Vintage luxury handbags funds and collectible sneakers funds offer distinct investment opportunities within alternative assets, with handbags typically exhibiting strong historical appreciation tied to global fashion trends and brand exclusivity. Collectible sneakers funds capitalize on limited releases, collaborations, and cultural hype, often delivering higher short-term returns but with increased market volatility. Explore the nuances and performance of these niche funds to determine the ideal investment strategy for your portfolio.

Why it is important

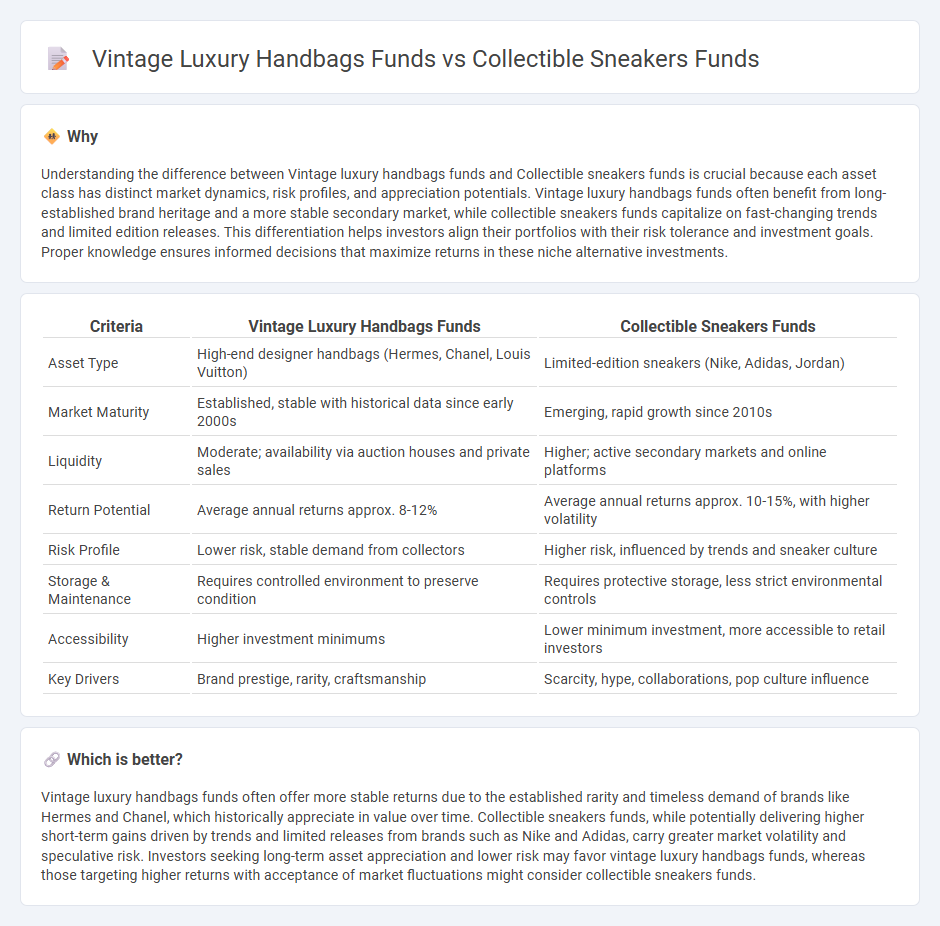

Understanding the difference between Vintage luxury handbags funds and Collectible sneakers funds is crucial because each asset class has distinct market dynamics, risk profiles, and appreciation potentials. Vintage luxury handbags funds often benefit from long-established brand heritage and a more stable secondary market, while collectible sneakers funds capitalize on fast-changing trends and limited edition releases. This differentiation helps investors align their portfolios with their risk tolerance and investment goals. Proper knowledge ensures informed decisions that maximize returns in these niche alternative investments.

