Psychedelic stocks have gained traction by targeting mental health treatments with compounds like psilocybin and MDMA, showing potential for high growth amid evolving regulatory landscapes. Pharmaceutical stocks represent established market leaders focused on broad drug portfolios, including vaccines, oncology, and chronic disease therapies, offering stability and consistent returns. Explore the comparative dynamics of these sectors to make informed investment decisions.

Why it is important

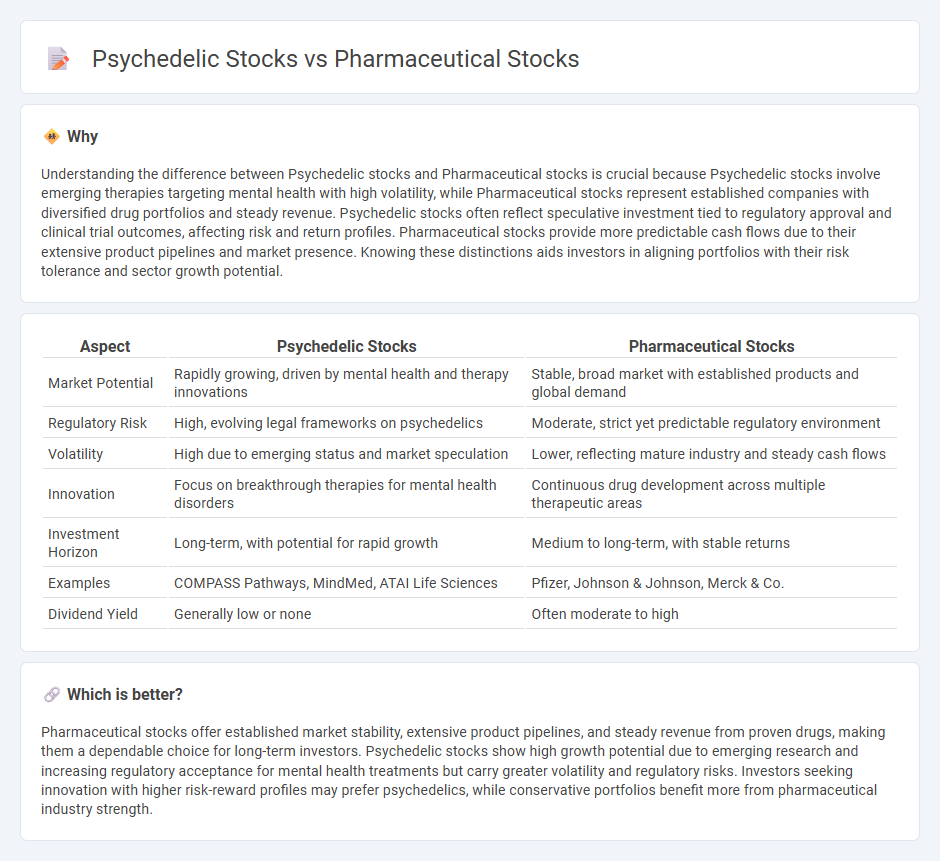

Understanding the difference between Psychedelic stocks and Pharmaceutical stocks is crucial because Psychedelic stocks involve emerging therapies targeting mental health with high volatility, while Pharmaceutical stocks represent established companies with diversified drug portfolios and steady revenue. Psychedelic stocks often reflect speculative investment tied to regulatory approval and clinical trial outcomes, affecting risk and return profiles. Pharmaceutical stocks provide more predictable cash flows due to their extensive product pipelines and market presence. Knowing these distinctions aids investors in aligning portfolios with their risk tolerance and sector growth potential.

Comparison Table

| Aspect | Psychedelic Stocks | Pharmaceutical Stocks |

|---|---|---|

| Market Potential | Rapidly growing, driven by mental health and therapy innovations | Stable, broad market with established products and global demand |

| Regulatory Risk | High, evolving legal frameworks on psychedelics | Moderate, strict yet predictable regulatory environment |

| Volatility | High due to emerging status and market speculation | Lower, reflecting mature industry and steady cash flows |

| Innovation | Focus on breakthrough therapies for mental health disorders | Continuous drug development across multiple therapeutic areas |

| Investment Horizon | Long-term, with potential for rapid growth | Medium to long-term, with stable returns |

| Examples | COMPASS Pathways, MindMed, ATAI Life Sciences | Pfizer, Johnson & Johnson, Merck & Co. |

| Dividend Yield | Generally low or none | Often moderate to high |

Which is better?

Pharmaceutical stocks offer established market stability, extensive product pipelines, and steady revenue from proven drugs, making them a dependable choice for long-term investors. Psychedelic stocks show high growth potential due to emerging research and increasing regulatory acceptance for mental health treatments but carry greater volatility and regulatory risks. Investors seeking innovation with higher risk-reward profiles may prefer psychedelics, while conservative portfolios benefit more from pharmaceutical industry strength.

Connection

Psychedelic stocks and pharmaceutical stocks are interconnected through their shared focus on drug development, regulatory approval, and healthcare market dynamics. Both sectors invest heavily in clinical trials and scientific research to bring novel treatments to market, often targeting mental health conditions such as depression and PTSD. The rising interest in psychedelics as therapeutic agents drives pharmaceutical companies to explore partnerships, mergers, and acquisitions, blending biotechnology innovation with established pharmaceutical expertise.

Key Terms

Regulatory Approval

Pharmaceutical stocks often benefit from well-established regulatory pathways through agencies like the FDA, which provide clearer timelines and risk assessments for drug approvals. Psychedelic stocks face more complex and evolving regulatory landscapes, as psychedelics are transitioning from Schedule I substances to potential medical treatments, creating both uncertainties and significant growth opportunities. Explore the latest trends and regulatory updates shaping these dynamic sectors.

Market Volatility

Pharmaceutical stocks typically exhibit moderate volatility due to established drug pipelines and regulatory frameworks, whereas psychedelic stocks experience higher volatility driven by evolving legalization policies and nascent market dynamics. The psychedelic sector's growth potential attracts speculative investors, resulting in sharper price fluctuations compared to the relatively stable pharmaceutical industry. Explore market trends and volatility metrics to better understand the investment risks and opportunities in these sectors.

Intellectual Property

Pharmaceutical stocks often hold extensive intellectual property portfolios, including patents on drug compounds, formulations, and manufacturing processes, providing strong market exclusivity and competitive advantage. Psychedelic stocks, emerging in the biotech sector, focus on intellectual property related to novel therapeutic psychedelic compounds and proprietary drug delivery systems aimed at mental health treatments. Explore deeper insights into how intellectual property strategies shape investment potential in these evolving sectors.

Source and External Links

The Best Healthcare Stocks to Buy | Morningstar - Merck & Co. is highlighted as a leading pharmaceutical stock, considered 26% undervalued with a wide economic moat and strong drug pipeline, including its key cancer drug Keytruda.

Pharmaceuticals: Major: Industry Performance -- USA - TradingView - A performance overview and key metrics for major U.S. pharmaceutical companies like Eli Lilly, Cytokinetics, Akero Therapeutics, and ACADIA Pharmaceuticals, useful for analysis and investment decisions.

The Biggest Pharmaceutical Stocks by Market Cap - Stock Analysis - A list ranking the largest pharmaceutical and drug companies by market capitalization, showing diversity across major players and their market sizes.

dowidth.com

dowidth.com