Carbon credit arbitrage exploits price differences between carbon markets to generate profits while promoting emission reductions, offering flexible investment opportunities with varying risk levels. Green bonds provide stable, fixed-income returns by funding environmentally sustainable projects, appealing to investors seeking long-term impact alongside financial security. Discover how these distinct strategies can align your portfolio with both profitability and environmental responsibility.

Why it is important

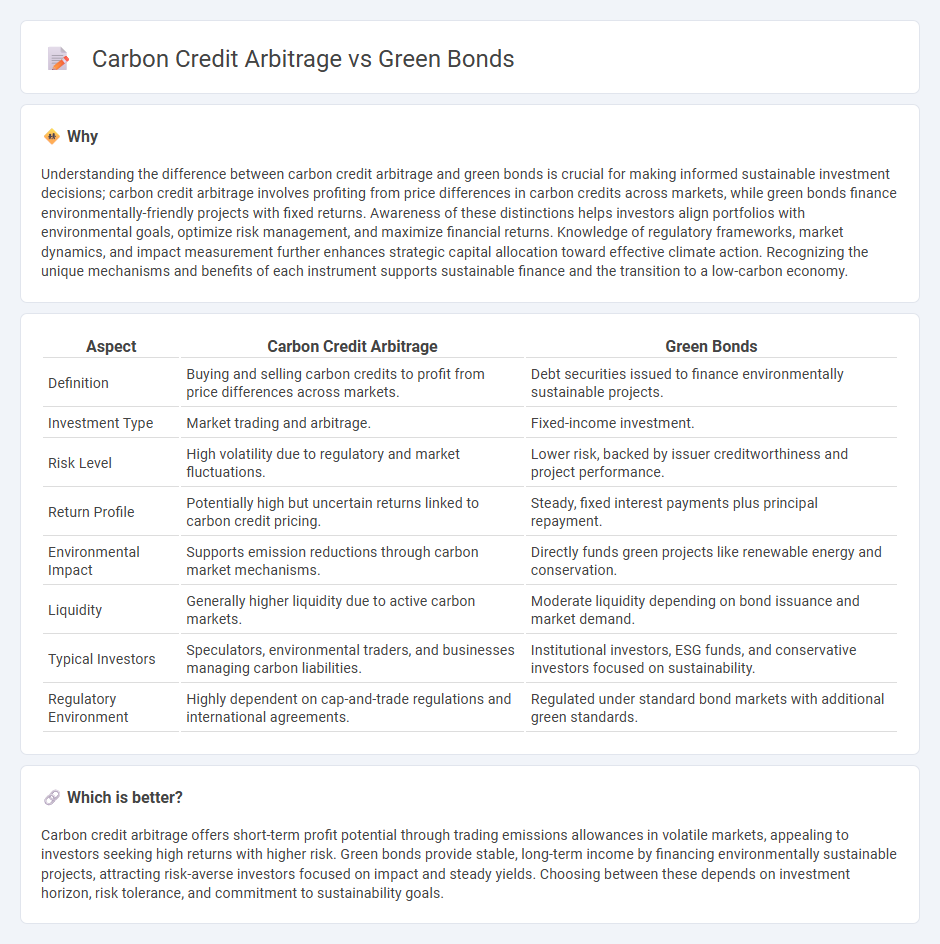

Understanding the difference between carbon credit arbitrage and green bonds is crucial for making informed sustainable investment decisions; carbon credit arbitrage involves profiting from price differences in carbon credits across markets, while green bonds finance environmentally-friendly projects with fixed returns. Awareness of these distinctions helps investors align portfolios with environmental goals, optimize risk management, and maximize financial returns. Knowledge of regulatory frameworks, market dynamics, and impact measurement further enhances strategic capital allocation toward effective climate action. Recognizing the unique mechanisms and benefits of each instrument supports sustainable finance and the transition to a low-carbon economy.

Comparison Table

| Aspect | Carbon Credit Arbitrage | Green Bonds |

|---|---|---|

| Definition | Buying and selling carbon credits to profit from price differences across markets. | Debt securities issued to finance environmentally sustainable projects. |

| Investment Type | Market trading and arbitrage. | Fixed-income investment. |

| Risk Level | High volatility due to regulatory and market fluctuations. | Lower risk, backed by issuer creditworthiness and project performance. |

| Return Profile | Potentially high but uncertain returns linked to carbon credit pricing. | Steady, fixed interest payments plus principal repayment. |

| Environmental Impact | Supports emission reductions through carbon market mechanisms. | Directly funds green projects like renewable energy and conservation. |

| Liquidity | Generally higher liquidity due to active carbon markets. | Moderate liquidity depending on bond issuance and market demand. |

| Typical Investors | Speculators, environmental traders, and businesses managing carbon liabilities. | Institutional investors, ESG funds, and conservative investors focused on sustainability. |

| Regulatory Environment | Highly dependent on cap-and-trade regulations and international agreements. | Regulated under standard bond markets with additional green standards. |

Which is better?

Carbon credit arbitrage offers short-term profit potential through trading emissions allowances in volatile markets, appealing to investors seeking high returns with higher risk. Green bonds provide stable, long-term income by financing environmentally sustainable projects, attracting risk-averse investors focused on impact and steady yields. Choosing between these depends on investment horizon, risk tolerance, and commitment to sustainability goals.

Connection

Carbon credit arbitrage exploits price differences between carbon markets to generate profit while promoting emissions reduction, and green bonds fund sustainable projects that often create additional carbon credits. The interplay occurs as green bonds finance initiatives eligible for carbon credits, enhancing their value through arbitrage opportunities. This synergy supports climate finance by aligning investment returns with verified environmental impact.

Key Terms

Environmental Impact

Green bonds fund projects that generate measurable environmental benefits, such as renewable energy and sustainable infrastructure, providing long-term impact and investor confidence. Carbon credit arbitrage exploits price differences in carbon markets, potentially leading to short-term financial gains but with variable assurance on genuine emissions reduction. Explore deeper insights into how these financial instruments drive environmental change and investment strategies.

Financial Instruments

Green bonds represent fixed-income securities issued to finance environmentally sustainable projects, offering investors steady returns while promoting green initiatives. Carbon credit arbitrage involves trading carbon emission allowances to profit from price differentials across markets, leveraging regulatory frameworks for financial gain. Explore the distinct mechanisms and market impacts of these financial instruments to enhance investment strategies in sustainability finance.

Regulatory Compliance

Green bonds offer regulated investment opportunities by financing projects with clear environmental benefits, adhering to established criteria from bodies such as the Climate Bonds Initiative and the Green Bond Principles. Carbon credit arbitrage involves trading emission allowances across different markets, requiring strict compliance with international frameworks like the Kyoto Protocol and the EU Emissions Trading System to avoid legal risks and ensure market integrity. Discover more about how regulatory compliance shapes the effectiveness and risks of these environmental finance instruments.

Source and External Links

Green bond - Wikipedia - A green bond is a fixed-income financial instrument used to fund projects with positive environmental benefits, such as renewable energy, energy efficiency, and pollution control, allowing investors to support environmental and climate goals while receiving returns like normal bonds.

What are Green Bonds and what projects do they finance? - Iberdrola - Green bonds are debt instruments issued to finance sustainable and socially responsible projects, particularly targeting the Sustainable Development Goals related to affordable energy and climate action.

Green Bond Principles (GBP) - ICMA - The Green Bond Principles provide voluntary guidelines to ensure transparency, disclosure, and integrity in green bond issuance, supporting projects that foster a net-zero emissions economy and environmental protection.

dowidth.com

dowidth.com