Comparison Table

| Criteria | Vintage Luxury Handbags Funds | Collectible Sneakers Funds |

|---|---|---|

| Asset Type | High-end designer handbags (Hermes, Chanel, Louis Vuitton) | Limited-edition sneakers (Nike, Adidas, Jordan) |

| Market Maturity | Established, stable with historical data since early 2000s | Emerging, rapid growth since 2010s |

| Liquidity | Moderate; availability via auction houses and private sales | Higher; active secondary markets and online platforms |

| Return Potential | Average annual returns approx. 8-12% | Average annual returns approx. 10-15%, with higher volatility |

| Risk Profile | Lower risk, stable demand from collectors | Higher risk, influenced by trends and sneaker culture |

| Storage & Maintenance | Requires controlled environment to preserve condition | Requires protective storage, less strict environmental controls |

| Accessibility | Higher investment minimums | Lower minimum investment, more accessible to retail investors |

| Key Drivers | Brand prestige, rarity, craftsmanship | Scarcity, hype, collaborations, pop culture influence |

Which is better?

Vintage luxury handbags funds often offer more stable returns due to the established rarity and timeless demand of brands like Hermes and Chanel, which historically appreciate in value over time. Collectible sneakers funds, while potentially delivering higher short-term gains driven by trends and limited releases from brands such as Nike and Adidas, carry greater market volatility and speculative risk. Investors seeking long-term asset appreciation and lower risk may favor vintage luxury handbags funds, whereas those targeting higher returns with acceptance of market fluctuations might consider collectible sneakers funds.

Connection

Vintage luxury handbags funds and collectible sneakers funds are connected through their strategic focus on alternative luxury asset investment, targeting high-net-worth individuals seeking portfolio diversification beyond traditional equities and bonds. Both markets leverage rarity, brand prestige, and cultural significance, driving strong appreciation potential and liquidity in secondary markets. Data from recent reports indicate these funds have delivered average annual returns of 10-15%, reflecting growing institutional interest in tangible luxury collectibles.

Key Terms

Authentication

Authentication plays a crucial role in both collectible sneakers funds and vintage luxury handbags funds by verifying provenance and preventing counterfeit risks that can significantly impact investment value. While sneaker authentication often relies on advanced technology such as blockchain and AI-driven image analysis, vintage handbag authentication typically involves expert appraisals focusing on craftsmanship, materials, and brand-specific markers. Explore detailed authentication methods and risk mitigation strategies to enhance your investment confidence in these collectible asset classes.

Market Liquidity

Collectible sneakers funds exhibit higher market liquidity due to rapid turnover and growing demand in the resale platforms, with average holding periods often less than a year. Vintage luxury handbags funds, while offering stability and strong brand equity from houses like Hermes and Chanel, typically show lower liquidity due to limited supply and longer selling cycles. Discover more about how market liquidity impacts these alternative investment options and portfolio diversification.

Asset Appreciation

Collectible sneakers funds have shown rapid asset appreciation driven by high demand in streetwear culture and limited-edition releases, with some rare pairs increasing in value by over 500% in recent years. Vintage luxury handbags funds focus on timeless brands like Hermes and Chanel, which have demonstrated steady, long-term appreciation averaging 7-12% annually, bolstered by consistent market demand and brand prestige. Explore detailed performance metrics and market trends to determine which asset class aligns with your investment goals.

Source and External Links

Soleful Investments: Investing in Sneakers - Discusses sneaker investing as a blend of fashion and finance, highlighting buying limited editions, holding sneakers to appreciate value, and mentions funding expansions in sneaker investment platforms.

How sneakers took a grip on investment portfolios - Explores collectible sneakers as alternative assets, the role of scarcity, authentication challenges, and how technology like NFC chips may transform sneaker investment markets.

Why Invest in Sneakers? Step Up Your Portfolio ... - Provides an overview of sneaker investment benefits and risks, comparing it to other alternative assets, with advice on selecting the right sneakers by brand, limited editions, collaborations, and market trends.

dowidth.com

dowidth.com