Fractional real estate allows investors to purchase a share of a property, enabling diversified portfolios and lower entry costs compared to traditional real estate investment. Property flipping involves buying undervalued properties, renovating them, and selling for profit, offering potential high returns but requiring active management and market expertise. Explore the advantages and risks of each strategy to determine the best fit for your investment goals.

Why it is important

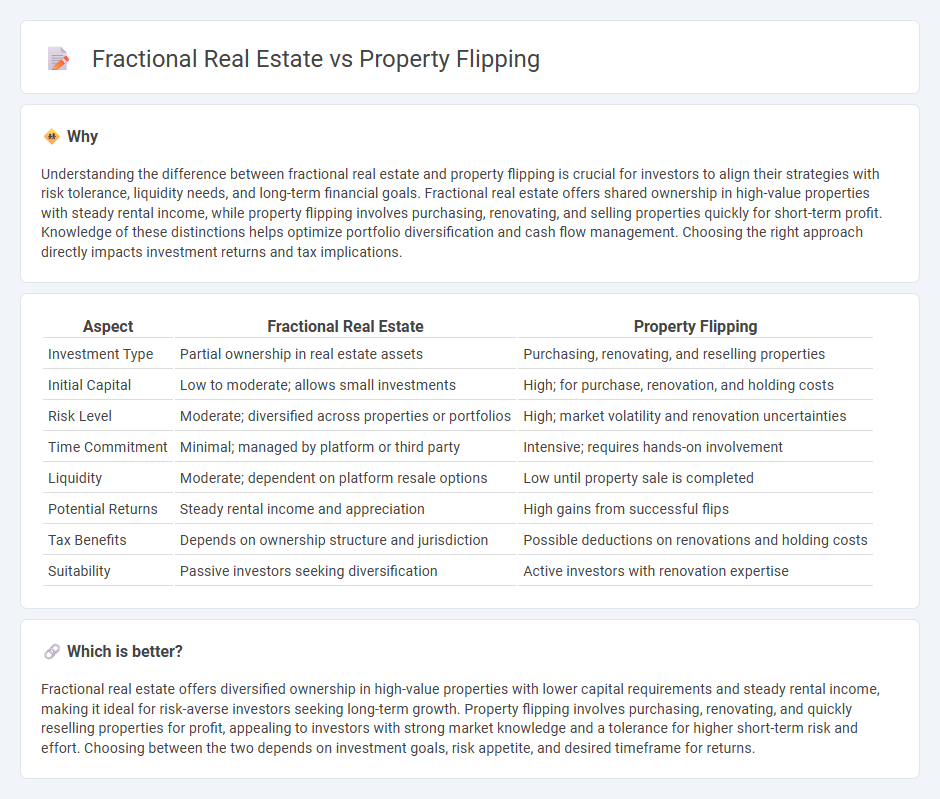

Understanding the difference between fractional real estate and property flipping is crucial for investors to align their strategies with risk tolerance, liquidity needs, and long-term financial goals. Fractional real estate offers shared ownership in high-value properties with steady rental income, while property flipping involves purchasing, renovating, and selling properties quickly for short-term profit. Knowledge of these distinctions helps optimize portfolio diversification and cash flow management. Choosing the right approach directly impacts investment returns and tax implications.

Comparison Table

| Aspect | Fractional Real Estate | Property Flipping |

|---|---|---|

| Investment Type | Partial ownership in real estate assets | Purchasing, renovating, and reselling properties |

| Initial Capital | Low to moderate; allows small investments | High; for purchase, renovation, and holding costs |

| Risk Level | Moderate; diversified across properties or portfolios | High; market volatility and renovation uncertainties |

| Time Commitment | Minimal; managed by platform or third party | Intensive; requires hands-on involvement |

| Liquidity | Moderate; dependent on platform resale options | Low until property sale is completed |

| Potential Returns | Steady rental income and appreciation | High gains from successful flips |

| Tax Benefits | Depends on ownership structure and jurisdiction | Possible deductions on renovations and holding costs |

| Suitability | Passive investors seeking diversification | Active investors with renovation expertise |

Which is better?

Fractional real estate offers diversified ownership in high-value properties with lower capital requirements and steady rental income, making it ideal for risk-averse investors seeking long-term growth. Property flipping involves purchasing, renovating, and quickly reselling properties for profit, appealing to investors with strong market knowledge and a tolerance for higher short-term risk and effort. Choosing between the two depends on investment goals, risk appetite, and desired timeframe for returns.

Connection

Fractional real estate and property flipping both leverage the concept of maximizing return on investment through real estate, with fractional ownership allowing multiple investors to share equity in high-value properties while property flipping involves purchasing, renovating, and reselling properties for profit. Both strategies require thorough market analysis, capital allocation, and risk management to capitalize on real estate market fluctuations. Investors often use fractional real estate to diversify portfolios and generate passive income, whereas property flipping focuses on active investment and short-term gains.

Key Terms

Capital Gains

Property flipping generates short-term capital gains taxed at higher ordinary income rates, often between 22% and 37% depending on the investor's tax bracket. Fractional real estate investments typically yield long-term capital gains, benefiting from reduced tax rates around 15% to 20% after holding periods over one year. Explore more about how these tax implications impact investment strategies and profitability in real estate.

Ownership Structure

Property flipping involves full ownership of a property, allowing investors to buy, renovate, and sell for profit, while fractional real estate divides ownership among multiple investors who share equity, risks, and returns. Fractional ownership provides access to high-value assets with lower capital requirements and offers diversified investment portfolios without the hassle of complete property management. Discover how these distinct ownership structures can align with your investment goals and risk appetite.

Liquidity

Property flipping involves buying, renovating, and selling properties quickly to generate high returns but often requires substantial capital and carries market risk, impacting liquidity negatively. Fractional real estate offers investors the opportunity to purchase shares of high-value properties, enhancing liquidity by allowing partial ownership and easier entry or exit from assets. Explore how fractional real estate can provide flexible investment options and improve liquidity compared to traditional property flipping.

Source and External Links

Is Flipping Houses a Profitable Strategy in 2025? - Property flipping involves buying a house below market value, making minor repairs, and reselling it quickly for profit by estimating buying, repairing, and selling costs carefully.

Flipping - Wikipedia - Flipping in real estate refers to buying, rehabbing, and quickly selling properties for profit, with 207,088 houses flipped in the US in 2017, representing 5.9% of single-family homes sold.

Illegal Property Flipping - FBI.gov - Illegal property flipping schemes involve artificially inflating property prices with minor repairs and using straw buyers and false appraisals to defraud lenders, a practice warned against by the FBI.

dowidth.com

dowidth.com