Investment in the space economy focuses on cutting-edge technologies like satellite communications, space exploration, and orbital manufacturing, offering high-growth potential and strategic geopolitical advantages. Consumer goods investment targets everyday products with established markets, emphasizing steady cash flow and brand loyalty in sectors such as electronics, apparel, and food. Explore further to understand which investment aligns with your financial goals and risk tolerance.

Why it is important

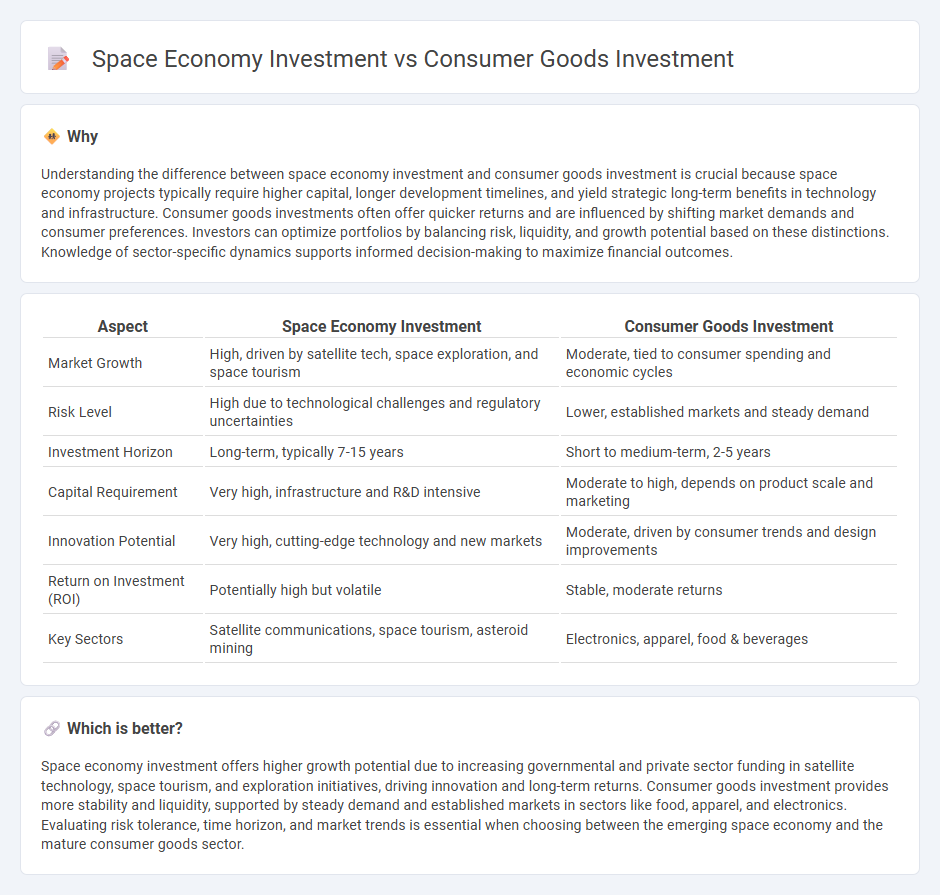

Understanding the difference between space economy investment and consumer goods investment is crucial because space economy projects typically require higher capital, longer development timelines, and yield strategic long-term benefits in technology and infrastructure. Consumer goods investments often offer quicker returns and are influenced by shifting market demands and consumer preferences. Investors can optimize portfolios by balancing risk, liquidity, and growth potential based on these distinctions. Knowledge of sector-specific dynamics supports informed decision-making to maximize financial outcomes.

Comparison Table

| Aspect | Space Economy Investment | Consumer Goods Investment |

|---|---|---|

| Market Growth | High, driven by satellite tech, space exploration, and space tourism | Moderate, tied to consumer spending and economic cycles |

| Risk Level | High due to technological challenges and regulatory uncertainties | Lower, established markets and steady demand |

| Investment Horizon | Long-term, typically 7-15 years | Short to medium-term, 2-5 years |

| Capital Requirement | Very high, infrastructure and R&D intensive | Moderate to high, depends on product scale and marketing |

| Innovation Potential | Very high, cutting-edge technology and new markets | Moderate, driven by consumer trends and design improvements |

| Return on Investment (ROI) | Potentially high but volatile | Stable, moderate returns |

| Key Sectors | Satellite communications, space tourism, asteroid mining | Electronics, apparel, food & beverages |

Which is better?

Space economy investment offers higher growth potential due to increasing governmental and private sector funding in satellite technology, space tourism, and exploration initiatives, driving innovation and long-term returns. Consumer goods investment provides more stability and liquidity, supported by steady demand and established markets in sectors like food, apparel, and electronics. Evaluating risk tolerance, time horizon, and market trends is essential when choosing between the emerging space economy and the mature consumer goods sector.

Connection

Investment in the space economy drives technological advancements that create new materials and manufacturing processes, directly benefiting consumer goods production. Enhanced satellite data and space-derived insights improve supply chain management, market analytics, and product innovation within the consumer goods sector. Consequently, capital flows into space ventures stimulate growth and competitiveness in consumer goods markets through integrated technological and informational synergies.

Key Terms

Market Demand

Investment in consumer goods is driven by consistent market demand fueled by population growth and evolving consumer preferences, ensuring steady returns through widespread consumption trends. Space economy investment, targeting satellite technology, space tourism, and resource extraction, relies on emerging demand from technological advancements and governmental support, presenting high-growth potential but higher risk. Explore the latest market data to understand how these sectors capitalize on shifting demand dynamics.

Capital Intensity

Consumer goods investment typically involves moderate capital intensity, with substantial allocation towards manufacturing facilities, supply chain infrastructure, and marketing channels to meet steady demand. Space economy investment, however, demands significantly higher capital intensity due to the costs associated with advanced technology development, rocket launches, satellite deployment, and research and development. Explore the nuances and financial strategies behind these sectors to better understand their distinct investment dynamics.

Regulatory Environment

The regulatory environment for consumer goods investment is well-established, with clear guidelines on product safety, advertising standards, and consumer protection enforced by agencies like the FDA and FTC. In contrast, space economy investment faces a complex and evolving regulatory landscape, involving international treaties such as the Outer Space Treaty, alongside national regulations on satellite licensing, space debris management, and launch permissions. Explore the key regulatory challenges shaping the future of investments in these dynamic sectors.

Source and External Links

Consumer Retail Investment Banking: Detailed Guide - Consumer goods investment can be broadly categorized into consumer staples (everyday products used regularly) and consumer discretionary (non-essential items like cars and luxury goods), with retail companies acting as distributors for these products.

Global M&A trends in consumer markets: 2025 mid-year outlook | PwC - Investment activity in consumer goods is expected to strengthen in 2025 with rising deal values, driven by recovering investor confidence and strategic company transformations despite lingering economic uncertainties.

Top 292 Consumer Goods Investment Banks - Axial - There are nearly 300 investment banks specializing in consumer goods, facilitating mergers, acquisitions, and capital raising in this sector, especially in the lower middle market segment.

dowidth.com

dowidth.com