NFT domain names represent a cutting-edge digital asset class offering unique ownership and potential high returns through blockchain technology, while bonds provide traditional, stable income through fixed interest payments and lower risk. Investors seeking growth and diversification may find NFT domains appealing for their novelty and scarcity, whereas bonds serve as reliable instruments for preserving capital and generating steady cash flow. Explore deeper insights into how NFT domain names compare with bonds to tailor your investment strategy effectively.

Why it is important

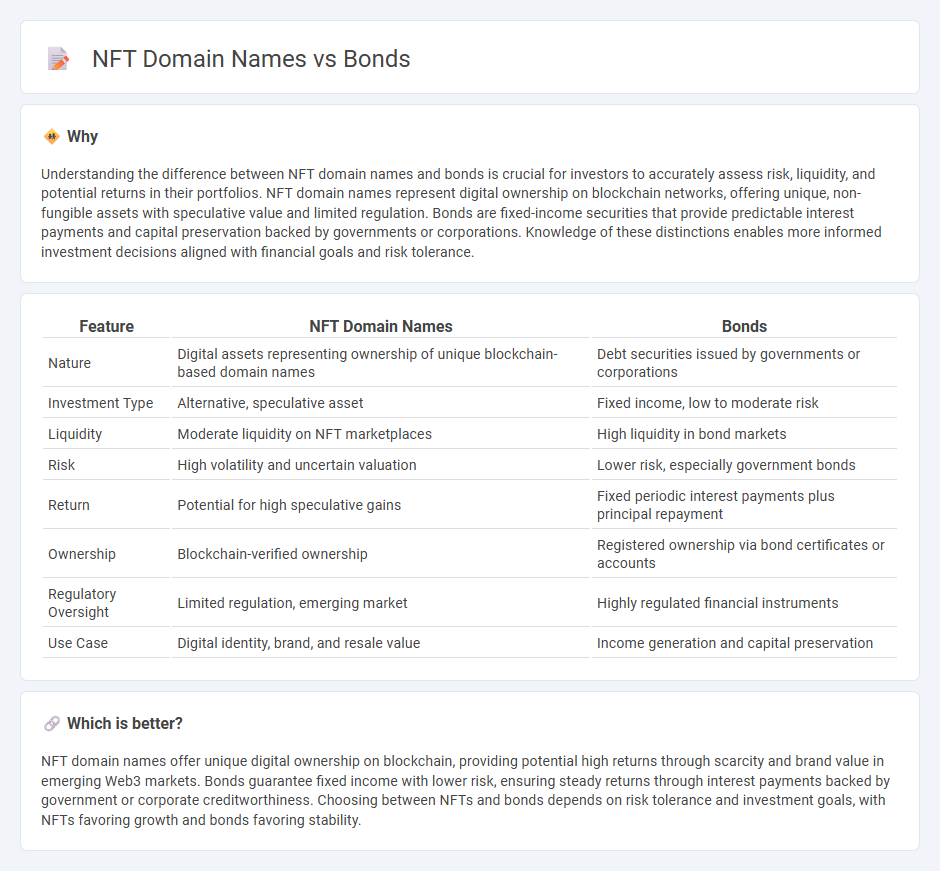

Understanding the difference between NFT domain names and bonds is crucial for investors to accurately assess risk, liquidity, and potential returns in their portfolios. NFT domain names represent digital ownership on blockchain networks, offering unique, non-fungible assets with speculative value and limited regulation. Bonds are fixed-income securities that provide predictable interest payments and capital preservation backed by governments or corporations. Knowledge of these distinctions enables more informed investment decisions aligned with financial goals and risk tolerance.

Comparison Table

| Feature | NFT Domain Names | Bonds |

|---|---|---|

| Nature | Digital assets representing ownership of unique blockchain-based domain names | Debt securities issued by governments or corporations |

| Investment Type | Alternative, speculative asset | Fixed income, low to moderate risk |

| Liquidity | Moderate liquidity on NFT marketplaces | High liquidity in bond markets |

| Risk | High volatility and uncertain valuation | Lower risk, especially government bonds |

| Return | Potential for high speculative gains | Fixed periodic interest payments plus principal repayment |

| Ownership | Blockchain-verified ownership | Registered ownership via bond certificates or accounts |

| Regulatory Oversight | Limited regulation, emerging market | Highly regulated financial instruments |

| Use Case | Digital identity, brand, and resale value | Income generation and capital preservation |

Which is better?

NFT domain names offer unique digital ownership on blockchain, providing potential high returns through scarcity and brand value in emerging Web3 markets. Bonds guarantee fixed income with lower risk, ensuring steady returns through interest payments backed by government or corporate creditworthiness. Choosing between NFTs and bonds depends on risk tolerance and investment goals, with NFTs favoring growth and bonds favoring stability.

Connection

NFT domain names represent a new class of blockchain-based digital assets with potential for unique ownership verification, while bonds are traditional financial instruments offering fixed income through debt securities. Both NFT domains and bonds can be integrated into decentralized finance (DeFi) platforms, enabling innovative investment opportunities by combining the liquidity and programmability of NFTs with the security and predictability of bonds. This convergence facilitates diversified portfolios, blending collectible digital assets with stable income streams in blockchain ecosystems.

Key Terms

Yield vs. Scarcity

Bonds offer predictable yield through fixed interest payments, making them appealing for income-focused investors seeking stability and regular returns. NFT domain names derive value from scarcity and uniqueness within decentralized web ecosystems, often appreciating based on cultural trends and demand rather than steady income streams. Explore the dynamics of yield versus scarcity to better understand these investment options and optimize your portfolio strategy.

Maturity vs. Ownership

Bonds offer a fixed maturity date and predictable returns, appealing to investors seeking time-bound financial growth and capital preservation. NFT domain names provide decentralized ownership, enabling users to control digital identities and web real estate without intermediaries. Discover how maturity in bonds contrasts with perpetual ownership in NFT domains for strategic asset allocation.

Credit Risk vs. Digital Asset

Credit risk in bonds involves assessing the issuer's ability to meet interest and principal payments, with ratings from agencies like Moody's and S&P providing key risk indicators. NFT domain names represent digital assets on blockchain platforms, where value is influenced by factors such as scarcity, utility, and market demand rather than creditworthiness. Explore the distinct risk profiles and valuation methods of bonds and NFT domain names to understand their investment dynamics better.

Source and External Links

Bonds | Investor.gov - Bonds are debt securities that allow governments, municipalities, or corporations to borrow money from investors, who receive regular interest payments and the return of principal at maturity.

Bond (finance) - Wikipedia - Bonds are loans or IOUs issued to finance long-term investments, traded mostly by institutions, and generally considered lower-risk than stocks but with their own set of risks and legal protections for holders.

What is a Bond and How do they Work? - Vanguard - When you buy a bond, you lend money to an issuer (government or corporation) in exchange for periodic interest payments and the return of the face value at maturity, though you get no ownership rights like with stocks.

dowidth.com

dowidth.com