NFT domain names represent a novel asset class offering potential high returns through digital ownership and blockchain technology, contrasting with mutual funds that provide diversified portfolios managed by financial experts for long-term growth and reduced risk. The liquidity and market volatility differ significantly between NFT domains, known for speculative value spikes, and mutual funds, which emphasize stability and regulated transparency. Explore deeper insights into how these investment vehicles align with your financial goals and risk tolerance.

Why it is important

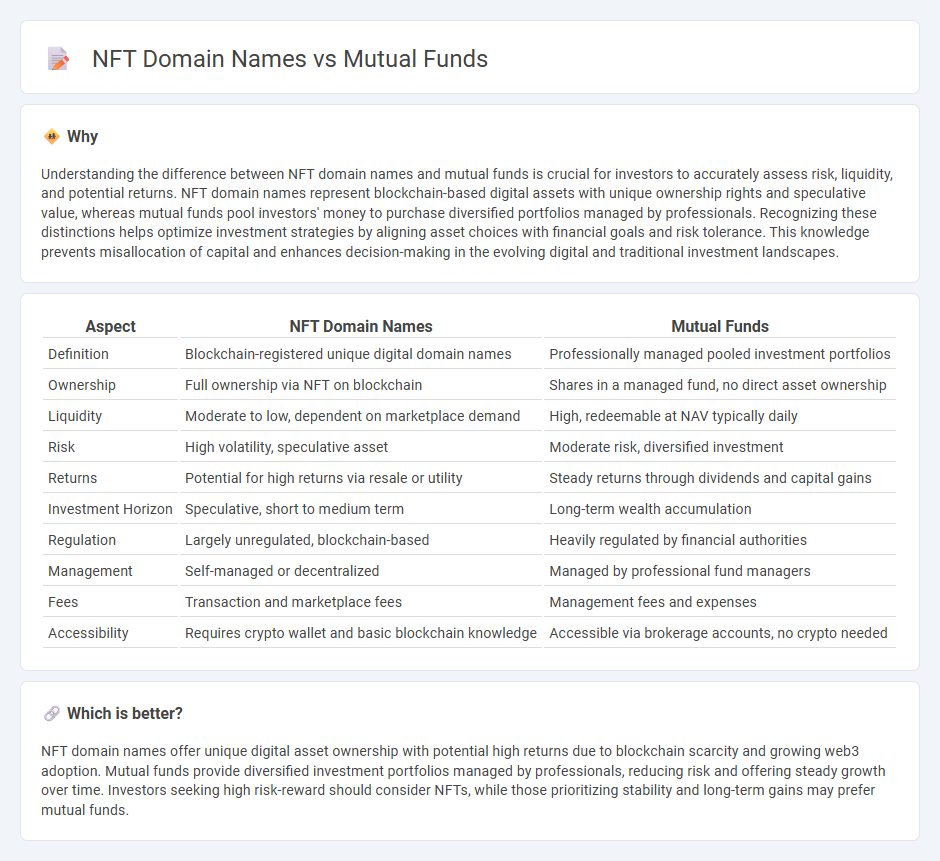

Understanding the difference between NFT domain names and mutual funds is crucial for investors to accurately assess risk, liquidity, and potential returns. NFT domain names represent blockchain-based digital assets with unique ownership rights and speculative value, whereas mutual funds pool investors' money to purchase diversified portfolios managed by professionals. Recognizing these distinctions helps optimize investment strategies by aligning asset choices with financial goals and risk tolerance. This knowledge prevents misallocation of capital and enhances decision-making in the evolving digital and traditional investment landscapes.

Comparison Table

| Aspect | NFT Domain Names | Mutual Funds |

|---|---|---|

| Definition | Blockchain-registered unique digital domain names | Professionally managed pooled investment portfolios |

| Ownership | Full ownership via NFT on blockchain | Shares in a managed fund, no direct asset ownership |

| Liquidity | Moderate to low, dependent on marketplace demand | High, redeemable at NAV typically daily |

| Risk | High volatility, speculative asset | Moderate risk, diversified investment |

| Returns | Potential for high returns via resale or utility | Steady returns through dividends and capital gains |

| Investment Horizon | Speculative, short to medium term | Long-term wealth accumulation |

| Regulation | Largely unregulated, blockchain-based | Heavily regulated by financial authorities |

| Management | Self-managed or decentralized | Managed by professional fund managers |

| Fees | Transaction and marketplace fees | Management fees and expenses |

| Accessibility | Requires crypto wallet and basic blockchain knowledge | Accessible via brokerage accounts, no crypto needed |

Which is better?

NFT domain names offer unique digital asset ownership with potential high returns due to blockchain scarcity and growing web3 adoption. Mutual funds provide diversified investment portfolios managed by professionals, reducing risk and offering steady growth over time. Investors seeking high risk-reward should consider NFTs, while those prioritizing stability and long-term gains may prefer mutual funds.

Connection

NFT domain names represent digital ownership and decentralized asset management, which parallels the mutual funds' concept of pooled investments managed by professionals. Both investment vehicles offer diversification: NFTs provide unique digital assets across blockchain ecosystems, while mutual funds spread risk across multiple securities. Integrating NFTs into mutual funds could enhance portfolio innovation by including digital asset ownership alongside traditional financial instruments.

Key Terms

Diversification

Mutual funds offer diversified investment portfolios by pooling assets across various sectors, reducing risk through broad market exposure. NFT domain names represent a niche digital asset class with limited diversification but high potential for unique value appreciation. Explore the differences in diversification strategies to determine which investment aligns best with your financial goals.

Liquidity

Mutual funds offer high liquidity by allowing investors to buy or sell shares easily through stock exchanges or fund managers, ensuring quick access to cash. NFT domain names, however, present lower liquidity due to their niche market, limited buyers, and the often lengthy transfer process on blockchain platforms. Explore the differences in liquidity dynamics and investment implications to make informed portfolio decisions.

Ownership

Mutual funds represent pooled investments managed by professionals, offering fractional ownership in a diversified portfolio of securities, whereas NFT domain names provide unique, blockchain-verified ownership of a specific digital asset linked to internet domains. Ownership of mutual funds is shared and regulated, with investors holding redeemable units, while NFT domain names grant exclusive, non-fungible rights that can be transferred or sold on decentralized platforms. Explore the distinct benefits and legal frameworks of both ownership models to determine which aligns with your investment strategy.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered investment companies that pool money to invest in stocks, bonds, and other securities, offering benefits like professional management and diversification.

Mutual fund - Wikipedia - A mutual fund is an investment fund that pools money to purchase securities, often classified by investment type and management style, such as active or index funds.

Understanding Mutual Funds - Charles Schwab - Mutual funds provide an affordable way to diversify investment portfolios, offering exposure to various asset classes through professional management.

dowidth.com

dowidth.com