth Stocks |

|---|---|---|

| Industry Focus | Mental health, biotech, psychedelics | Technology, consumer services, innovation |

| Risk Level | High - regulatory and clinical trial uncertainties | Moderate to high - market competition and valuation risks |

| Growth Potential | Explosive - emerging market with expanding acceptance | Strong - driven by innovation and market demand |

| Volatility | High - sensitive to regulatory news and trial outcomes | Moderate to high - influenced by earnings and sector trends |

| Market Maturity | Nascent - early-stage industry | Established - diverse and developed sectors |

| Typical Investors | Speculators, biotech enthusiasts, impact investors | Long-term growth investors, retail and institutional |

| Examples | COMPASS Pathways, MindMed, Field Trip Health | Amazon, Tesla, Shopify |

Which is better?

Psychedelic stocks offer high-risk, high-reward potential driven by emerging medical research and evolving regulatory landscapes in mental health treatments. Growth stocks, characterized by established companies with consistent revenue increases, provide more stable long-term gains and lower volatility. Investment decisions should consider individual risk tolerance, market trends, and sector-specific catalysts influencing valuation trajectories.

Connection

Psychedelic stocks and growth stocks intersect through their shared emphasis on innovation and high potential returns driven by emerging market trends. Investors target psychedelic companies for their pioneering drug development in mental health, anticipating rapid revenue growth akin to tech-driven growth stocks. Both sectors often exhibit heightened volatility and significant upside, appealing to risk-tolerant portfolios seeking disruptive industry breakthroughs.

Key Terms

Capital Appreciation

Growth stocks represent companies with strong potential for rapid revenue and earnings expansion, attracting investors seeking substantial capital appreciation over time. Psychedelic stocks, a niche within the biotech sector, focus on developing mental health treatments and have shown volatile but potentially high returns due to emerging regulatory approvals and increasing market interest. Explore detailed comparisons and investment strategies to understand how each category can fit into your portfolio for optimal capital growth.

Volatility

Growth stocks typically exhibit moderate volatility driven by earnings growth expectations and market sentiment, while psychedelic stocks often display higher volatility due to regulatory uncertainties and emerging market dynamics. The biotech nature of psychedelic companies combined with speculative investor interest can lead to rapid price fluctuations compared to more established growth firms. Explore further insights on volatility trends and risk management strategies in these distinct stock categories.

Regulatory Risk

Growth stocks often face regulatory scrutiny related to market competition and data privacy, impacting their valuation and investor confidence. Psychedelic stocks encounter significant regulatory risk due to ongoing shifts in drug policy, FDA approvals, and legal frameworks governing controlled substances. Explore how evolving regulations shape investment opportunities and risk profiles in these high-potential sectors.

Source and External Links

Growth stocks: what they are and why you should care - Saxo Bank - Growth stocks are shares of companies expected to grow much faster than the overall market or their industry peers, often found in sectors like technology, healthcare, and semiconductors.

Stocks Signals - Today 20/07: Best Growth Stocks (Charts) - Growth stocks tend to outperform value stocks and the broader market, especially those at the forefront of technology and healthcare, and their performance can be boosted by lower interest rates.

Growth Stocks - Definition, Examples, Characteristics - Growth stocks typically offer a substantially higher growth rate than the average stock in the market and usually reinvest earnings instead of paying dividends.

dowidth.com

dowidth.com