Psychedelic stocks have surged as interest in mental health treatments grows, offering high-risk, high-reward opportunities driven by promising clinical trials and regulatory progress. SPACs (Special Purpose Acquisition Companies) provide investors with alternative routes to public markets, often targeting emerging sectors with expedited IPO processes but carrying inherent uncertainties. Explore the dynamics between psychedelic stocks and SPACs to better understand strategic investment potentials.

Why it is important

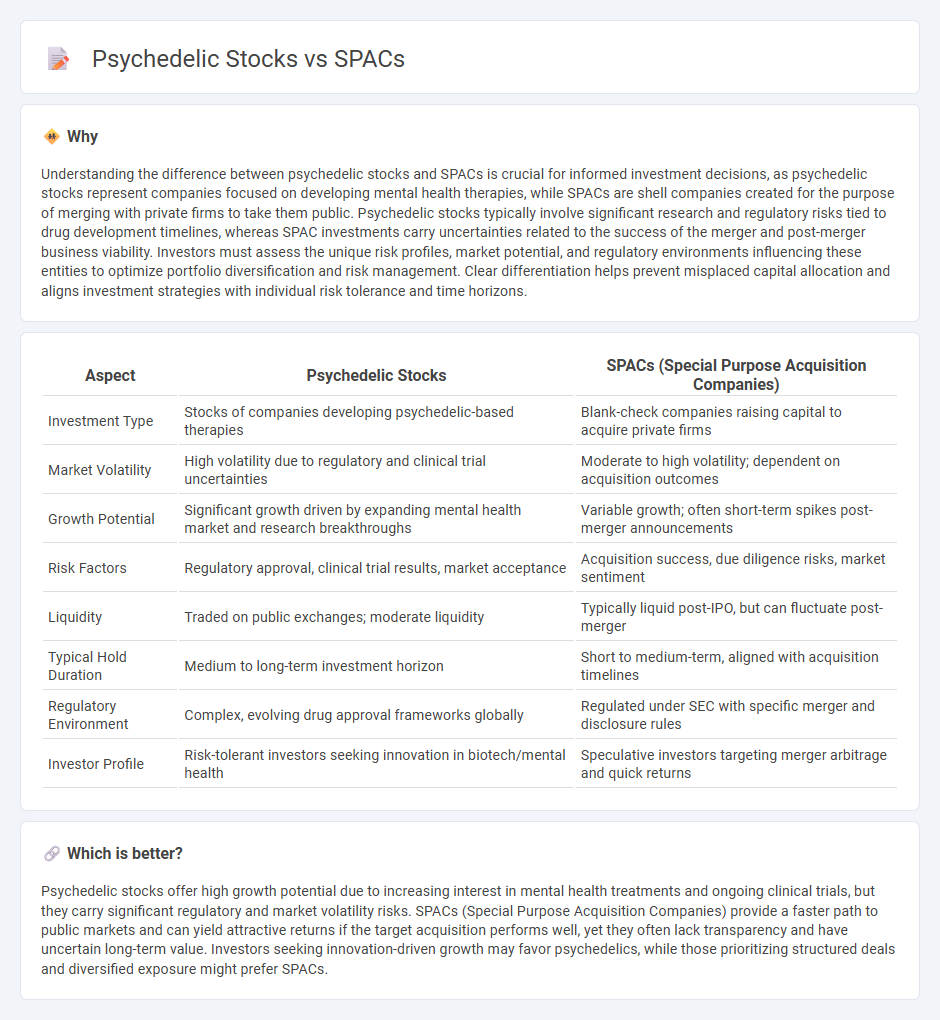

Understanding the difference between psychedelic stocks and SPACs is crucial for informed investment decisions, as psychedelic stocks represent companies focused on developing mental health therapies, while SPACs are shell companies created for the purpose of merging with private firms to take them public. Psychedelic stocks typically involve significant research and regulatory risks tied to drug development timelines, whereas SPAC investments carry uncertainties related to the success of the merger and post-merger business viability. Investors must assess the unique risk profiles, market potential, and regulatory environments influencing these entities to optimize portfolio diversification and risk management. Clear differentiation helps prevent misplaced capital allocation and aligns investment strategies with individual risk tolerance and time horizons.

