Wine cask aging offers a unique investment opportunity by combining tangible asset appreciation with potential value growth influenced by vintage quality and market demand. Gold bullion remains a reliable store of value, providing liquidity and protecting against inflation with historically stable performance. Explore the differences between these investment strategies to determine which aligns best with your financial goals.

Why it is important

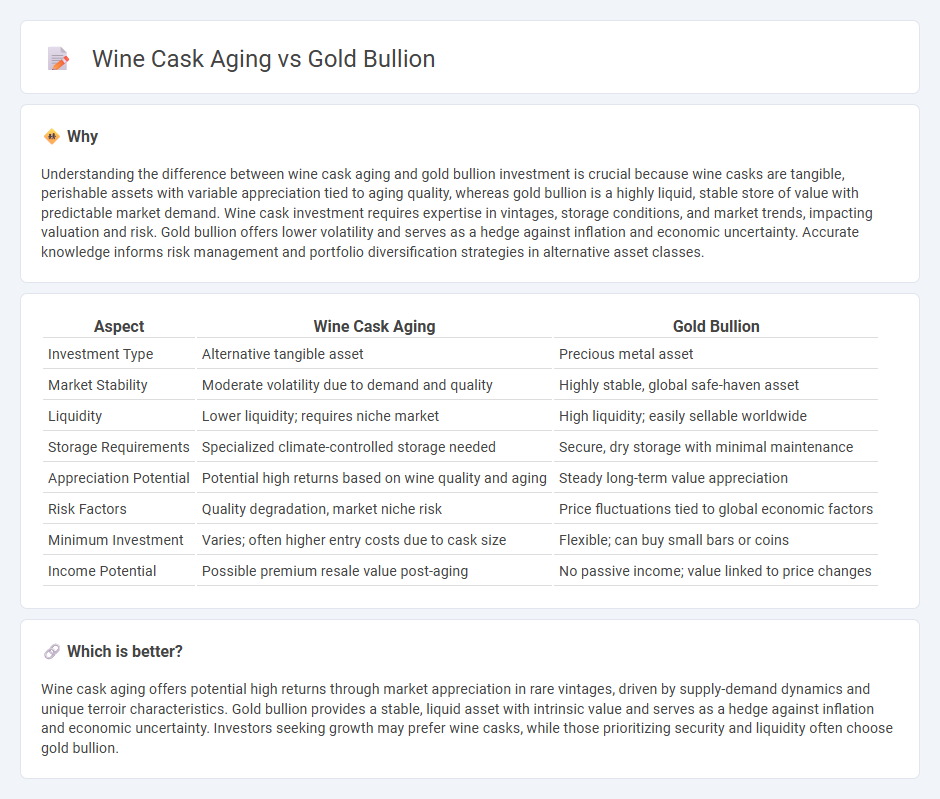

Understanding the difference between wine cask aging and gold bullion investment is crucial because wine casks are tangible, perishable assets with variable appreciation tied to aging quality, whereas gold bullion is a highly liquid, stable store of value with predictable market demand. Wine cask investment requires expertise in vintages, storage conditions, and market trends, impacting valuation and risk. Gold bullion offers lower volatility and serves as a hedge against inflation and economic uncertainty. Accurate knowledge informs risk management and portfolio diversification strategies in alternative asset classes.

Comparison Table

| Aspect | Wine Cask Aging | Gold Bullion |

|---|---|---|

| Investment Type | Alternative tangible asset | Precious metal asset |

| Market Stability | Moderate volatility due to demand and quality | Highly stable, global safe-haven asset |

| Liquidity | Lower liquidity; requires niche market | High liquidity; easily sellable worldwide |

| Storage Requirements | Specialized climate-controlled storage needed | Secure, dry storage with minimal maintenance |

| Appreciation Potential | Potential high returns based on wine quality and aging | Steady long-term value appreciation |

| Risk Factors | Quality degradation, market niche risk | Price fluctuations tied to global economic factors |

| Minimum Investment | Varies; often higher entry costs due to cask size | Flexible; can buy small bars or coins |

| Income Potential | Possible premium resale value post-aging | No passive income; value linked to price changes |

Which is better?

Wine cask aging offers potential high returns through market appreciation in rare vintages, driven by supply-demand dynamics and unique terroir characteristics. Gold bullion provides a stable, liquid asset with intrinsic value and serves as a hedge against inflation and economic uncertainty. Investors seeking growth may prefer wine casks, while those prioritizing security and liquidity often choose gold bullion.

Connection

Wine cask aging and gold bullion share value as alternative investments that hedge against inflation and market volatility. Both assets leverage scarcity and craftsmanship--wine casks gain worth through time-enhanced flavor profiles, while gold bullion derives value from its historical role as a stable store of wealth. Investors diversify portfolios by combining tangible assets like aged wine and physical gold to balance risk and preserve capital.

Key Terms

Liquidity

Gold bullion offers high liquidity due to its standardized pricing and global market acceptance, enabling quick buying and selling with minimal transaction costs. In contrast, wine cask aging involves longer holding periods and a niche market, making liquidity lower and sales more dependent on market demand and quality perception. Explore further insights on maximizing asset liquidity between precious metals and fine wine investments.

Volatility

Gold bullion offers low volatility as a precious metal with a stable value, making it a reliable store of wealth. Wine cask aging, while potentially lucrative, carries higher volatility due to factors like market demand, storage conditions, and vintage quality variations. Explore deeper insights into balancing risk and returns between these unique investment options.

Storage

Gold bullion offers unparalleled durability and requires minimal storage conditions, making it a low-maintenance investment resistant to environmental factors such as humidity or temperature fluctuations. Wine cask aging demands specialized storage environments with controlled temperature, humidity, and ventilation to ensure the cask matures properly and the wine develops desired flavors. Explore comprehensive insights on optimal storage strategies to enhance your investment in both gold bullion and wine casks.

Source and External Links

Buy Gold Bullion | Gold Bars & Coins Online - Gold bullion includes bars, rounds, and coins, with bars and rounds typically valued close to their gold content, and coins often carrying a government-backed face value and higher premium due to collectibility.

Bullion - Bullion refers to high-purity precious metals, especially gold and silver, refined to a standard suitable for investment, with gold bullion commonly held as a hedge against economic uncertainty and regulated for minimum purity (99.5% for bars, 90% for coins in the EU).

Buy Gold Bullion Bars and Coins Online - Gold bullion bars offer diverse sizes and styles with lower premiums than coins, are produced by private mints and refineries, and are certified for purity and weight, while coins are government-issued and carry legal tender status.

dowidth.com

dowidth.com