Farmland crowdfunding offers investors access to agricultural assets with potential for stable, long-term returns, contrasting with the stock market's more volatile and liquid nature. This alternative investment diversifies portfolios by tapping into the growing demand for sustainable food production and land appreciation. Explore the benefits and risks of farmland crowdfunding versus stock market investing to make informed decisions.

Why it is important

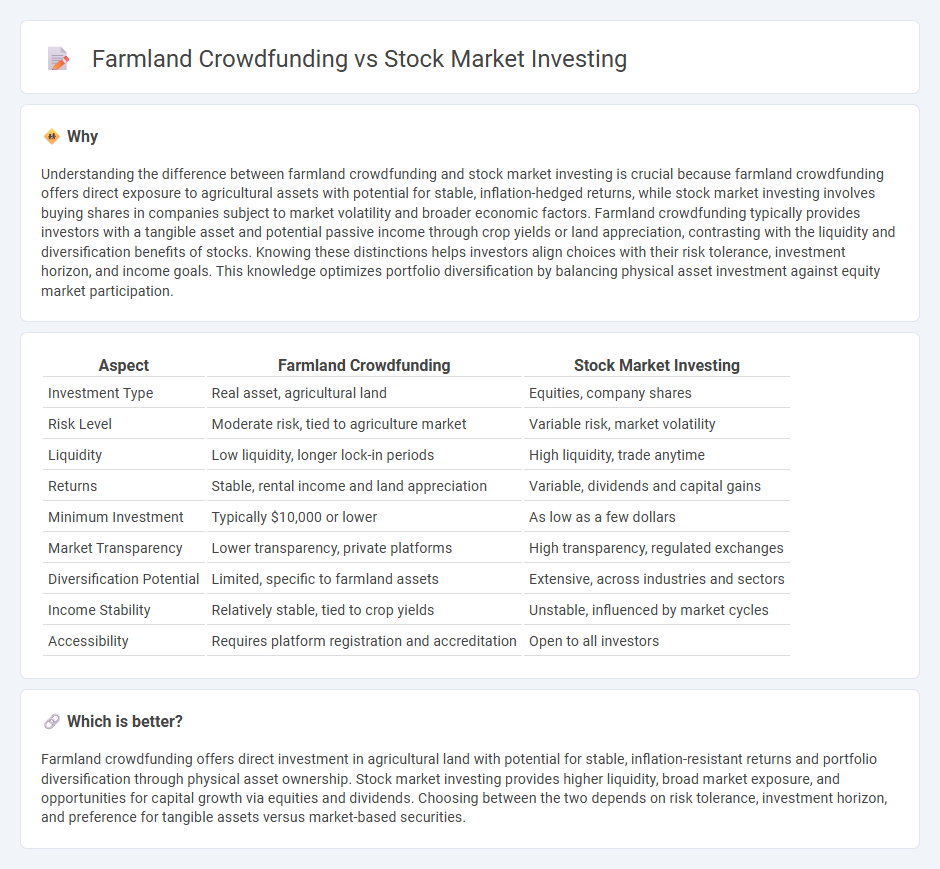

Understanding the difference between farmland crowdfunding and stock market investing is crucial because farmland crowdfunding offers direct exposure to agricultural assets with potential for stable, inflation-hedged returns, while stock market investing involves buying shares in companies subject to market volatility and broader economic factors. Farmland crowdfunding typically provides investors with a tangible asset and potential passive income through crop yields or land appreciation, contrasting with the liquidity and diversification benefits of stocks. Knowing these distinctions helps investors align choices with their risk tolerance, investment horizon, and income goals. This knowledge optimizes portfolio diversification by balancing physical asset investment against equity market participation.

Comparison Table

| Aspect | Farmland Crowdfunding | Stock Market Investing |

|---|---|---|

| Investment Type | Real asset, agricultural land | Equities, company shares |

| Risk Level | Moderate risk, tied to agriculture market | Variable risk, market volatility |

| Liquidity | Low liquidity, longer lock-in periods | High liquidity, trade anytime |

| Returns | Stable, rental income and land appreciation | Variable, dividends and capital gains |

| Minimum Investment | Typically $10,000 or lower | As low as a few dollars |

| Market Transparency | Lower transparency, private platforms | High transparency, regulated exchanges |

| Diversification Potential | Limited, specific to farmland assets | Extensive, across industries and sectors |

| Income Stability | Relatively stable, tied to crop yields | Unstable, influenced by market cycles |

| Accessibility | Requires platform registration and accreditation | Open to all investors |

Which is better?

Farmland crowdfunding offers direct investment in agricultural land with potential for stable, inflation-resistant returns and portfolio diversification through physical asset ownership. Stock market investing provides higher liquidity, broad market exposure, and opportunities for capital growth via equities and dividends. Choosing between the two depends on risk tolerance, investment horizon, and preference for tangible assets versus market-based securities.

Connection

Farmland crowdfunding and stock market investing intersect through their shared goal of portfolio diversification by providing access to alternative asset classes. Both investment types leverage digital platforms for accessibility, enabling investors to participate in agricultural real estate or equity markets with lower capital requirements. These methods balance risk exposure by combining stable, tangible assets in farmland crowdfunding with the high liquidity and volatility characteristic of stock market investing.

Key Terms

**Stock market investing:**

Stock market investing provides liquidity, diversification, and access to a broad range of industries through publicly traded equities, ETFs, and mutual funds, making it ideal for both short-term trading and long-term wealth building. Historical data shows an average annual return of approximately 7-10% after inflation, driven by capital gains and dividends, with risks managed via portfolio diversification and market analysis. Explore strategies to maximize returns and understand market trends by learning more about stock market investing.

Shares

Stock market investing offers liquidity and diversification through shares of publicly traded companies, enabling investors to buy and sell quickly on major exchanges like NYSE and NASDAQ. Farmland crowdfunding involves purchasing fractional shares in agricultural land projects, providing exposure to real estate assets with potential for stable, long-term returns driven by crop yields and land value appreciation. Explore the nuances of share-based investments in both markets to enhance your portfolio strategy.

Dividends

Dividend yields in stock market investing average around 2% to 4% annually, providing regular income through quarterly or annual payments from established companies. Farmland crowdfunding offers dividends that often exceed 5%, generated from agricultural profits and land lease agreements, presenting an alternative income stream tied to real assets. Explore detailed comparisons to understand which dividend strategy aligns best with your investment goals.

Source and External Links

Stocks | Investor.gov - Stocks represent ownership shares in a company, and you can buy them through direct stock plans, dividend reinvestment plans, brokers, or stock funds, each with different features and costs.

How to Invest in Stocks: 2025 Beginner's Guide - NerdWallet - To invest in stocks, open an online brokerage account, fund it, and purchase shares or stock funds, with options starting from very small amounts including fractional shares.

The Basics of Investing In Stocks - Common ways to buy stocks include direct stock plans, dividend reinvestment plans, brokers (discount or full service), and stock funds, each offering different access methods and fees.

dowidth.com

dowidth.com