Sneaker flipping generates high returns through short-term market trends and limited-edition releases, appealing to younger, trend-savvy investors. Gold investing offers long-term stability and protection against inflation, favored by those seeking a reliable, tangible asset. Discover the key differences and find which investment strategy suits your financial goals best.

Why it is important

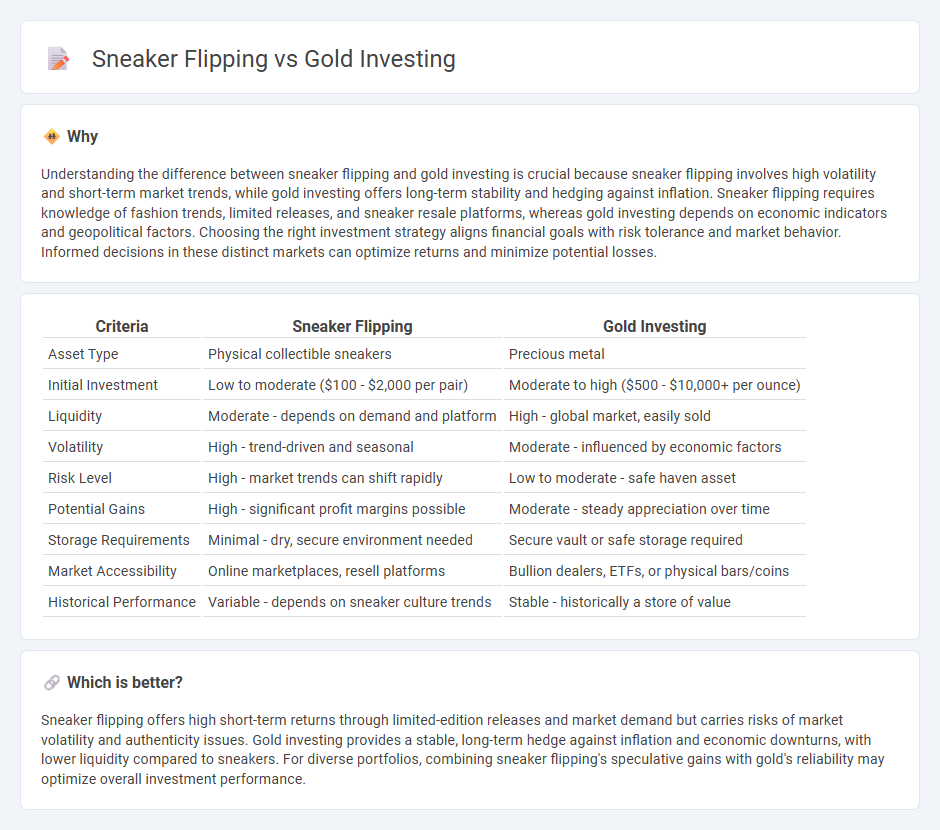

Understanding the difference between sneaker flipping and gold investing is crucial because sneaker flipping involves high volatility and short-term market trends, while gold investing offers long-term stability and hedging against inflation. Sneaker flipping requires knowledge of fashion trends, limited releases, and sneaker resale platforms, whereas gold investing depends on economic indicators and geopolitical factors. Choosing the right investment strategy aligns financial goals with risk tolerance and market behavior. Informed decisions in these distinct markets can optimize returns and minimize potential losses.

Comparison Table

| Criteria | Sneaker Flipping | Gold Investing |

|---|---|---|

| Asset Type | Physical collectible sneakers | Precious metal |

| Initial Investment | Low to moderate ($100 - $2,000 per pair) | Moderate to high ($500 - $10,000+ per ounce) |

| Liquidity | Moderate - depends on demand and platform | High - global market, easily sold |

| Volatility | High - trend-driven and seasonal | Moderate - influenced by economic factors |

| Risk Level | High - market trends can shift rapidly | Low to moderate - safe haven asset |

| Potential Gains | High - significant profit margins possible | Moderate - steady appreciation over time |

| Storage Requirements | Minimal - dry, secure environment needed | Secure vault or safe storage required |

| Market Accessibility | Online marketplaces, resell platforms | Bullion dealers, ETFs, or physical bars/coins |

| Historical Performance | Variable - depends on sneaker culture trends | Stable - historically a store of value |

Which is better?

Sneaker flipping offers high short-term returns through limited-edition releases and market demand but carries risks of market volatility and authenticity issues. Gold investing provides a stable, long-term hedge against inflation and economic downturns, with lower liquidity compared to sneakers. For diverse portfolios, combining sneaker flipping's speculative gains with gold's reliability may optimize overall investment performance.

Connection

Sneaker flipping and gold investing both rely on market demand and scarcity to generate profit, where limited supply drives up resale values. Each investment requires strategic timing and market knowledge to maximize returns, as trends in sneaker culture or gold prices fluctuate based on consumer interest and economic factors. Both serve as alternative assets, offering diversification beyond traditional stocks and bonds.

Key Terms

Asset Liquidity

Gold investing offers high liquidity due to its universal market demand and ability to be quickly traded in global exchanges, making it a preferred choice for asset liquidity. Sneaker flipping, while potentially lucrative, faces lower liquidity as it depends on niche market trends, limited editions, and buyer interest within sneaker communities. Explore the advantages and risks of both assets to enhance your investment strategy.

Market Volatility

Gold investing offers a stable hedge against market volatility due to its intrinsic value and historical role as a safe haven asset, often preserving wealth during economic downturns. Sneaker flipping involves higher risk with rapid price fluctuations driven by trends, limited editions, and consumer demand, resulting in potential for quick gains but less predictability. Explore detailed strategies and risk profiles to determine which investment aligns best with your financial goals.

Authenticity Verification

Authenticity verification is paramount in both gold investing and sneaker flipping to ensure value retention and avoid counterfeit losses. Gold investors rely on assays, hallmark certifications, and advanced testing methods like X-ray fluorescence to confirm purity and authenticity, while sneaker flippers depend on serial numbers, detailed stitching quality, brand-specific markers, and specialized UV light checks to distinguish genuine pairs from fakes. Explore proven authenticity verification techniques to safeguard your investments in gold and sneakers.

Source and External Links

How to Buy Gold to Diversify Your Portfolio - Gold can be added to a portfolio through physical bars, coins, gold mining stocks, or ETFs, offering potential diversification and a hedge against market stress, though it doesn't guarantee protection from loss.

How to buy gold: 2 ways to invest in gold - Investors can choose between owning physical gold (bars, coins) or gold-related financial products like ETFs, funds, futures, and mining stocks, each with distinct risks and complexities.

An Introduction to Gold Investment - Gold investment options range from coins and bars (with considerations for storage and security) to digital platforms, offering flexibility and potential tax benefits for certain bullion coins.

dowidth.com

dowidth.com