Hedge fund replication employs statistical techniques to mimic the performance of hedge funds by analyzing historical returns and factor exposures, offering cost-effective access to alternative investment strategies. Quantitative strategies utilize algorithm-driven models and vast datasets to identify and exploit market inefficiencies, focusing on systematic, data-driven decision-making. Explore the distinctions and advantages of these approaches to enhance your investment portfolio.

Why it is important

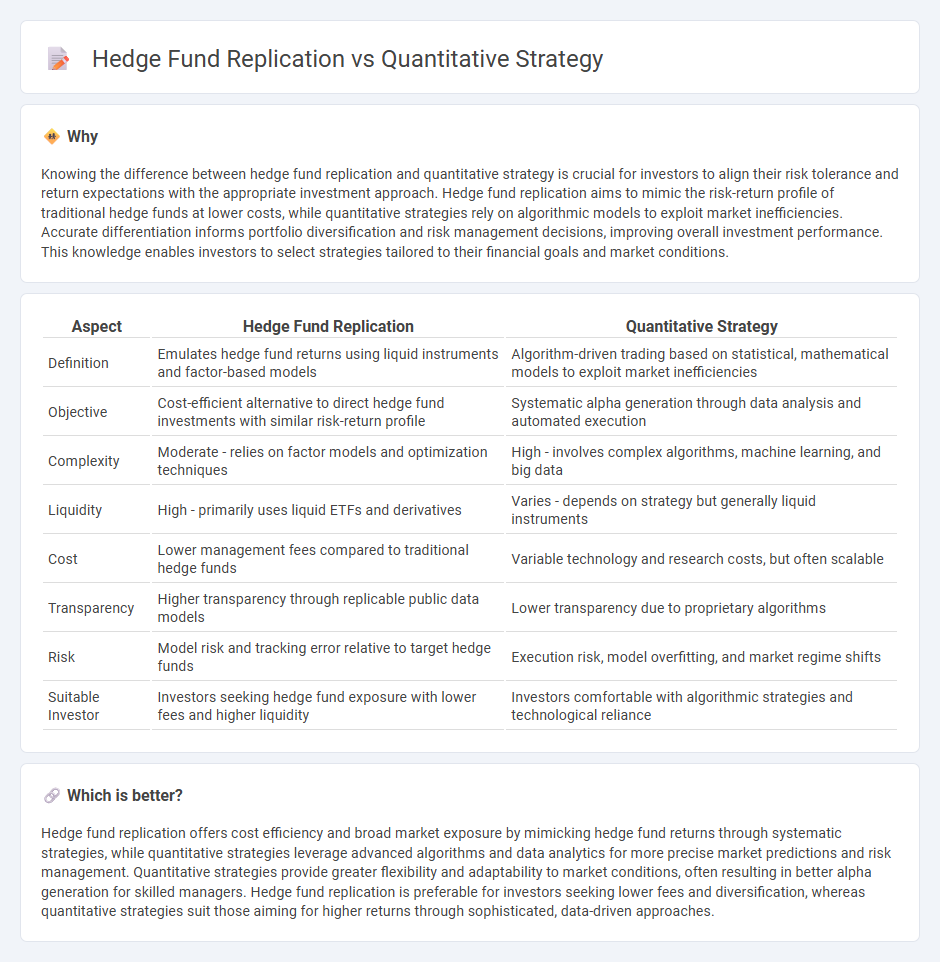

Knowing the difference between hedge fund replication and quantitative strategy is crucial for investors to align their risk tolerance and return expectations with the appropriate investment approach. Hedge fund replication aims to mimic the risk-return profile of traditional hedge funds at lower costs, while quantitative strategies rely on algorithmic models to exploit market inefficiencies. Accurate differentiation informs portfolio diversification and risk management decisions, improving overall investment performance. This knowledge enables investors to select strategies tailored to their financial goals and market conditions.

