Royalty streams generate income from intellectual property rights like patents, trademarks, or copyrights, providing consistent cash flow based on usage or sales. Dividends are payments made by corporations to shareholders from profits, reflecting company earnings and financial health. Explore the differences and benefits of royalty streams versus dividends to enhance your investment strategy.

Why it is important

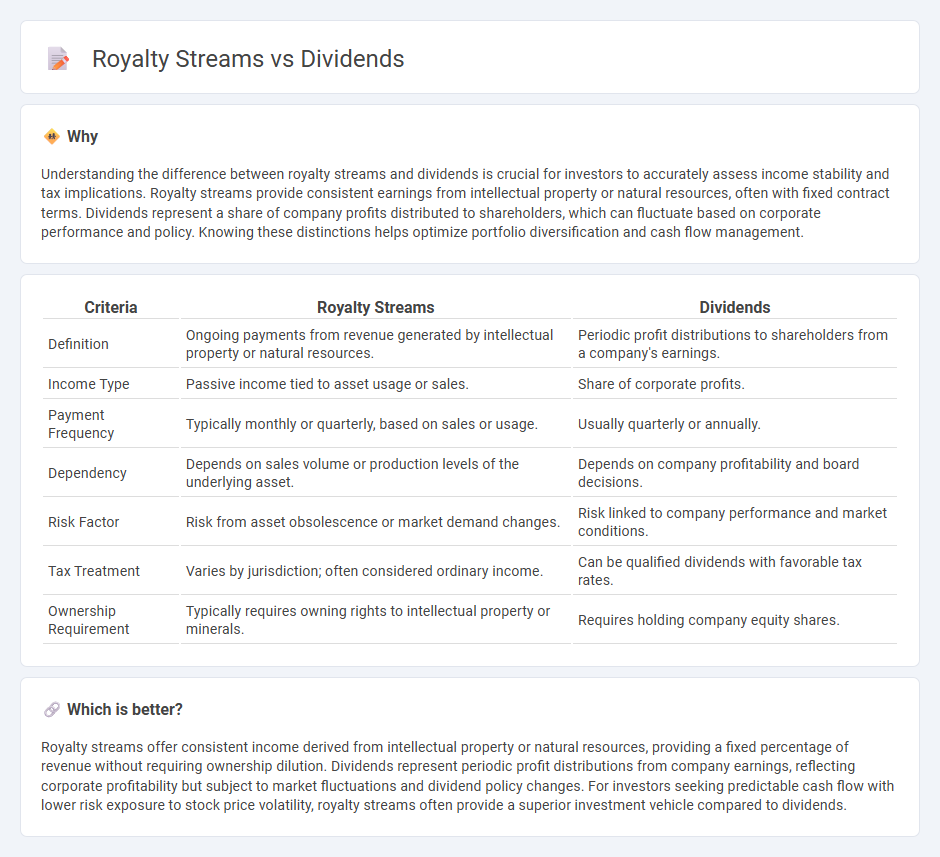

Understanding the difference between royalty streams and dividends is crucial for investors to accurately assess income stability and tax implications. Royalty streams provide consistent earnings from intellectual property or natural resources, often with fixed contract terms. Dividends represent a share of company profits distributed to shareholders, which can fluctuate based on corporate performance and policy. Knowing these distinctions helps optimize portfolio diversification and cash flow management.

Comparison Table

| Criteria | Royalty Streams | Dividends |

|---|---|---|

| Definition | Ongoing payments from revenue generated by intellectual property or natural resources. | Periodic profit distributions to shareholders from a company's earnings. |

| Income Type | Passive income tied to asset usage or sales. | Share of corporate profits. |

| Payment Frequency | Typically monthly or quarterly, based on sales or usage. | Usually quarterly or annually. |

| Dependency | Depends on sales volume or production levels of the underlying asset. | Depends on company profitability and board decisions. |

| Risk Factor | Risk from asset obsolescence or market demand changes. | Risk linked to company performance and market conditions. |

| Tax Treatment | Varies by jurisdiction; often considered ordinary income. | Can be qualified dividends with favorable tax rates. |

| Ownership Requirement | Typically requires owning rights to intellectual property or minerals. | Requires holding company equity shares. |

Which is better?

Royalty streams offer consistent income derived from intellectual property or natural resources, providing a fixed percentage of revenue without requiring ownership dilution. Dividends represent periodic profit distributions from company earnings, reflecting corporate profitability but subject to market fluctuations and dividend policy changes. For investors seeking predictable cash flow with lower risk exposure to stock price volatility, royalty streams often provide a superior investment vehicle compared to dividends.

Connection

Royalty streams and dividends both represent passive income sources derived from investments, with royalties generated from intellectual property or natural resource rights and dividends paid by corporations to shareholders from profits. Investors seeking steady cash flow often include both asset types in diversified portfolios to balance risk and return, leveraging royalty streams' long-term contracts alongside dividends' potential for growth. Understanding the correlation between royalty income stability and dividend yield trends enhances strategic asset allocation in income-focused investment strategies.

Key Terms

Passive Income

Dividends provide shareholders with a portion of a company's profits based on stock ownership, often yielding consistent passive income tied to corporate performance. Royalty streams generate revenue from the ongoing use of intellectual property, such as patents or copyrights, offering payment regardless of company ownership and potential for long-term financial benefits. Explore how each income stream can diversify your passive income portfolio and maximize returns.

Revenue Source

Dividends generate revenue from company profits shared with shareholders, offering potential for steady income tied to corporate earnings and performance. Royalty streams provide revenue through licensing agreements, based on sales or usage of intellectual property such as patents, trademarks, or copyrights. Explore how these distinct revenue sources impact investment strategies and cash flow stability.

Ownership Rights

Dividends represent earnings distributed to shareholders based on company ownership, reflecting equity stakes in a business. Royalty streams, however, are payments made to rights holders for the ongoing use of intellectual property or natural resources, independent of company equity. Explore the nuances between dividend income and royalty streams to optimize your asset portfolio effectively.

Source and External Links

dividend | Wex | US Law | LII / Legal Information Institute - Dividends are payments of a corporation's profits to its shareholders, decided at the discretion of the board of directors and not mandatory.

Dividend: Types, Examples, and Valuation Impact | CFI - A dividend is a portion of a company's profits shared with shareholders, typically paid in cash or additional shares, and often issued on a regular schedule like quarterly.

How are dividends taxed? - Vanguard - Dividends are taxable income to shareholders, with tax rates depending on whether they are qualified or ordinary and how long the shares have been held.

dowidth.com

dowidth.com