Sports memorabilia trading offers unique investment opportunities driven by rarity, athlete popularity, and collectible demand, providing tangible asset value growth. In contrast, mutual funds pool investor capital to diversify across stocks, bonds, or other securities, balancing risk and return through professional management. Explore the benefits and risks of each to make informed investment decisions.

Why it is important

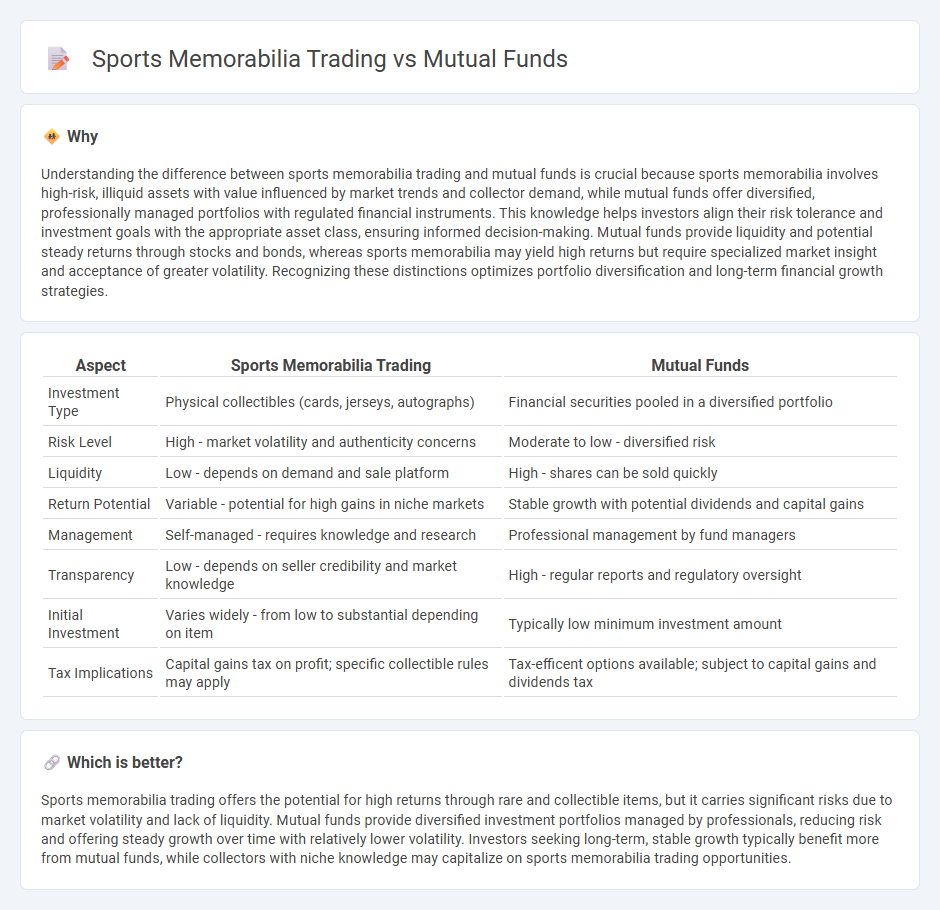

Understanding the difference between sports memorabilia trading and mutual funds is crucial because sports memorabilia involves high-risk, illiquid assets with value influenced by market trends and collector demand, while mutual funds offer diversified, professionally managed portfolios with regulated financial instruments. This knowledge helps investors align their risk tolerance and investment goals with the appropriate asset class, ensuring informed decision-making. Mutual funds provide liquidity and potential steady returns through stocks and bonds, whereas sports memorabilia may yield high returns but require specialized market insight and acceptance of greater volatility. Recognizing these distinctions optimizes portfolio diversification and long-term financial growth strategies.

Comparison Table

| Aspect | Sports Memorabilia Trading | Mutual Funds |

|---|---|---|

| Investment Type | Physical collectibles (cards, jerseys, autographs) | Financial securities pooled in a diversified portfolio |

| Risk Level | High - market volatility and authenticity concerns | Moderate to low - diversified risk |

| Liquidity | Low - depends on demand and sale platform | High - shares can be sold quickly |

| Return Potential | Variable - potential for high gains in niche markets | Stable growth with potential dividends and capital gains |

| Management | Self-managed - requires knowledge and research | Professional management by fund managers |

| Transparency | Low - depends on seller credibility and market knowledge | High - regular reports and regulatory oversight |

| Initial Investment | Varies widely - from low to substantial depending on item | Typically low minimum investment amount |

| Tax Implications | Capital gains tax on profit; specific collectible rules may apply | Tax-efficent options available; subject to capital gains and dividends tax |

Which is better?

Sports memorabilia trading offers the potential for high returns through rare and collectible items, but it carries significant risks due to market volatility and lack of liquidity. Mutual funds provide diversified investment portfolios managed by professionals, reducing risk and offering steady growth over time with relatively lower volatility. Investors seeking long-term, stable growth typically benefit more from mutual funds, while collectors with niche knowledge may capitalize on sports memorabilia trading opportunities.

Connection

Sports memorabilia trading and mutual funds both represent alternative investment strategies that diversify portfolios beyond traditional stocks and bonds. While sports memorabilia involves tangible assets with value driven by rarity and fan demand, mutual funds pool capital to invest in a broad range of securities, offering liquidity and professional management. Investors may leverage sports memorabilia trading to complement mutual fund holdings by balancing high-risk collectibles with more stable, diversified equity investments.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling investments across various asset classes, industries, and regions, reducing risk and enhancing returns. Sports memorabilia trading provides diversification through unique collectibles whose value depends on rarity, athlete popularity, and market trends, creating a niche investment landscape. Explore further to understand how diversification strategies differ fundamentally between these two investment options.

Liquidity

Mutual funds offer high liquidity by allowing investors to buy or sell shares on any trading day, providing quick access to cash. In contrast, sports memorabilia trading is significantly less liquid due to the niche market, requiring more time to find buyers at desired prices. Explore detailed comparisons to understand which investment aligns better with your liquidity needs.

Valuation

Mutual funds are valued based on net asset value (NAV), calculated by dividing the total market value of the fund's portfolio by the outstanding shares, providing a transparent and standardized metric. Sports memorabilia valuation depends on factors such as rarity, condition, provenance, and market demand, making it inherently subjective and prone to greater price volatility. Explore deeper insights into these valuation methods to optimize your investment strategy.

Source and External Links

Mutual Funds | Investor.gov - A mutual fund is an SEC-registered open-end investment company pooling money from many investors to invest in diversified assets managed by professionals, offering benefits like diversification, professional management, low minimum investments, and liquidity.

Mutual fund - Wikipedia - Mutual funds pool investors' money to buy securities, classified by investment type and management style, providing economies of scale, diversification, liquidity, and professional management but also involve fees.

Understanding mutual funds - Charles Schwab - Mutual funds allow investors to pool money for diversified investments managed by professionals, offering low costs, convenience, and access to various asset classes and investment strategies.

dowidth.com

dowidth.com