Music royalties platforms enable investors to earn passive income by purchasing rights to songs, benefiting from streaming, licensing, and other revenue streams. Sports memorabilia platforms offer investment opportunities in rare collectibles, capitalizing on the growing market demand and historical value appreciation. Explore the unique advantages and risks of each platform to make informed investment decisions.

Why it is important

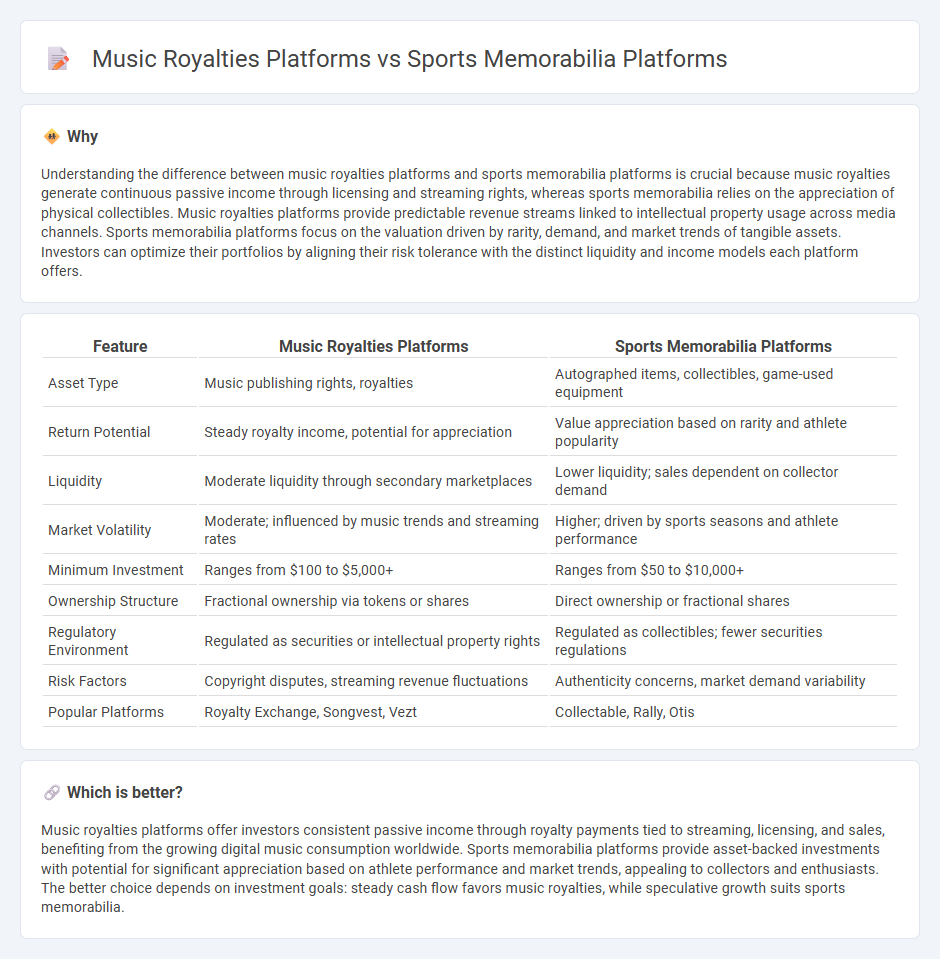

Understanding the difference between music royalties platforms and sports memorabilia platforms is crucial because music royalties generate continuous passive income through licensing and streaming rights, whereas sports memorabilia relies on the appreciation of physical collectibles. Music royalties platforms provide predictable revenue streams linked to intellectual property usage across media channels. Sports memorabilia platforms focus on the valuation driven by rarity, demand, and market trends of tangible assets. Investors can optimize their portfolios by aligning their risk tolerance with the distinct liquidity and income models each platform offers.

Comparison Table

| Feature | Music Royalties Platforms | Sports Memorabilia Platforms |

|---|---|---|

| Asset Type | Music publishing rights, royalties | Autographed items, collectibles, game-used equipment |

| Return Potential | Steady royalty income, potential for appreciation | Value appreciation based on rarity and athlete popularity |

| Liquidity | Moderate liquidity through secondary marketplaces | Lower liquidity; sales dependent on collector demand |

| Market Volatility | Moderate; influenced by music trends and streaming rates | Higher; driven by sports seasons and athlete performance |

| Minimum Investment | Ranges from $100 to $5,000+ | Ranges from $50 to $10,000+ |

| Ownership Structure | Fractional ownership via tokens or shares | Direct ownership or fractional shares |

| Regulatory Environment | Regulated as securities or intellectual property rights | Regulated as collectibles; fewer securities regulations |

| Risk Factors | Copyright disputes, streaming revenue fluctuations | Authenticity concerns, market demand variability |

| Popular Platforms | Royalty Exchange, Songvest, Vezt | Collectable, Rally, Otis |

Which is better?

Music royalties platforms offer investors consistent passive income through royalty payments tied to streaming, licensing, and sales, benefiting from the growing digital music consumption worldwide. Sports memorabilia platforms provide asset-backed investments with potential for significant appreciation based on athlete performance and market trends, appealing to collectors and enthusiasts. The better choice depends on investment goals: steady cash flow favors music royalties, while speculative growth suits sports memorabilia.

Connection

Music royalties platforms and sports memorabilia platforms both capitalize on the rising trend of fractional ownership and digital asset monetization, allowing investors to purchase shares in valuable intellectual property and tangible collectibles. These platforms leverage blockchain technology and smart contracts to ensure transparent transactions and secure revenue streams from royalties or memorabilia sales. By democratizing access to alternative investments, they attract diverse investor bases seeking passive income and portfolio diversification through non-traditional assets.

Key Terms

Asset Authenticity

Sports memorabilia platforms employ advanced blockchain technology and expert verification processes to ensure the authenticity and provenance of collectibles, significantly reducing counterfeit risks. Music royalties platforms integrate digital rights management and smart contracts to verify ownership and ensure transparent royalty distribution, reinforcing asset legitimacy. Explore deeper into how these mechanisms safeguard your investments in each market.

Revenue Streams

Sports memorabilia platforms generate revenue primarily through the sale and auction of collectible items, including autographed gear, limited edition merchandise, and vintage sports cards. Music royalties platforms derive income by managing and distributing royalty payments from streaming services, licensing deals, and broadcast performances, often leveraging blockchain technology for transparency. Explore the evolving dynamics of revenue streams in both industries to understand their unique economic models.

Secondary Market

Sports memorabilia platforms harness the power of authentic collectibles with verified provenance, driving high demand and liquidity in the secondary market through dynamic pricing and fan engagement. Music royalties platforms focus on fractional ownership of royalty streams, enabling investors to trade shares of future income, which generates a unique secondary market driven by streaming data and catalog valuation. Explore in-depth insights on how these platforms reshape asset liquidity and investment strategies.

Source and External Links

Sports Memorabilia - Offers over 500,000 authentic products, including autographed and game-used memorabilia from all major sports leagues, each with a certificate of authenticity and a lifetime guarantee of authenticity.

Fanatics Authentic - A premier destination for high-quality, licensed sports memorabilia and exclusive autograph signings with top athletes across professional leagues and universities.

Steiner Sports - Specializes in hand-signed collectibles and game-used sports memorabilia, featuring direct relationships with thousands of athletes and partnerships with major sports leagues.

dowidth.com

dowidth.com