Music royalties investing offers a unique opportunity to earn passive income through the ownership of song rights, often providing higher liquidity compared to traditional real estate investments. Real estate investing involves acquiring physical properties, balancing potential long-term appreciation with management responsibilities and market fluctuations. Explore how these distinct asset classes compare in terms of risk, return, and diversification potential.

Why it is important

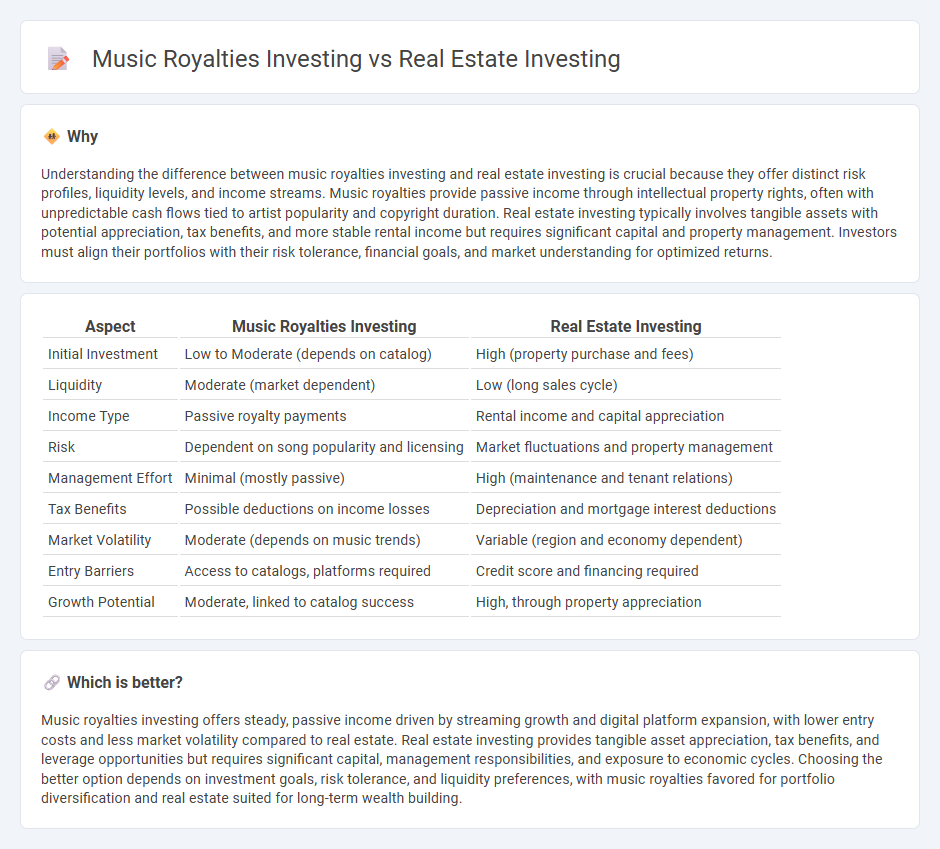

Understanding the difference between music royalties investing and real estate investing is crucial because they offer distinct risk profiles, liquidity levels, and income streams. Music royalties provide passive income through intellectual property rights, often with unpredictable cash flows tied to artist popularity and copyright duration. Real estate investing typically involves tangible assets with potential appreciation, tax benefits, and more stable rental income but requires significant capital and property management. Investors must align their portfolios with their risk tolerance, financial goals, and market understanding for optimized returns.

Comparison Table

| Aspect | Music Royalties Investing | Real Estate Investing |

|---|---|---|

| Initial Investment | Low to Moderate (depends on catalog) | High (property purchase and fees) |

| Liquidity | Moderate (market dependent) | Low (long sales cycle) |

| Income Type | Passive royalty payments | Rental income and capital appreciation |

| Risk | Dependent on song popularity and licensing | Market fluctuations and property management |

| Management Effort | Minimal (mostly passive) | High (maintenance and tenant relations) |

| Tax Benefits | Possible deductions on income losses | Depreciation and mortgage interest deductions |

| Market Volatility | Moderate (depends on music trends) | Variable (region and economy dependent) |

| Entry Barriers | Access to catalogs, platforms required | Credit score and financing required |

| Growth Potential | Moderate, linked to catalog success | High, through property appreciation |

Which is better?

Music royalties investing offers steady, passive income driven by streaming growth and digital platform expansion, with lower entry costs and less market volatility compared to real estate. Real estate investing provides tangible asset appreciation, tax benefits, and leverage opportunities but requires significant capital, management responsibilities, and exposure to economic cycles. Choosing the better option depends on investment goals, risk tolerance, and liquidity preferences, with music royalties favored for portfolio diversification and real estate suited for long-term wealth building.

Connection

Music royalties investing and real estate investing are connected through their shared characteristic of generating passive income streams from asset ownership. Both asset classes provide investors with cash flow; music royalties yield earnings from intellectual property rights tied to song usage, while real estate offers rental income from property leases. Diversification across these counter-cyclical investments helps mitigate market volatility, enhancing portfolio stability and long-term wealth accumulation.

Key Terms

Real estate investing:

Real estate investing offers tangible asset ownership, potential for rental income, and property appreciation, making it a reliable long-term wealth-building strategy. Investors benefit from leveraging opportunities, tax advantages like depreciation, and diversification through residential, commercial, or industrial properties. Explore how real estate investments can provide stability and growth in your portfolio.

Cash flow

Real estate investing generates cash flow primarily through rental income, offering predictable monthly returns and potential property appreciation. Music royalties investing delivers passive income based on song performance, streaming, and licensing, often fluctuating with market trends and artist popularity. Explore detailed comparisons of cash flow dynamics between these two investment types to optimize your portfolio strategy.

Appreciation

Real estate investing offers potential for property value appreciation driven by market trends, location, and economic factors, often providing both income and asset growth over time. Music royalties investing generates cash flow based on the performance and popularity of songs, with appreciation linked to catalog demand and rights valuation in the entertainment market. Explore deeper insights into the benefits and risks of each investment type to optimize your portfolio strategy.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - NerdWallet - Outlines five accessible ways to invest in real estate, including REITs, rental properties, property flipping, and online platforms, highlighting options that require minimal hands-on management for passive income.

Real Estate Investing for Beginners: 5 Skills of Successful Investors - Discusses the importance of understanding different property types and zoning, and lists key skills needed for success, emphasizing that real estate investing is not always low risk and requires patience and knowledge.

Real estate investment made easy - Start today - Yieldstreet - Offers diversified and direct private real estate investment opportunities with data-driven insights, noting that U.S. property prices and income have historically outpaced inflation, but reminding investors that past performance does not guarantee future results.

dowidth.com

dowidth.com