Wine funds offer tangible asset investment with potential for value appreciation through rare and collectible vintages, appealing to enthusiasts and diversifiers seeking portfolio stability. Cryptocurrency funds provide exposure to highly volatile digital assets, featuring opportunities for rapid growth and decentralized financial innovation but with significant risk. Explore how these distinct investment vehicles align with your financial goals and risk tolerance.

Why it is important

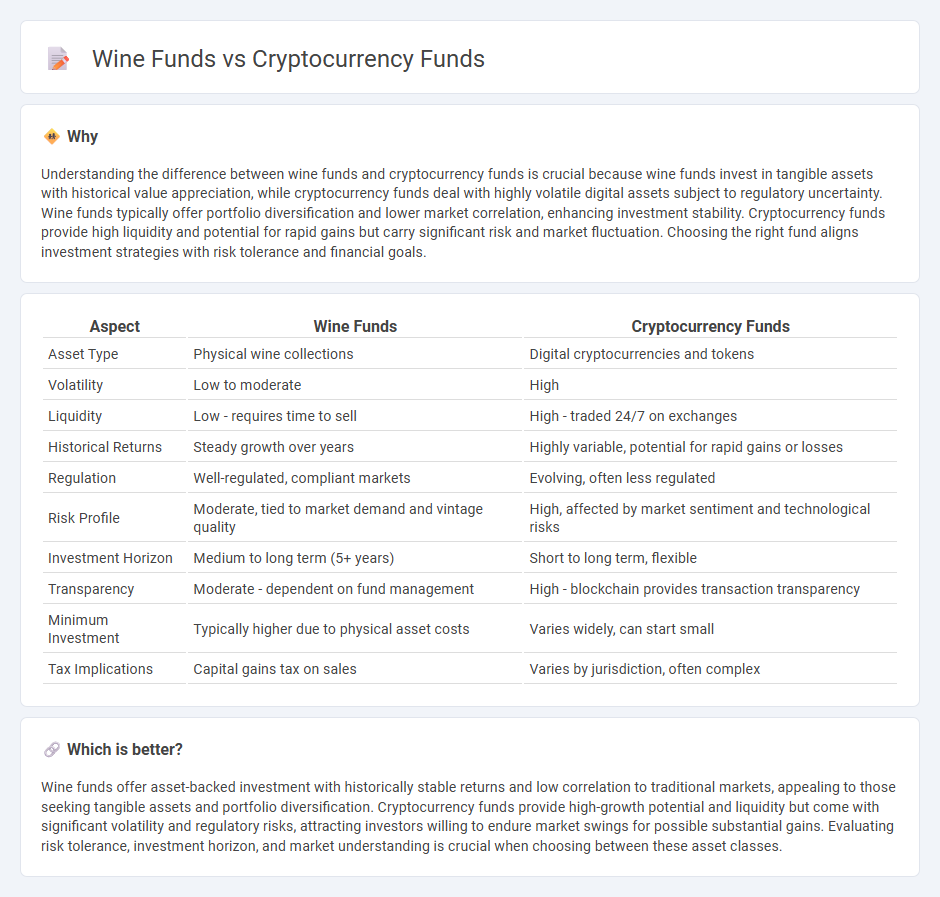

Understanding the difference between wine funds and cryptocurrency funds is crucial because wine funds invest in tangible assets with historical value appreciation, while cryptocurrency funds deal with highly volatile digital assets subject to regulatory uncertainty. Wine funds typically offer portfolio diversification and lower market correlation, enhancing investment stability. Cryptocurrency funds provide high liquidity and potential for rapid gains but carry significant risk and market fluctuation. Choosing the right fund aligns investment strategies with risk tolerance and financial goals.

