Crowdlending platforms facilitate loans by connecting businesses seeking capital with multiple investors, while peer-to-peer lending typically involves individual borrowers obtaining funds directly from individual lenders. Both investment methods offer opportunities for portfolio diversification and potential high returns by bypassing traditional financial institutions. Explore the differences and advantages of crowdlending and peer-to-peer lending to enhance your investment strategy.

Why it is important

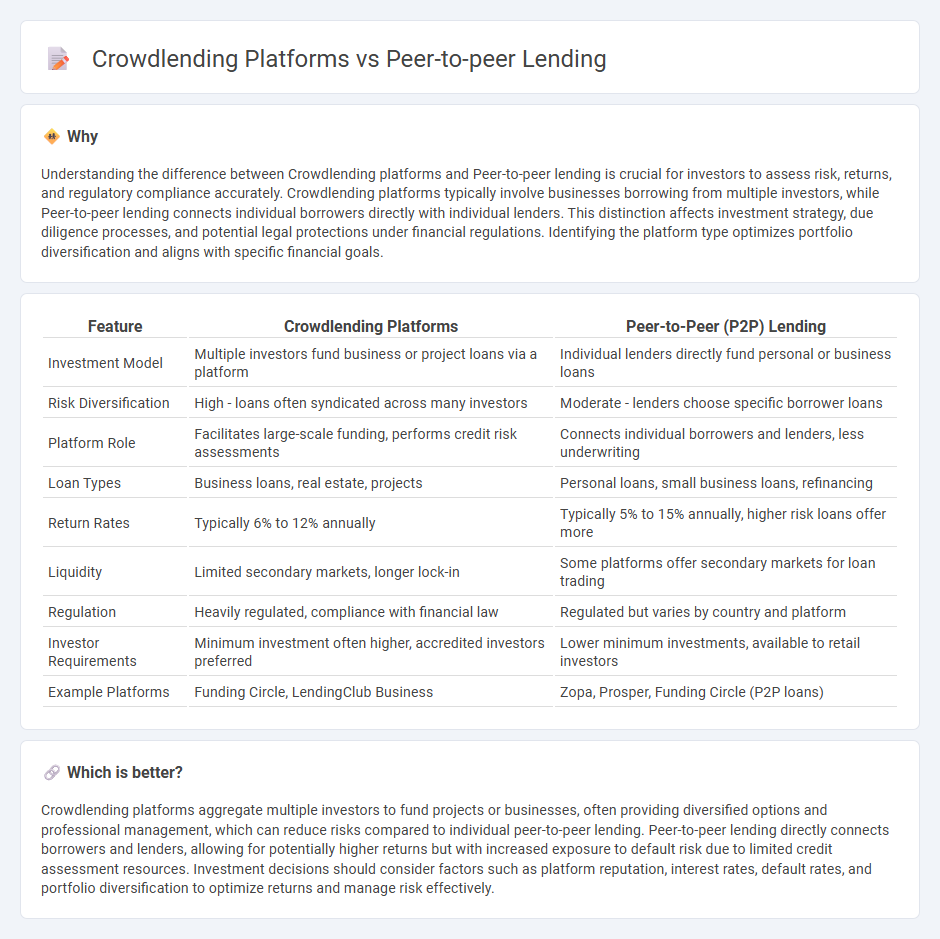

Understanding the difference between Crowdlending platforms and Peer-to-peer lending is crucial for investors to assess risk, returns, and regulatory compliance accurately. Crowdlending platforms typically involve businesses borrowing from multiple investors, while Peer-to-peer lending connects individual borrowers directly with individual lenders. This distinction affects investment strategy, due diligence processes, and potential legal protections under financial regulations. Identifying the platform type optimizes portfolio diversification and aligns with specific financial goals.

