Royalty stream investing offers direct income derived from intellectual property or natural resources, providing potentially stable cash flows independent of market volatility. Index fund investing involves purchasing a diversified portfolio tracking market indices, offering broad market exposure with lower fees but variable returns tied to overall market performance. Explore the differences in risk, return, and income potential to determine which investment aligns with your financial goals.

Why it is important

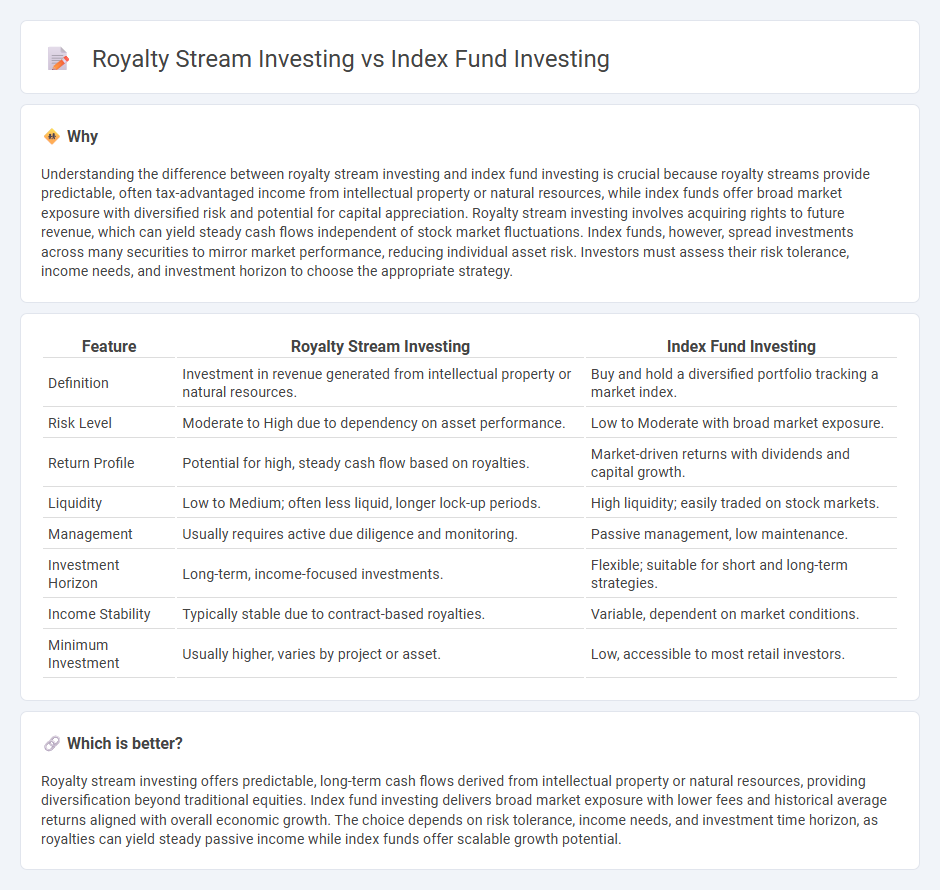

Understanding the difference between royalty stream investing and index fund investing is crucial because royalty streams provide predictable, often tax-advantaged income from intellectual property or natural resources, while index funds offer broad market exposure with diversified risk and potential for capital appreciation. Royalty stream investing involves acquiring rights to future revenue, which can yield steady cash flows independent of stock market fluctuations. Index funds, however, spread investments across many securities to mirror market performance, reducing individual asset risk. Investors must assess their risk tolerance, income needs, and investment horizon to choose the appropriate strategy.

Comparison Table

| Feature | Royalty Stream Investing | Index Fund Investing |

|---|---|---|

| Definition | Investment in revenue generated from intellectual property or natural resources. | Buy and hold a diversified portfolio tracking a market index. |

| Risk Level | Moderate to High due to dependency on asset performance. | Low to Moderate with broad market exposure. |

| Return Profile | Potential for high, steady cash flow based on royalties. | Market-driven returns with dividends and capital growth. |

| Liquidity | Low to Medium; often less liquid, longer lock-up periods. | High liquidity; easily traded on stock markets. |

| Management | Usually requires active due diligence and monitoring. | Passive management, low maintenance. |

| Investment Horizon | Long-term, income-focused investments. | Flexible; suitable for short and long-term strategies. |

| Income Stability | Typically stable due to contract-based royalties. | Variable, dependent on market conditions. |

| Minimum Investment | Usually higher, varies by project or asset. | Low, accessible to most retail investors. |

Which is better?

Royalty stream investing offers predictable, long-term cash flows derived from intellectual property or natural resources, providing diversification beyond traditional equities. Index fund investing delivers broad market exposure with lower fees and historical average returns aligned with overall economic growth. The choice depends on risk tolerance, income needs, and investment time horizon, as royalties can yield steady passive income while index funds offer scalable growth potential.

Connection

Royalty stream investing and index fund investing both provide diversified income streams but differ in risk and asset structure; royalty streams generate cash flow from intellectual property or natural resources, while index funds aggregate shares across multiple companies to track market performance. Investors often use index funds for broad market exposure and royalty streams for steady, asset-backed income with potential inflation protection. Combining these strategies can optimize portfolio balance between growth potential and consistent return generation.

Key Terms

Diversification

Index fund investing offers broad diversification by pooling assets across various sectors and companies, reducing exposure to individual risks. Royalty stream investing provides diversification through income generated from multiple intellectual property assets or natural resources, often independent of market fluctuations. Explore the benefits and strategies of each approach to tailor your investment portfolio effectively.

Passive income

Index fund investing offers diversified exposure to a broad market with relatively low fees, enabling investors to build passive income through dividends and capital appreciation. Royalty stream investing generates consistent and often higher passive income by acquiring rights to ongoing revenue from intellectual property, natural resources, or other assets, albeit with higher risk and less liquidity. Explore the nuances of both strategies to determine which passive income approach aligns best with your financial goals.

Liquidity

Index fund investing offers high liquidity as shares can be bought or sold on the stock market instantly, providing investors with quick access to capital. Royalty stream investing generally involves lower liquidity due to its dependence on ongoing revenue from intellectual property or natural resources, often requiring longer holding periods to realize returns. Explore detailed comparisons of liquidity characteristics in these investment types to optimize your portfolio strategy.

Source and External Links

What is an index fund and how does it work? - An index fund is a type of mutual fund or ETF designed to mimic the performance of a specific index by investing in the securities that make up that index, offering a low-cost and diversified way to invest with generally less effort than picking individual stocks.

Index Funds - Index funds track the returns of market indexes like the S&P 500 by investing in all or a sample of securities within that index, and their composition is often weighted by market capitalization or price.

What is an index fund? - Vanguard - Index funds are investments that mirror the performance of a specific benchmark such as the S&P 500 by holding all or a representative sample of the stocks or bonds in that index, providing diversification and long-term growth potential without active stock picking.

dowidth.com

dowidth.com