Vintage luxury handbags funds offer investors portfolio diversification through tangible assets with historical appreciation trends, often outperforming traditional markets due to their rarity and strong collector demand. Music memorabilia funds capitalize on the cultural significance and escalating value of iconic items, leveraging fan base loyalty and limited availability for potential high returns. Explore the distinct advantages and risks of each investment type to determine which aligns best with your financial goals.

Why it is important

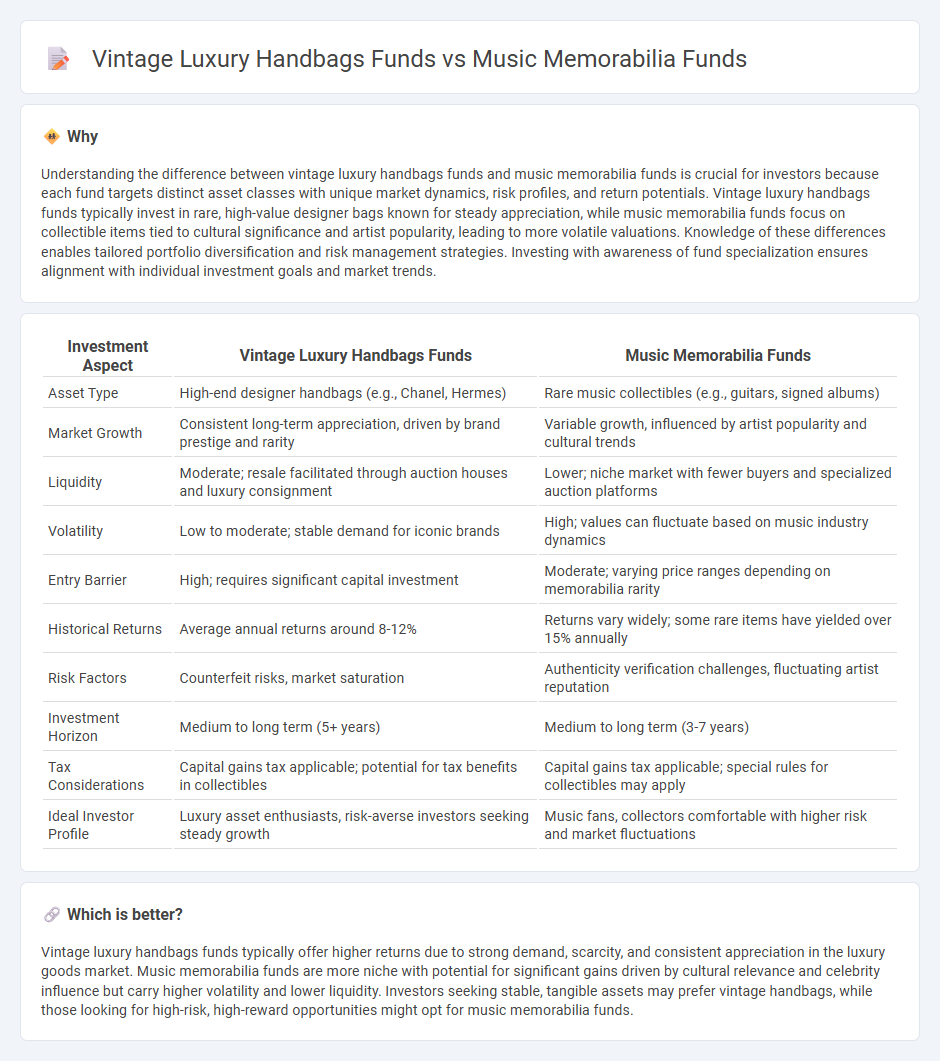

Understanding the difference between vintage luxury handbags funds and music memorabilia funds is crucial for investors because each fund targets distinct asset classes with unique market dynamics, risk profiles, and return potentials. Vintage luxury handbags funds typically invest in rare, high-value designer bags known for steady appreciation, while music memorabilia funds focus on collectible items tied to cultural significance and artist popularity, leading to more volatile valuations. Knowledge of these differences enables tailored portfolio diversification and risk management strategies. Investing with awareness of fund specialization ensures alignment with individual investment goals and market trends.