Comparison Table

| Aspect | Psychedelic Stocks | SPACs (Special Purpose Acquisition Companies) |

|---|---|---|

| Investment Type | Stocks of companies developing psychedelic-based therapies | Blank-check companies raising capital to acquire private firms |

| Market Volatility | High volatility due to regulatory and clinical trial uncertainties | Moderate to high volatility; dependent on acquisition outcomes |

| Growth Potential | Significant growth driven by expanding mental health market and research breakthroughs | Variable growth; often short-term spikes post-merger announcements |

| Risk Factors | Regulatory approval, clinical trial results, market acceptance | Acquisition success, due diligence risks, market sentiment |

| Liquidity | Traded on public exchanges; moderate liquidity | Typically liquid post-IPO, but can fluctuate post-merger |

| Typical Hold Duration | Medium to long-term investment horizon | Short to medium-term, aligned with acquisition timelines |

| Regulatory Environment | Complex, evolving drug approval frameworks globally | Regulated under SEC with specific merger and disclosure rules |

| Investor Profile | Risk-tolerant investors seeking innovation in biotech/mental health | Speculative investors targeting merger arbitrage and quick returns |

Which is better?

Psychedelic stocks offer high growth potential due to increasing interest in mental health treatments and ongoing clinical trials, but they carry significant regulatory and market volatility risks. SPACs (Special Purpose Acquisition Companies) provide a faster path to public markets and can yield attractive returns if the target acquisition performs well, yet they often lack transparency and have uncertain long-term value. Investors seeking innovation-driven growth may favor psychedelics, while those prioritizing structured deals and diversified exposure might prefer SPACs.

Connection

Psychedelic stocks have surged through special purpose acquisition companies (SPACs), which provide fast-track routes for these companies to access public markets. SPACs offer psychedelics firms capital to accelerate research and commercialization of mental health treatments using compounds like psilocybin and MDMA. This connection has attracted significant investor interest, blending biotech innovation with novel financial vehicles in the investment landscape.

Key Terms

Merger (SPACs)

SPACs (Special Purpose Acquisition Companies) enable faster market entry through mergers, providing a streamlined path for psychedelic companies to access public capital. This merger strategy reduces regulatory hurdles and accelerates growth opportunities within the psychedelic stock sector. Explore how SPAC mergers have transformed investment dynamics in psychedelic markets for detailed insights.

Clinical Trials (Psychedelic stocks)

Psychedelic stocks are heavily influenced by the progress and outcomes of clinical trials, as successful trials can significantly boost investor confidence and stock valuation due to their potential to revolutionize mental health treatments. SPACs (Special Purpose Acquisition Companies) offer a faster route to public markets but often lack the clinical validation that psychedelic companies depend on for credibility. Explore the latest clinical trial advancements to better understand the unique risks and opportunities within psychedelic stock investments.

Regulatory Approval

SPACs targeting psychedelic companies often face intense regulatory scrutiny due to the novel nature of psychedelic substances and evolving legal frameworks. The approval process for psychedelic drugs involves rigorous clinical trials and FDA evaluations to ensure safety and efficacy, which can significantly impact stock performance and investor confidence. Explore the regulatory landscape further to understand how approval timelines influence the growth potential of both SPACs and psychedelic stocks.

Source and External Links

The Rise and Fall of SPACs: A Comprehensive Analysis - SPACs are publicly listed shell companies designed to take private companies public via mergers as an alternative to IPOs, with rapid growth peaking in 2021 when over 600 SPACs raised $145 billion, but facing declines thereafter.

Special-purpose acquisition company - A SPAC is a publicly traded shell corporation created to pool funds to acquire a private company within a timeframe, offering a faster, less regulated route to go public than traditional IPOs, though post-merger investor returns tend to be negative.

SPACs explained - SPACs raise money through a public IPO with cash held for acquisitions, and if no deal is made within a deadline, funds are returned; investors receive shares and warrants, and recent regulatory changes have made it easier for SPAC management to close deals.

dowidth.com

dowidth.com