Royalty streams provide investors with a fixed percentage of revenue generated by an asset, ensuring steady cash flow without ownership dilution. Equity investments grant partial ownership in a company, offering potential for capital appreciation and voting rights but with higher risk exposure. Explore the distinct advantages and risks of royalty streams versus equity to determine the best investment strategy for your portfolio.

Why it is important

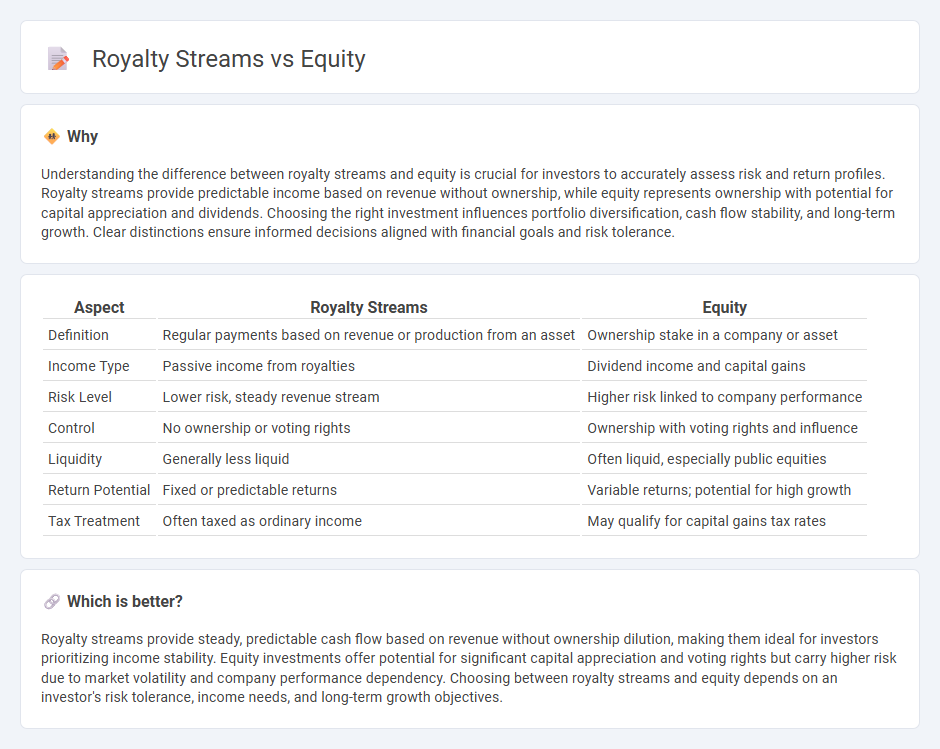

Understanding the difference between royalty streams and equity is crucial for investors to accurately assess risk and return profiles. Royalty streams provide predictable income based on revenue without ownership, while equity represents ownership with potential for capital appreciation and dividends. Choosing the right investment influences portfolio diversification, cash flow stability, and long-term growth. Clear distinctions ensure informed decisions aligned with financial goals and risk tolerance.

Comparison Table

| Aspect | Royalty Streams | Equity |

|---|---|---|

| Definition | Regular payments based on revenue or production from an asset | Ownership stake in a company or asset |

| Income Type | Passive income from royalties | Dividend income and capital gains |

| Risk Level | Lower risk, steady revenue stream | Higher risk linked to company performance |

| Control | No ownership or voting rights | Ownership with voting rights and influence |

| Liquidity | Generally less liquid | Often liquid, especially public equities |

| Return Potential | Fixed or predictable returns | Variable returns; potential for high growth |

| Tax Treatment | Often taxed as ordinary income | May qualify for capital gains tax rates |

Which is better?

Royalty streams provide steady, predictable cash flow based on revenue without ownership dilution, making them ideal for investors prioritizing income stability. Equity investments offer potential for significant capital appreciation and voting rights but carry higher risk due to market volatility and company performance dependency. Choosing between royalty streams and equity depends on an investor's risk tolerance, income needs, and long-term growth objectives.

Connection

Royalty streams provide a consistent income derived from intellectual property or natural resources, serving as a potentially lucrative investment vehicle. Equity investment involves purchasing ownership shares in a company, offering the possibility of capital appreciation along with dividend income. The connection lies in investors leveraging equity stakes in royalty-generating assets or companies to gain proportional rights to royalty income, aligning financial returns with company performance and asset value.

Key Terms

Ownership Stake

Equity streams provide investors with ownership stakes in a company, granting rights to profits, voting power, and potential appreciation of shares. Royalty streams enable investors to earn a percentage of revenue generated from specific assets or products without ownership rights or control. Explore the detailed comparisons to understand which investment approach aligns with your financial goals.

Dividend/Profit Share

Equity streams provide shareholders with ownership stakes, offering dividends based on company profits and potential capital gains. Royalty streams grant fixed payments tied to revenue from intellectual property without ownership, focusing primarily on profit share per usage or sale. Explore detailed comparisons to understand which financial model aligns best with investment goals.

Intellectual Property Rights

Equity in intellectual property rights involves owning a stake in the IP asset, granting long-term control and potential for value appreciation, whereas royalty streams provide ongoing income based on IP usage without ownership transfer. Equity holders benefit from strategic decision-making and profit sharing, while royalty recipients enjoy predictable cash flow tied to licensing agreements. Explore the nuances of IP equity and royalty arrangements to optimize your intellectual property investments.

Source and External Links

Equity Definition: Understanding Key Differences - Equity means allocating different resources based on individual circumstances so everyone has the same opportunity to thrive, unlike equality, which gives everyone the same resources regardless of need.

Equity (finance) - Wikipedia - In finance, equity refers to ownership in property or a business, calculated as the value of assets minus liabilities, and represents the owner's stake subject to any debts or obligations.

Equity - Definition, Example, Market Value, Estimate - Equity is the value attributable to a business's owners, determined by subtracting liabilities from assets on the balance sheet and may also be called shareholders' equity or net worth.

dowidth.com

dowidth.com