Sneaker flipping involves buying limited-edition sneakers at retail prices and reselling them for profit, capitalizing on trends and brand popularity within a fast-paced market. Real estate investing requires purchasing properties to generate rental income or long-term appreciation, providing a stable and tangible asset backed by market demand and location value. Explore the benefits and risks of sneaker flipping and real estate investing to determine which strategy matches your financial goals.

Why it is important

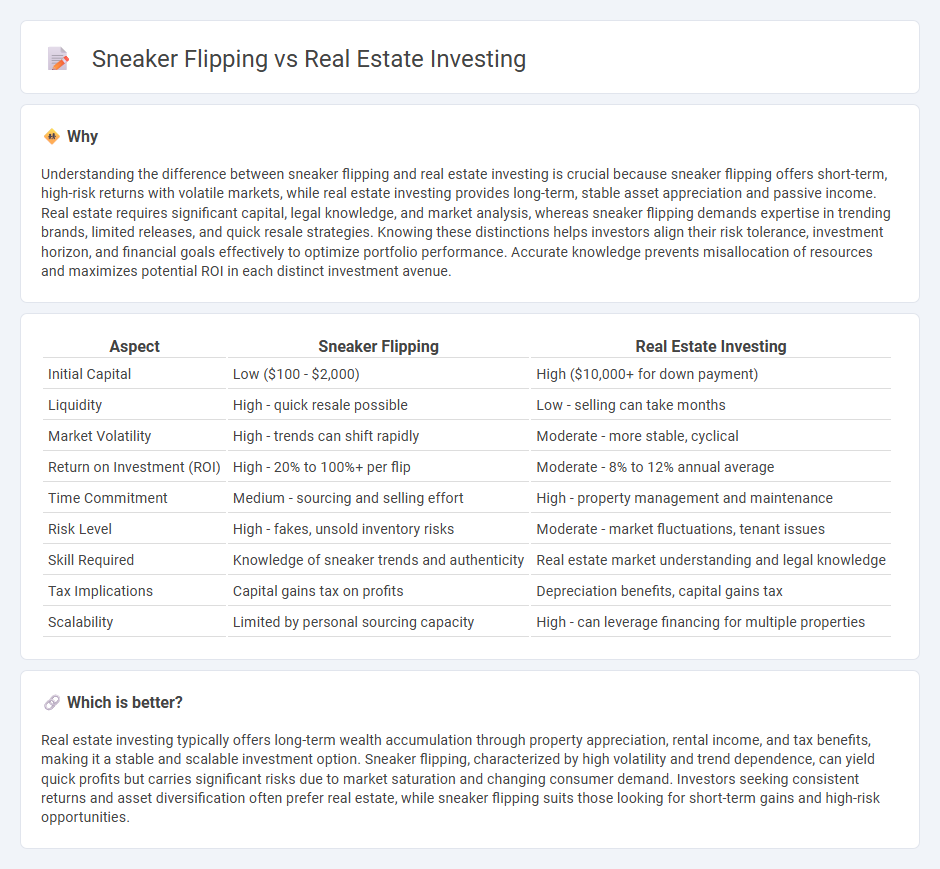

Understanding the difference between sneaker flipping and real estate investing is crucial because sneaker flipping offers short-term, high-risk returns with volatile markets, while real estate investing provides long-term, stable asset appreciation and passive income. Real estate requires significant capital, legal knowledge, and market analysis, whereas sneaker flipping demands expertise in trending brands, limited releases, and quick resale strategies. Knowing these distinctions helps investors align their risk tolerance, investment horizon, and financial goals effectively to optimize portfolio performance. Accurate knowledge prevents misallocation of resources and maximizes potential ROI in each distinct investment avenue.

Comparison Table

| Aspect | Sneaker Flipping | Real Estate Investing |

|---|---|---|

| Initial Capital | Low ($100 - $2,000) | High ($10,000+ for down payment) |

| Liquidity | High - quick resale possible | Low - selling can take months |

| Market Volatility | High - trends can shift rapidly | Moderate - more stable, cyclical |

| Return on Investment (ROI) | High - 20% to 100%+ per flip | Moderate - 8% to 12% annual average |

| Time Commitment | Medium - sourcing and selling effort | High - property management and maintenance |

| Risk Level | High - fakes, unsold inventory risks | Moderate - market fluctuations, tenant issues |

| Skill Required | Knowledge of sneaker trends and authenticity | Real estate market understanding and legal knowledge |

| Tax Implications | Capital gains tax on profits | Depreciation benefits, capital gains tax |

| Scalability | Limited by personal sourcing capacity | High - can leverage financing for multiple properties |

Which is better?

Real estate investing typically offers long-term wealth accumulation through property appreciation, rental income, and tax benefits, making it a stable and scalable investment option. Sneaker flipping, characterized by high volatility and trend dependence, can yield quick profits but carries significant risks due to market saturation and changing consumer demand. Investors seeking consistent returns and asset diversification often prefer real estate, while sneaker flipping suits those looking for short-term gains and high-risk opportunities.

Connection

Sneaker flipping and real estate investing both rely heavily on market demand analysis and timing to maximize returns. Both activities require a keen understanding of asset value fluctuations, where sneakers appreciate due to limited releases and trends, while real estate values grow based on location and economic factors. Strategic buying low and selling high is central to generating profit in these markets, making research, patience, and market insight critical for success.

Key Terms

**Real estate investing:**

Real estate investing offers long-term wealth building through property appreciation, rental income, and tax benefits, making it a stable and scalable investment strategy. Investors can leverage diverse markets, including residential, commercial, and multifamily properties, to maximize returns and mitigate risks. Discover how real estate investing can transform your financial future by exploring expert insights and market trends.

Cash Flow

Real estate investing generates consistent cash flow through rental income and property appreciation, providing long-term financial stability and passive income streams. Sneaker flipping offers quick profits from limited-edition releases but carries higher volatility and requires constant market monitoring. Explore how each investment impacts cash flow dynamics and portfolio diversification by learning more.

Equity

Real estate investing builds long-term equity through property appreciation and mortgage principal reduction, providing substantial wealth accumulation over time. Sneaker flipping generates quicker profits by capitalizing on limited-edition releases and market demand but lacks sustained equity growth. Explore the comparative benefits of these investment strategies to better understand their impact on your financial future.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - NerdWallet - Real estate investing can be lucrative and diversified through options like REITs, rental properties, flipping houses, and online platforms, catering to both hands-on and low-maintenance investors.

4 ways to invest in real estate - Fidelity - Key methods to invest in real estate include homeownership, REITs, mutual funds or ETFs, and becoming a landlord, each with its own benefits such as equity building and potential tax advantages.

Real estate investment made easy - Start today - Yieldstreet - Yieldstreet offers access to private real estate investments with diversified property types and the potential to hedge inflation, starting with minimum investments of $10,000.

dowidth.com

dowidth.com