Whiskey barrel investment provides a tangible asset backed by the aging value of rare spirits, often yielding returns through appreciation and limited market availability. Venture capital investment focuses on high-growth potential startups, offering equity stakes with the possibility of substantial financial gains tied to company success and innovation. Explore the unique advantages and risks of each investment strategy to align with your financial goals.

Why it is important

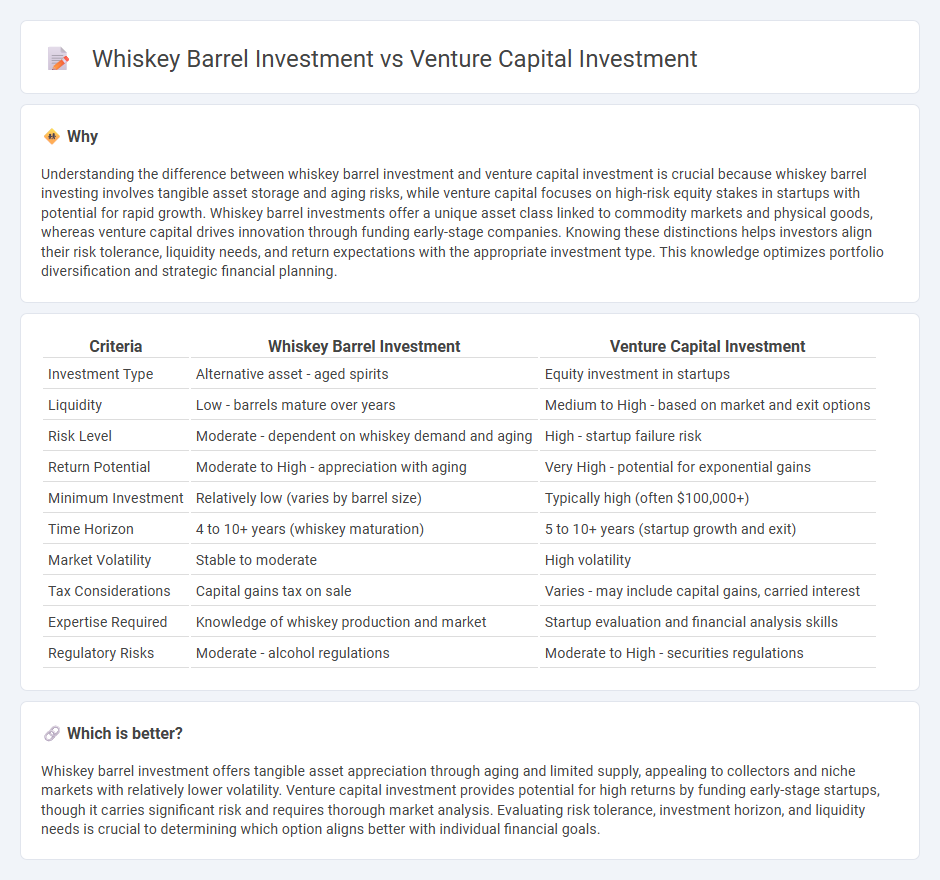

Understanding the difference between whiskey barrel investment and venture capital investment is crucial because whiskey barrel investing involves tangible asset storage and aging risks, while venture capital focuses on high-risk equity stakes in startups with potential for rapid growth. Whiskey barrel investments offer a unique asset class linked to commodity markets and physical goods, whereas venture capital drives innovation through funding early-stage companies. Knowing these distinctions helps investors align their risk tolerance, liquidity needs, and return expectations with the appropriate investment type. This knowledge optimizes portfolio diversification and strategic financial planning.

Comparison Table

| Criteria | Whiskey Barrel Investment | Venture Capital Investment |

|---|---|---|

| Investment Type | Alternative asset - aged spirits | Equity investment in startups |

| Liquidity | Low - barrels mature over years | Medium to High - based on market and exit options |

| Risk Level | Moderate - dependent on whiskey demand and aging | High - startup failure risk |

| Return Potential | Moderate to High - appreciation with aging | Very High - potential for exponential gains |

| Minimum Investment | Relatively low (varies by barrel size) | Typically high (often $100,000+) |

| Time Horizon | 4 to 10+ years (whiskey maturation) | 5 to 10+ years (startup growth and exit) |

| Market Volatility | Stable to moderate | High volatility |

| Tax Considerations | Capital gains tax on sale | Varies - may include capital gains, carried interest |

| Expertise Required | Knowledge of whiskey production and market | Startup evaluation and financial analysis skills |

| Regulatory Risks | Moderate - alcohol regulations | Moderate to High - securities regulations |

Which is better?

Whiskey barrel investment offers tangible asset appreciation through aging and limited supply, appealing to collectors and niche markets with relatively lower volatility. Venture capital investment provides potential for high returns by funding early-stage startups, though it carries significant risk and requires thorough market analysis. Evaluating risk tolerance, investment horizon, and liquidity needs is crucial to determining which option aligns better with individual financial goals.

Connection

Whiskey barrel investment and venture capital investment both capitalize on high-growth potential assets with unique value appreciation. Whiskey barrel investments involve purchasing and aging barrels that increase in worth over time, similar to venture capital funding startups expected to scale rapidly. Both strategies leverage market trends and expert knowledge to maximize returns through asset maturation or business growth.

Key Terms

**Venture Capital Investment:**

Venture capital investment delivers high-growth potential by funding early-stage startups and innovative companies with scalable business models. This approach offers significant returns through equity stakes but carries considerable risk due to market volatility and company performance uncertainties. Explore deeper insights into venture capital strategies and portfolio management to optimize your investment outcomes.

Equity Stake

Venture capital investment offers equity stakes in high-growth startups, providing investors ownership shares that can appreciate significantly if the company succeeds. Whiskey barrel investment involves purchasing barrels of aging whiskey, with value tied to the quality and aging process, but it does not confer equity ownership or voting rights. Explore the nuances of equity stakes and asset types in these investment options to determine which aligns best with your portfolio strategy.

Startup Valuation

Venture capital investment hinges on startup valuation, where investors assess factors like market potential, revenue growth, and founder expertise to determine equity stake and future returns. Whiskey barrel investment relies on tangible assets with value tied to aging process, market demand, and rarity rather than financial metrics typical in startups. Explore the nuances between financial evaluation and physical asset appreciation in these contrasting investment types to understand which aligns best with your portfolio goals.

Source and External Links

What is venture capital? - Silicon Valley Bank - Venture capital is private equity invested in startups and early-stage companies with high growth potential, typically in exchange for equity and with the expectation of significant returns if the company succeeds, despite the high risk of loss on most investments.

Venture capital | British Business Bank - Venture capital involves multiple rounds of funding for innovative, early-stage businesses, often through minority stakes, with investments typically held for five to seven years before exits via IPO, acquisition, or sale to another investor.

What is Venture Capital? - Venture capital transforms ideas into high-growth companies by providing not only funding but also strategic guidance, leveraging long-term, high-risk investments that have fueled many of the world's largest and most innovative businesses.

dowidth.com

dowidth.com