Tangible asset tokenization transforms physical assets like real estate and art into digital tokens, offering increased liquidity and fractional ownership compared to traditional mutual funds, which pool investor money into diversified portfolios managed by professionals. This innovative approach enhances transparency through blockchain technology, reduces entry barriers, and enables direct trading of asset-backed tokens. Explore how these investment methods differ to identify the best strategy for your financial goals.

Why it is important

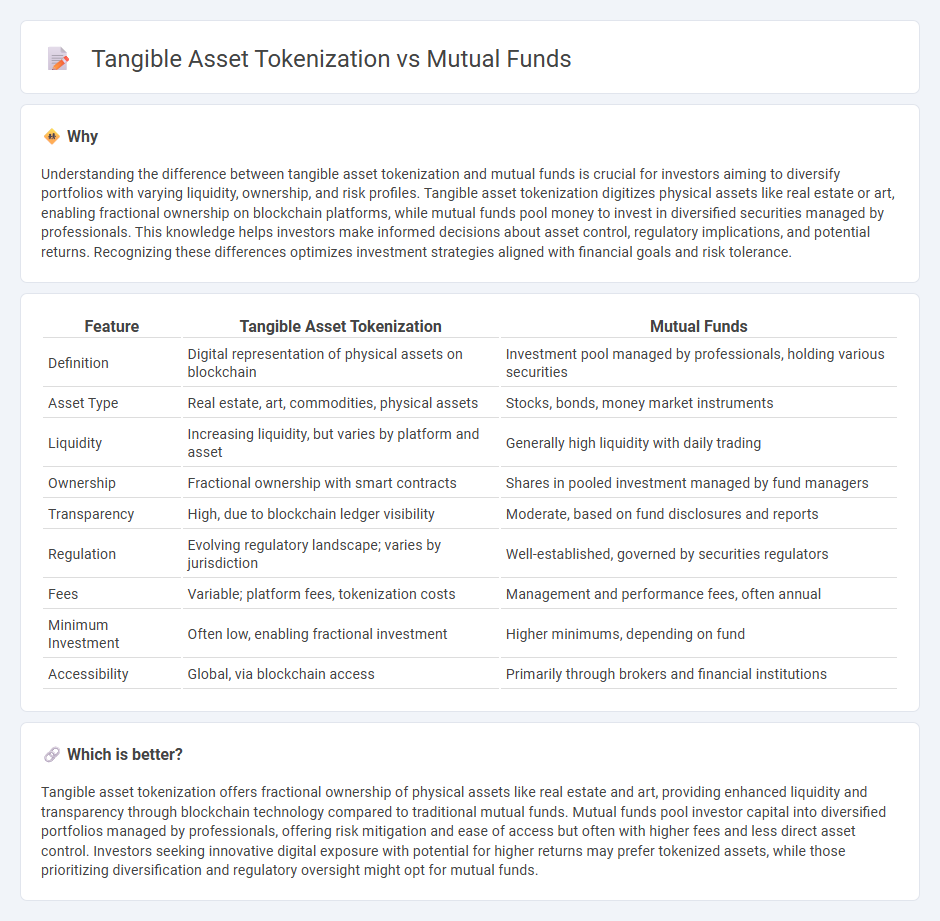

Understanding the difference between tangible asset tokenization and mutual funds is crucial for investors aiming to diversify portfolios with varying liquidity, ownership, and risk profiles. Tangible asset tokenization digitizes physical assets like real estate or art, enabling fractional ownership on blockchain platforms, while mutual funds pool money to invest in diversified securities managed by professionals. This knowledge helps investors make informed decisions about asset control, regulatory implications, and potential returns. Recognizing these differences optimizes investment strategies aligned with financial goals and risk tolerance.

Comparison Table

| Feature | Tangible Asset Tokenization | Mutual Funds |

|---|---|---|

| Definition | Digital representation of physical assets on blockchain | Investment pool managed by professionals, holding various securities |

| Asset Type | Real estate, art, commodities, physical assets | Stocks, bonds, money market instruments |

| Liquidity | Increasing liquidity, but varies by platform and asset | Generally high liquidity with daily trading |

| Ownership | Fractional ownership with smart contracts | Shares in pooled investment managed by fund managers |

| Transparency | High, due to blockchain ledger visibility | Moderate, based on fund disclosures and reports |

| Regulation | Evolving regulatory landscape; varies by jurisdiction | Well-established, governed by securities regulators |

| Fees | Variable; platform fees, tokenization costs | Management and performance fees, often annual |

| Minimum Investment | Often low, enabling fractional investment | Higher minimums, depending on fund |

| Accessibility | Global, via blockchain access | Primarily through brokers and financial institutions |

Which is better?

Tangible asset tokenization offers fractional ownership of physical assets like real estate and art, providing enhanced liquidity and transparency through blockchain technology compared to traditional mutual funds. Mutual funds pool investor capital into diversified portfolios managed by professionals, offering risk mitigation and ease of access but often with higher fees and less direct asset control. Investors seeking innovative digital exposure with potential for higher returns may prefer tokenized assets, while those prioritizing diversification and regulatory oversight might opt for mutual funds.

Connection

Tangible asset tokenization transforms physical assets like real estate, commodities, or art into digital tokens, enabling fractional ownership and enhanced liquidity. Mutual funds aggregate investments from multiple investors to diversify assets and reduce risk, and integrating tokenized tangible assets within these funds can increase transparency and accessibility. This connection allows investors to benefit from diversified portfolios that include fractional shares of traditionally illiquid tangible assets, optimizing asset management and investment strategies.

Key Terms

Diversification

Mutual funds offer diversification by pooling investments across various securities, reducing risk exposure through professionally managed portfolios. Tangible asset tokenization enables fractional ownership of physical assets like real estate or art, providing liquidity and access to markets traditionally limited by high entry costs. Explore more to understand how each option can enhance your investment diversification strategy.

Liquidity

Mutual funds offer high liquidity as investors can buy or sell shares on a daily basis, making capital readily accessible. Tangible asset tokenization, while improving liquidity over traditional ownership of physical assets like real estate or art, still faces market limitations and regulatory hurdles that can affect the speed of transactions. Explore the nuances of liquidity in both investment options to make informed financial decisions.

Ownership structure

Mutual funds consolidate investor capital into professionally managed portfolios, granting shareholders proportional ownership without direct control over individual assets. In contrast, tangible asset tokenization digitizes physical assets into blockchain-based tokens, enabling fractional ownership with transparent, immutable records and potentially enhanced liquidity. Explore how these ownership structures redefine investment accessibility and control by learning more.

Source and External Links

Mutual Funds - A mutual fund is an SEC-registered open-end investment company that pools money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities, managed professionally, offering benefits such as diversification, professional management, liquidity, and often low minimum investments.

Mutual fund - Mutual funds pool money from investors to buy securities, existing as open-end, closed-end, or unit investment trusts, and can be actively or passively managed, offering diversification, liquidity, and professional management, but also involving fees and expenses.

Understanding mutual funds - Mutual funds enable investors to pool money to buy diversified assets professionally managed with lower transaction costs and convenience, providing access to a broad range of asset classes and professional portfolio management.

dowidth.com

dowidth.com