Comparison Table

| Investment Aspect | Vintage Luxury Handbags Funds | Music Memorabilia Funds |

|---|---|---|

| Asset Type | High-end designer handbags (e.g., Chanel, Hermes) | Rare music collectibles (e.g., guitars, signed albums) |

| Market Growth | Consistent long-term appreciation, driven by brand prestige and rarity | Variable growth, influenced by artist popularity and cultural trends |

| Liquidity | Moderate; resale facilitated through auction houses and luxury consignment | Lower; niche market with fewer buyers and specialized auction platforms |

| Volatility | Low to moderate; stable demand for iconic brands | High; values can fluctuate based on music industry dynamics |

| Entry Barrier | High; requires significant capital investment | Moderate; varying price ranges depending on memorabilia rarity |

| Historical Returns | Average annual returns around 8-12% | Returns vary widely; some rare items have yielded over 15% annually |

| Risk Factors | Counterfeit risks, market saturation | Authenticity verification challenges, fluctuating artist reputation |

| Investment Horizon | Medium to long term (5+ years) | Medium to long term (3-7 years) |

| Tax Considerations | Capital gains tax applicable; potential for tax benefits in collectibles | Capital gains tax applicable; special rules for collectibles may apply |

| Ideal Investor Profile | Luxury asset enthusiasts, risk-averse investors seeking steady growth | Music fans, collectors comfortable with higher risk and market fluctuations |

Which is better?

Vintage luxury handbags funds typically offer higher returns due to strong demand, scarcity, and consistent appreciation in the luxury goods market. Music memorabilia funds are more niche with potential for significant gains driven by cultural relevance and celebrity influence but carry higher volatility and lower liquidity. Investors seeking stable, tangible assets may prefer vintage handbags, while those looking for high-risk, high-reward opportunities might opt for music memorabilia funds.

Connection

Vintage luxury handbags funds and music memorabilia funds intersect through their focus on alternative asset investment, catering to collectors seeking tangible, appreciating assets beyond traditional financial markets. Both fund types leverage rarity, provenance, and cultural significance as key value drivers, attracting investors aiming for portfolio diversification and inflation hedging. These funds capitalize on niche markets where scarcity and historical relevance create robust demand and potential for significant long-term capital gains.

Key Terms

Asset Authentication

Asset authentication in music memorabilia funds relies heavily on expert verification of provenance, signatures, and historical significance to ensure genuine ownership and value. Vintage luxury handbags funds use meticulous examination of serial numbers, craftsmanship details, and brand-specific markers to authenticate items and prevent counterfeit risks. Discover the key differences in authentication processes that define investment security in these unique asset classes.

Market Liquidity

Music memorabilia funds generally exhibit lower market liquidity due to a niche collector base and fewer transaction platforms compared to vintage luxury handbags funds, which benefit from a broader, global demand and established secondary markets. Vintage luxury handbags, especially iconic brands like Hermes and Chanel, often see higher turnover rates, facilitating quicker asset liquidation. Explore how these liquidity dynamics impact investment performance and risk profiles.

Provenance Documentation

Provenance documentation is crucial for music memorabilia funds, ensuring authenticity and historical significance of rare items like signed guitars and iconic concert posters. Vintage luxury handbags funds rely on detailed ownership histories and certification from brands such as Chanel and Hermes to validate authenticity and condition, directly impacting resale value. Explore more about how provenance documentation strengthens investment confidence in these niche asset classes.

Source and External Links

Memorabilia - Doors of Change - This charity has raised over $850,000 through the sale of signed music memorabilia donated by legends like Billy Joel and Elton John, funding programs to help homeless youth.

Top 5 Music Memorabilia Investments for Collectors - Jerks Store - Music memorabilia, including vintage band t-shirts and rare records, is increasingly popular among collectors both as a personal passion and a financial investment.

Sweet Relief Musicians Fund Launches Fundraiser To Benefit Music's Mental Health Fund - This fundraiser offers signed memorabilia from artists like Coldplay and R.E.M. to raise money for mental health services for music industry professionals.

dowidth.com

dowidth.com