Sports memorabilia trading offers unique investment opportunities through rare collectibles with potential high appreciation due to cultural significance and limited supply. Private equity focuses on acquiring equity ownership in companies, aiming for substantial returns by improving business operations and increasing market value over time. Explore these investment avenues further to understand their risks and rewards.

Why it is important

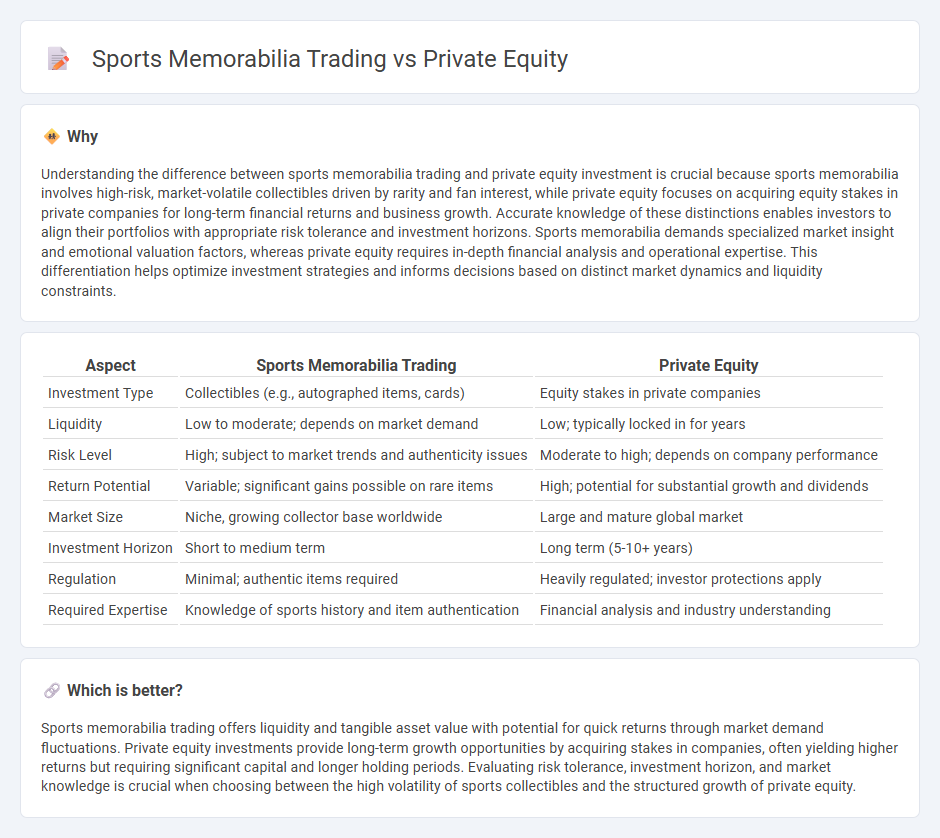

Understanding the difference between sports memorabilia trading and private equity investment is crucial because sports memorabilia involves high-risk, market-volatile collectibles driven by rarity and fan interest, while private equity focuses on acquiring equity stakes in private companies for long-term financial returns and business growth. Accurate knowledge of these distinctions enables investors to align their portfolios with appropriate risk tolerance and investment horizons. Sports memorabilia demands specialized market insight and emotional valuation factors, whereas private equity requires in-depth financial analysis and operational expertise. This differentiation helps optimize investment strategies and informs decisions based on distinct market dynamics and liquidity constraints.

Comparison Table

| Aspect | Sports Memorabilia Trading | Private Equity |

|---|---|---|

| Investment Type | Collectibles (e.g., autographed items, cards) | Equity stakes in private companies |

| Liquidity | Low to moderate; depends on market demand | Low; typically locked in for years |

| Risk Level | High; subject to market trends and authenticity issues | Moderate to high; depends on company performance |

| Return Potential | Variable; significant gains possible on rare items | High; potential for substantial growth and dividends |

| Market Size | Niche, growing collector base worldwide | Large and mature global market |

| Investment Horizon | Short to medium term | Long term (5-10+ years) |

| Regulation | Minimal; authentic items required | Heavily regulated; investor protections apply |

| Required Expertise | Knowledge of sports history and item authentication | Financial analysis and industry understanding |

Which is better?

Sports memorabilia trading offers liquidity and tangible asset value with potential for quick returns through market demand fluctuations. Private equity investments provide long-term growth opportunities by acquiring stakes in companies, often yielding higher returns but requiring significant capital and longer holding periods. Evaluating risk tolerance, investment horizon, and market knowledge is crucial when choosing between the high volatility of sports collectibles and the structured growth of private equity.

Connection

Sports memorabilia trading intersects with private equity through the monetization and investment potential of rare collectibles, which can be pooled into specialized funds attracting high-net-worth investors. Private equity firms leverage their capital and expertise to identify undervalued sports assets, driving market liquidity and valuation growth. This convergence supports diversification strategies and creates alternative investment opportunities within the expanding sports memorabilia market.

Key Terms

Capital commitment

Capital commitment in private equity typically involves long-term investments ranging from $1 million to over $100 million, requiring investors to lock in funds for periods of 7 to 10 years or more. In contrast, sports memorabilia trading demands significantly lower capital, often allowing entry with just a few hundred to tens of thousands of dollars, providing greater liquidity and quicker turnover. Explore more about how these distinct capital requirements impact investment strategies and risk profiles.

Illiquidity

Private equity investments typically involve long-term capital commitments with limited liquidity, often requiring investors to lock in funds for several years before realizing returns. In contrast, sports memorabilia trading offers higher liquidity as collectors and investors can buy or sell items relatively quickly through auctions or online marketplaces. Explore the nuances of illiquidity in these asset classes to better understand risk and return dynamics.

Provenance

Provenance plays a critical role in both private equity and sports memorabilia trading, ensuring the authenticity and historical value of assets. In private equity, a thorough due diligence process verifies a company's track record and financial history, while in sports memorabilia, provenance documents the item's origin, previous ownership, and legitimacy to enhance market value. Discover more about how provenance impacts investment decisions and asset valuation in these industries.

Source and External Links

Private equity - Wikipedia - Private equity (PE) involves investing in private companies through specialized investment funds using equity and debt, aiming to generate returns via strategies like revenue growth, margin expansion, and governance restructuring over a 4-7 year horizon.

What is Private Equity? - BVCA - Private equity provides medium to long-term equity finance to mature companies, working closely with management to enhance business value and typically exiting investments after four to seven years through sale or IPO.

Private Equity Funds | Investor.gov - Private equity funds pool capital from investors to take controlling or minority stakes in companies, actively managing portfolio businesses to increase value, with investment horizons often exceeding 10 years.

dowidth.com

dowidth.com