Comparison Table

| Feature | Crowdlending Platforms | Peer-to-Peer (P2P) Lending |

|---|---|---|

| Investment Model | Multiple investors fund business or project loans via a platform | Individual lenders directly fund personal or business loans |

| Risk Diversification | High - loans often syndicated across many investors | Moderate - lenders choose specific borrower loans |

| Platform Role | Facilitates large-scale funding, performs credit risk assessments | Connects individual borrowers and lenders, less underwriting |

| Loan Types | Business loans, real estate, projects | Personal loans, small business loans, refinancing |

| Return Rates | Typically 6% to 12% annually | Typically 5% to 15% annually, higher risk loans offer more |

| Liquidity | Limited secondary markets, longer lock-in | Some platforms offer secondary markets for loan trading |

| Regulation | Heavily regulated, compliance with financial law | Regulated but varies by country and platform |

| Investor Requirements | Minimum investment often higher, accredited investors preferred | Lower minimum investments, available to retail investors |

| Example Platforms | Funding Circle, LendingClub Business | Zopa, Prosper, Funding Circle (P2P loans) |

Which is better?

Crowdlending platforms aggregate multiple investors to fund projects or businesses, often providing diversified options and professional management, which can reduce risks compared to individual peer-to-peer lending. Peer-to-peer lending directly connects borrowers and lenders, allowing for potentially higher returns but with increased exposure to default risk due to limited credit assessment resources. Investment decisions should consider factors such as platform reputation, interest rates, default rates, and portfolio diversification to optimize returns and manage risk effectively.

Connection

Crowdlending platforms utilize peer-to-peer lending models by directly connecting individual investors with borrowers, bypassing traditional financial institutions. These platforms optimize investment opportunities by enabling diversified portfolios, reducing risks through multiple small loans, and offering higher potential returns compared to standard banking products. The integration of technology facilitates real-time transactions, transparent credit assessment, and streamlined loan servicing for both lenders and borrowers.

Key Terms

Risk Assessment

Peer-to-peer lending platforms and crowdlending platforms both facilitate direct financing between investors and borrowers, but their risk assessment models differ significantly. P2P lending relies heavily on individual credit scoring, automated algorithms, and borrower financial history, whereas crowdlending often incorporates project evaluation, collateral assessment, and sector-specific risk analysis. Explore the nuances of risk management strategies in these lending models for a comprehensive understanding.

Interest Rates

Peer-to-peer lending platforms typically offer interest rates ranging from 5% to 12%, depending on credit risk and loan terms, whereas crowdlending platforms often feature slightly lower rates due to diversified investor pools and larger funding volumes. Interest rates on both platforms fluctuate based on borrower creditworthiness, loan duration, and market conditions, influencing borrowers' overall cost of capital. Explore the detailed comparison of peer-to-peer lending and crowdlending interest rates to make informed financing decisions.

Loan Diversification

Peer-to-peer lending platforms enable investors to diversify their portfolios by funding individual loans with varying risk profiles, while crowdlending platforms aggregate funds to finance larger projects, offering exposure to sector-specific opportunities. Loan diversification in peer-to-peer lending reduces default risk by spreading investments across multiple borrowers, whereas crowdlending often pools funds into single ventures, potentially increasing concentration risk. Explore detailed comparisons and risk mitigation strategies to optimize your investment approach in alternative lending markets.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer (P2P) lending enables individuals to borrow money directly from individual investors via specialized websites, often with lower eligibility requirements and competitive rates compared to traditional banks, but with the added risk of lacking institutional protections.

Peer-to-peer lending - Wikipedia - P2P lending is an online financial service that matches individual lenders with borrowers, providing a platform for unsecured or secured loans without traditional financial intermediaries, and includes services like credit verification and loan servicing.

Peer-to-Peer Personal Loans for Borrowers - NerdWallet - Peer-to-peer loans involve borrowing money directly from individual investors online, typically including an origination fee, longer funding times, and offering an option for borrowers with bad credit looking for small personal or business loans.

dowidth.com

dowidth.com