Investment in the space economy focuses on expanding satellite technology, space exploration, and infrastructure development, promising long-term growth fueled by advancements in aerospace engineering and government funding. Biotechnology investment targets innovations in healthcare, pharmaceuticals, and agricultural improvements, driven by breakthroughs in genetic research and personalized medicine. Explore deeper insights into how these sectors shape the future of global markets and investment opportunities.

Why it is important

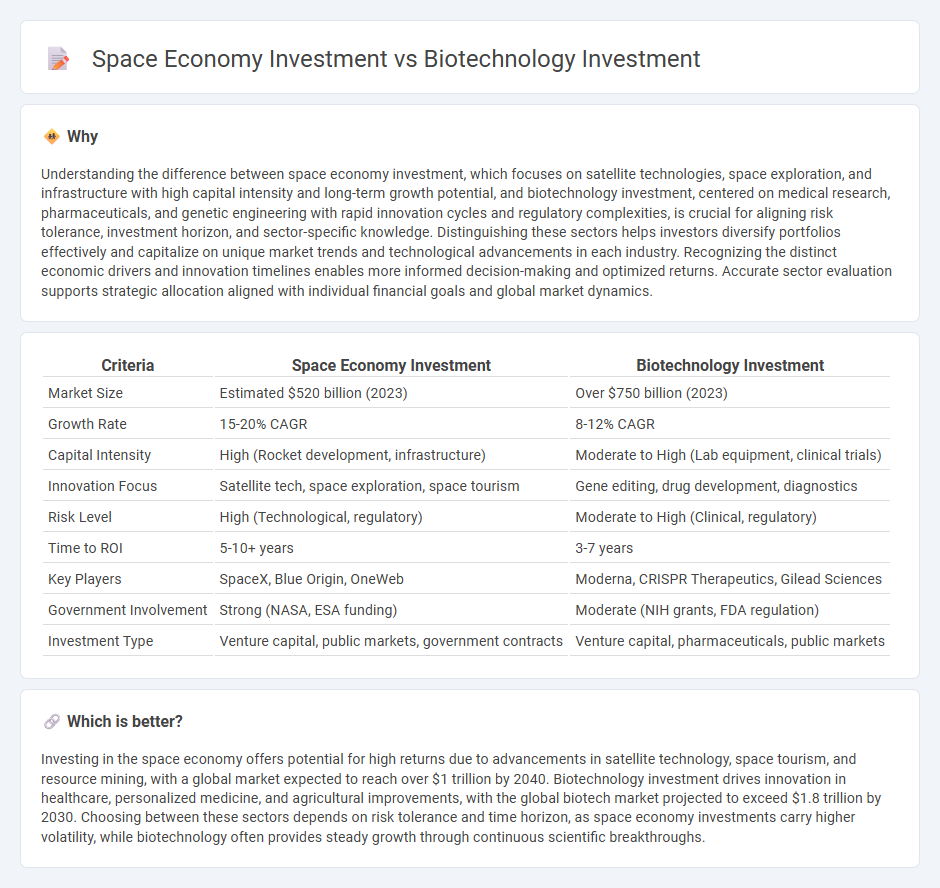

Understanding the difference between space economy investment, which focuses on satellite technologies, space exploration, and infrastructure with high capital intensity and long-term growth potential, and biotechnology investment, centered on medical research, pharmaceuticals, and genetic engineering with rapid innovation cycles and regulatory complexities, is crucial for aligning risk tolerance, investment horizon, and sector-specific knowledge. Distinguishing these sectors helps investors diversify portfolios effectively and capitalize on unique market trends and technological advancements in each industry. Recognizing the distinct economic drivers and innovation timelines enables more informed decision-making and optimized returns. Accurate sector evaluation supports strategic allocation aligned with individual financial goals and global market dynamics.

Comparison Table

| Criteria | Space Economy Investment | Biotechnology Investment |

|---|---|---|

| Market Size | Estimated $520 billion (2023) | Over $750 billion (2023) |

| Growth Rate | 15-20% CAGR | 8-12% CAGR |

| Capital Intensity | High (Rocket development, infrastructure) | Moderate to High (Lab equipment, clinical trials) |

| Innovation Focus | Satellite tech, space exploration, space tourism | Gene editing, drug development, diagnostics |

| Risk Level | High (Technological, regulatory) | Moderate to High (Clinical, regulatory) |

| Time to ROI | 5-10+ years | 3-7 years |

| Key Players | SpaceX, Blue Origin, OneWeb | Moderna, CRISPR Therapeutics, Gilead Sciences |

| Government Involvement | Strong (NASA, ESA funding) | Moderate (NIH grants, FDA regulation) |

| Investment Type | Venture capital, public markets, government contracts | Venture capital, pharmaceuticals, public markets |

Which is better?

Investing in the space economy offers potential for high returns due to advancements in satellite technology, space tourism, and resource mining, with a global market expected to reach over $1 trillion by 2040. Biotechnology investment drives innovation in healthcare, personalized medicine, and agricultural improvements, with the global biotech market projected to exceed $1.8 trillion by 2030. Choosing between these sectors depends on risk tolerance and time horizon, as space economy investments carry higher volatility, while biotechnology often provides steady growth through continuous scientific breakthroughs.

Connection

Investment in the space economy drives advancements in biotechnology by providing innovative technologies such as microgravity research environments that accelerate drug discovery and development. Biotechnology investment benefits from space-based data and materials, enabling enhanced precision in genetic engineering and biomanufacturing processes. The synergistic growth of these sectors fuels breakthroughs in healthcare, agriculture, and environmental sustainability through combined capital and technological integration.

Key Terms

**Biotechnology investment:**

Biotechnology investment drives innovation in healthcare, agriculture, and environmental sustainability, with global funding reaching over $50 billion annually. This sector offers rapid returns through novel therapeutics, precision medicine, and bioengineering breakthroughs that address critical human needs. Explore further to understand the dynamic growth and impact of biotechnology investments worldwide.

Clinical Trials

Investment in biotechnology, particularly in clinical trials, reached approximately $50 billion globally in 2023, reflecting the sector's critical role in developing new medicines and therapies. In contrast, the space economy's investment primarily targets satellite technology and exploration, with clinical applications such as space-based biomedical research still emerging and receiving a smaller share of the overall funding. Explore the latest trends and data shaping investments in both biotechnology clinical trials and the evolving space economy for a comprehensive understanding.

Intellectual Property

Investment in the biotechnology sector significantly boosts patent filings and intellectual property (IP) creation, driving innovation in medical and agricultural technologies. In contrast, space economy investment emphasizes IP in satellite technologies, aerospace engineering, and space exploration patents, fostering advancements in communication and navigation systems. Explore the key differences in how these sectors leverage intellectual property to fuel growth and technological leadership.

Source and External Links

The Top 10 Private Equity Firms for Biotechnology | Leland - Private equity investment in biotechnology is being driven by trends in AI-powered drug discovery, gene editing, and personalized medicine, creating a broad field of opportunity for firms with strong scientific and regulatory expertise.

Should you invest in biotech? | Charles Stanley - Biotechnology investments offer significant long-term growth potential due to global healthcare demand but are also high-risk, often experiencing high failure rates among smaller, early-stage companies.

Biotech startup funding dried up in second quarter, HSBC finds - Venture capital funding for biotech startups fell sharply in the second quarter of 2025, with quarterly totals tied for the lowest in three years, although Chinese drug candidates drew increasing investor interest.

dowidth.com

dowidth.com