Comparison Table

| Aspect | Wine Funds | Cryptocurrency Funds |

|---|---|---|

| Asset Type | Physical wine collections | Digital cryptocurrencies and tokens |

| Volatility | Low to moderate | High |

| Liquidity | Low - requires time to sell | High - traded 24/7 on exchanges |

| Historical Returns | Steady growth over years | Highly variable, potential for rapid gains or losses |

| Regulation | Well-regulated, compliant markets | Evolving, often less regulated |

| Risk Profile | Moderate, tied to market demand and vintage quality | High, affected by market sentiment and technological risks |

| Investment Horizon | Medium to long term (5+ years) | Short to long term, flexible |

| Transparency | Moderate - dependent on fund management | High - blockchain provides transaction transparency |

| Minimum Investment | Typically higher due to physical asset costs | Varies widely, can start small |

| Tax Implications | Capital gains tax on sales | Varies by jurisdiction, often complex |

Which is better?

Wine funds offer asset-backed investment with historically stable returns and low correlation to traditional markets, appealing to those seeking tangible assets and portfolio diversification. Cryptocurrency funds provide high-growth potential and liquidity but come with significant volatility and regulatory risks, attracting investors willing to endure market swings for possible substantial gains. Evaluating risk tolerance, investment horizon, and market understanding is crucial when choosing between these asset classes.

Connection

Wine funds and cryptocurrency funds are connected through their appeal as alternative investment vehicles offering portfolio diversification beyond traditional assets like stocks and bonds. Both fund types attract investors seeking unique growth opportunities and exposure to asset classes tied to tangible goods or decentralized digital currencies. Their market performance is influenced by factors such as rarity and demand for fine wines, while cryptocurrency funds are driven by blockchain technology developments and market volatility.

Key Terms

Cryptocurrency Funds:

Cryptocurrency funds invest in digital assets like Bitcoin, Ethereum, and other altcoins, offering exposure to highly volatile but potentially high-reward markets driven by blockchain technology and decentralized finance trends. These funds provide liquidity, ease of access, and professional management, making them attractive compared to traditional alternatives like wine funds, which invest in physical assets with longer appreciation horizons and lower liquidity. Explore the advantages of cryptocurrency funds to understand how they fit into modern investment portfolios.

Blockchain

Cryptocurrency funds leverage blockchain technology to offer transparent, secure, and decentralized investment options, allowing real-time tracking of assets and reducing fraud risk, unlike traditional wine funds that rely on physical storage and market valuation of rare vintages. Blockchain's immutability ensures verifiable provenance and ownership of digital assets, appealing to investors seeking liquidity and innovation in asset management. Explore how blockchain transforms fund strategies and asset security for deeper insights.

Volatility

Cryptocurrency funds exhibit significantly higher volatility compared to wine funds, with daily price fluctuations often exceeding 5%, driven by market sentiment, regulatory news, and technological developments. In contrast, wine funds tend to offer more stable returns, as wine prices are influenced by long-term factors such as rarity, vintage quality, and global demand rather than rapid market changes. Explore detailed comparisons to understand how volatility impacts investment strategies in these alternative asset classes.

Source and External Links

Crypto-Linked Mutual Funds - ProFunds - ProFunds offers crypto-linked mutual funds that invest in cryptocurrency futures, not directly in coins, with options including Bitcoin and Ether exposure and ease of trading on major platforms without needing a crypto wallet.

Crypto Funds - Fidelity Investments - Fidelity provides crypto funds including the Wise Origin Bitcoin Fund and Ethereum Fund, enabling crypto exposure through brokerage and IRA accounts without owning crypto directly, focusing on competitive expense ratios and accessibility.

The Best Bitcoin ETFs to Buy - Kiplinger - Major Bitcoin ETFs like Fidelity's Wise Origin Bitcoin Fund and ARK 21Shares Bitcoin ETF offer liquid, no-custody-needed investment vehicles tracking proprietary or CME-based bitcoin benchmarks, suitable for investors interested in bitcoin exposure via mutual fund structures.

dowidth.com

dowidth.com