Comparison Table

| Aspect | Hedge Fund Replication | Quantitative Strategy |

|---|---|---|

| Definition | Emulates hedge fund returns using liquid instruments and factor-based models | Algorithm-driven trading based on statistical, mathematical models to exploit market inefficiencies |

| Objective | Cost-efficient alternative to direct hedge fund investments with similar risk-return profile | Systematic alpha generation through data analysis and automated execution |

| Complexity | Moderate - relies on factor models and optimization techniques | High - involves complex algorithms, machine learning, and big data |

| Liquidity | High - primarily uses liquid ETFs and derivatives | Varies - depends on strategy but generally liquid instruments |

| Cost | Lower management fees compared to traditional hedge funds | Variable technology and research costs, but often scalable |

| Transparency | Higher transparency through replicable public data models | Lower transparency due to proprietary algorithms |

| Risk | Model risk and tracking error relative to target hedge funds | Execution risk, model overfitting, and market regime shifts |

| Suitable Investor | Investors seeking hedge fund exposure with lower fees and higher liquidity | Investors comfortable with algorithmic strategies and technological reliance |

Which is better?

Hedge fund replication offers cost efficiency and broad market exposure by mimicking hedge fund returns through systematic strategies, while quantitative strategies leverage advanced algorithms and data analytics for more precise market predictions and risk management. Quantitative strategies provide greater flexibility and adaptability to market conditions, often resulting in better alpha generation for skilled managers. Hedge fund replication is preferable for investors seeking lower fees and diversification, whereas quantitative strategies suit those aiming for higher returns through sophisticated, data-driven approaches.

Connection

Hedge fund replication utilizes quantitative strategies by applying algorithm-driven models to replicate hedge fund returns with lower costs and better transparency. Quantitative strategies leverage statistical analysis and machine learning to identify patterns and generate predictive insights, enabling effective hedge fund replication. This connection enhances portfolio diversification and risk management while reducing dependence on traditional hedge fund fees.

Key Terms

Factor Models

Quantitative strategies leverage advanced mathematical models to exploit specific market factors and deliver consistent alpha generation. Hedge fund replication utilizes factor models to mimic the returns of hedge funds by systematically capturing risk premia such as value, momentum, and low volatility. Explore how these factor-driven approaches enhance portfolio diversification and risk management.

Alpha Generation

Quantitative strategies leverage mathematical models and statistical techniques to identify mispriced assets and generate alpha, emphasizing data-driven decision-making and automated execution. Hedge fund replication aims to mimic hedge fund returns by approximating their factor exposures, often prioritizing cost efficiency and diversification over pure alpha generation. Explore the nuanced differences in approaches and outcomes to better understand which method aligns with your investment goals.

Alternative Beta

Quantitative strategies harness algorithmic models to exploit inefficiencies across various asset classes, while hedge fund replication aims to mimic hedge fund returns by capturing systematic risk factors, often referred to as Alternative Beta or smart beta. Alternative Beta strategies focus on disentangling alpha from beta by targeting persistent risk premia such as momentum, value, and carry, providing a cost-efficient and transparent approach to hedge fund exposure. Discover how leveraging Alternative Beta can enhance portfolio diversification and improve risk-adjusted returns.

Source and External Links

Quantitative Investing Explained: 6 Common Quantitative Strategies - Quantitative strategies use algorithmic models to identify trading opportunities, commonly including approaches such as quantitative value strategies that seek undervalued stocks by analyzing financial metrics to forecast price appreciation over time.

Quantitative Strategies for Investing: Types, Pros & Cons - Quantitative investing relies on statistical models and computer algorithms to make data-driven investment decisions, aiming to remove emotional bias and identify stocks more likely to outperform benchmarks by analyzing a broad range of factors systematically.

8 Quantitative Trading Strategies (Rules, Settings, And Backtests) - Quantitative trading strategies apply rule-based statistical models to predict market returns and can be automated, with examples including the Russell 2000 rebalancing strategy that trades seasonally to exploit market patterns with high win rates and positive expectancy.

dowidth.com

dowidth.com