Virtual land real estate offers investors a unique opportunity to own and develop digital parcels within metaverse platforms, providing potential for appreciation and monetization through virtual businesses and events. In contrast, art investments focus on acquiring physical or digital artworks, often driven by cultural value and market trends, with returns influenced by artist reputation and rarity. Discover more about the advantages and challenges of investing in virtual land real estate versus art to make informed decisions.

Why it is important

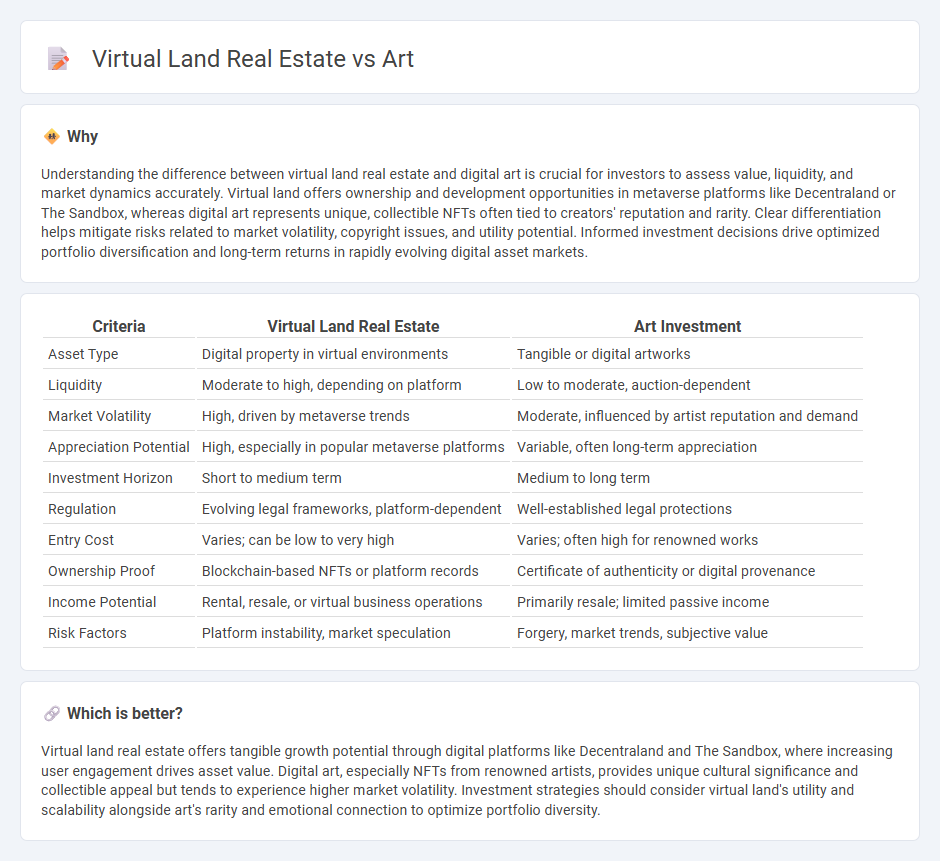

Understanding the difference between virtual land real estate and digital art is crucial for investors to assess value, liquidity, and market dynamics accurately. Virtual land offers ownership and development opportunities in metaverse platforms like Decentraland or The Sandbox, whereas digital art represents unique, collectible NFTs often tied to creators' reputation and rarity. Clear differentiation helps mitigate risks related to market volatility, copyright issues, and utility potential. Informed investment decisions drive optimized portfolio diversification and long-term returns in rapidly evolving digital asset markets.

Comparison Table

| Criteria | Virtual Land Real Estate | Art Investment |

|---|---|---|

| Asset Type | Digital property in virtual environments | Tangible or digital artworks |

| Liquidity | Moderate to high, depending on platform | Low to moderate, auction-dependent |

| Market Volatility | High, driven by metaverse trends | Moderate, influenced by artist reputation and demand |

| Appreciation Potential | High, especially in popular metaverse platforms | Variable, often long-term appreciation |

| Investment Horizon | Short to medium term | Medium to long term |

| Regulation | Evolving legal frameworks, platform-dependent | Well-established legal protections |

| Entry Cost | Varies; can be low to very high | Varies; often high for renowned works |

| Ownership Proof | Blockchain-based NFTs or platform records | Certificate of authenticity or digital provenance |

| Income Potential | Rental, resale, or virtual business operations | Primarily resale; limited passive income |

| Risk Factors | Platform instability, market speculation | Forgery, market trends, subjective value |

Which is better?

Virtual land real estate offers tangible growth potential through digital platforms like Decentraland and The Sandbox, where increasing user engagement drives asset value. Digital art, especially NFTs from renowned artists, provides unique cultural significance and collectible appeal but tends to experience higher market volatility. Investment strategies should consider virtual land's utility and scalability alongside art's rarity and emotional connection to optimize portfolio diversity.

Connection

Virtual land real estate and digital art converge within the metaverse, where blockchain technology secures ownership and provenance. NFTs (Non-Fungible Tokens) enable unique digital art pieces to be embedded in virtual properties, enhancing asset value and user experience. Investors capitalize on this synergy by acquiring virtual land that hosts exclusive art exhibits, blending real estate with the digital art market.

Key Terms

Asset Valuation

Art valuation relies heavily on subjective factors such as artist reputation, rarity, and provenance, making it a dynamic but often unpredictable asset class. Virtual land real estate valuation is driven by factors like platform popularity, virtual location, scarcity, and potential for monetization within metaverse ecosystems. Explore how these distinct valuation methods impact investment strategies in emerging digital and traditional asset markets.

Liquidity

Art and virtual land real estate differ significantly in liquidity, with art markets often requiring longer transaction times due to valuation complexities and physical exchange processes. Virtual land, traded on blockchain platforms and metaverses, offers higher liquidity through instant transactions and global accessibility, enabling faster asset transfers and price discovery. Explore the nuances of liquidity in digital versus physical asset markets to better understand investment dynamics.

Ownership Rights

Ownership rights in art typically confer exclusive control over the physical or digital piece, including the ability to display, sell, or transfer it, while virtual land real estate ownership grants rights to a specific plot within a digital metaverse, allowing for development, leasing, or monetization. Art ownership often involves copyright considerations and may include royalties from subsequent sales, whereas virtual land ownership is governed by blockchain protocols ensuring security and transparency of transactions. Explore the nuances of ownership rights in art versus virtual land to understand their legal frameworks and investment potentials.

Source and External Links

Art - Wikipedia - Art is a diverse range of cultural activities involving creative or imaginative talents expected to evoke meaningful experiences, encompassing visual arts like painting and sculpture, performing arts, literature, and media, with varying definitions and purposes across history and cultures.

Art Prints & Framed Wall Art - Minted - Offers a broad collection of fine art prints and framed wall art in various styles, materials, and themes including drawing, mixed media, photography, and painting, suitable for home decoration.

Artwork: Buy Original Art Online, Paintings & More - Saatchi Art provides a global platform to buy original paintings, fine art photography, and sculptures online with customer guarantees and expert curation assistance.

dowidth.com

dowidth.com