Sports memorabilia funds offer investors the chance to capitalize on the growing market for rare collectibles and athlete memorabilia, often exhibiting strong historical appreciation and limited market volatility. Commodities funds focus on physical assets like gold, oil, and agricultural products, providing diversification and a hedge against inflation with varying risk profiles depending on the commodity sector. Explore how both investment types can complement your portfolio and enhance financial growth opportunities.

Why it is important

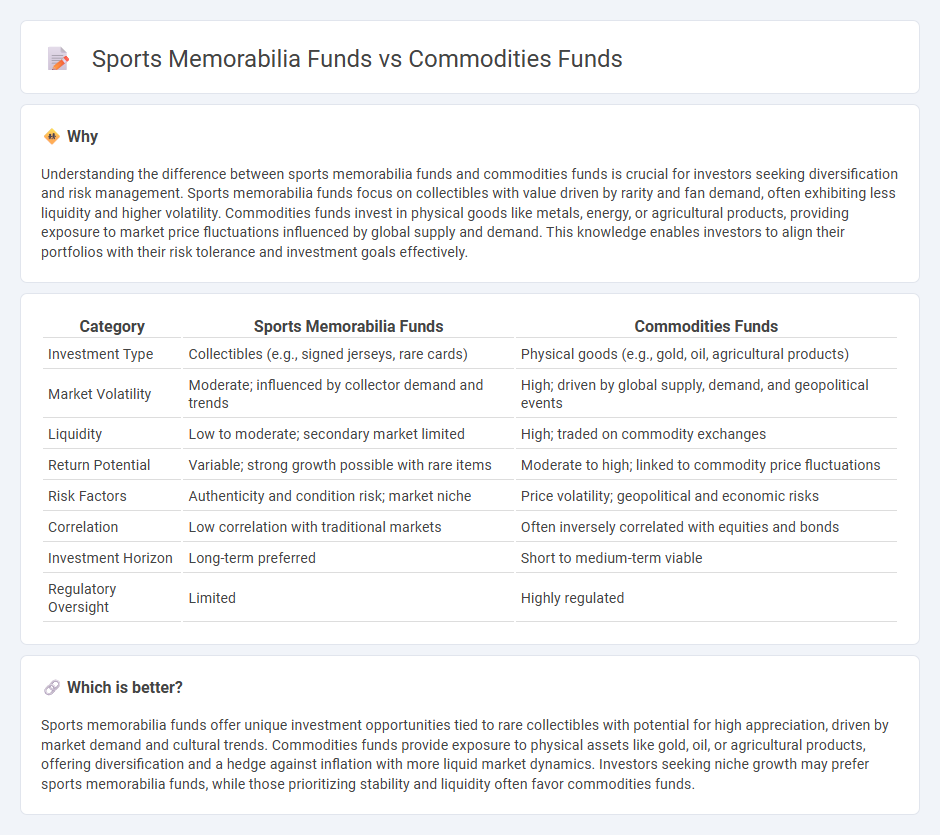

Understanding the difference between sports memorabilia funds and commodities funds is crucial for investors seeking diversification and risk management. Sports memorabilia funds focus on collectibles with value driven by rarity and fan demand, often exhibiting less liquidity and higher volatility. Commodities funds invest in physical goods like metals, energy, or agricultural products, providing exposure to market price fluctuations influenced by global supply and demand. This knowledge enables investors to align their portfolios with their risk tolerance and investment goals effectively.

Comparison Table

| Category | Sports Memorabilia Funds | Commodities Funds |

|---|---|---|

| Investment Type | Collectibles (e.g., signed jerseys, rare cards) | Physical goods (e.g., gold, oil, agricultural products) |

| Market Volatility | Moderate; influenced by collector demand and trends | High; driven by global supply, demand, and geopolitical events |

| Liquidity | Low to moderate; secondary market limited | High; traded on commodity exchanges |

| Return Potential | Variable; strong growth possible with rare items | Moderate to high; linked to commodity price fluctuations |

| Risk Factors | Authenticity and condition risk; market niche | Price volatility; geopolitical and economic risks |

| Correlation | Low correlation with traditional markets | Often inversely correlated with equities and bonds |

| Investment Horizon | Long-term preferred | Short to medium-term viable |

| Regulatory Oversight | Limited | Highly regulated |

Which is better?

Sports memorabilia funds offer unique investment opportunities tied to rare collectibles with potential for high appreciation, driven by market demand and cultural trends. Commodities funds provide exposure to physical assets like gold, oil, or agricultural products, offering diversification and a hedge against inflation with more liquid market dynamics. Investors seeking niche growth may prefer sports memorabilia funds, while those prioritizing stability and liquidity often favor commodities funds.

Connection

Sports memorabilia funds and commodities funds are connected through their shared role in diversification and alternative investment strategies, attracting investors seeking non-traditional assets beyond stocks and bonds. Both types of funds capitalize on the fluctuating value of tangible assets, with sports memorabilia linked to collectible market trends and commodities funds tied to physical goods like metals, energy, and agricultural products. This correlation allows portfolio managers to balance risk and potential returns by leveraging asset classes influenced by different economic factors and market demands.

Key Terms

**Commodities Funds:**

Commodities funds invest in physical goods such as oil, gold, and agricultural products, offering portfolio diversification and inflation protection through exposure to real assets. These funds typically track commodity indexes or directly trade futures contracts, providing liquidity and market transparency for investors. Explore the advantages and risks of commodities funds to enhance your investment strategy.

Futures Contracts

Commodities funds primarily invest in futures contracts tied to physical goods like oil, gold, and agricultural products, providing exposure to market price fluctuations and hedging opportunities. Sports memorabilia funds, on the other hand, focus on tangible collectibles such as autographed items and rare memorabilia, relying on asset appreciation rather than derivative contracts. Learn more about how futures contracts differentiate commodities funds from sports memorabilia funds and influence investment strategies.

Spot Price

Commodities funds primarily invest in raw materials such as gold, oil, and agricultural products, closely tracking their spot prices to capture market fluctuations and hedge against inflation. Sports memorabilia funds acquire valuable collectibles like autographed items and rare cards, where valuation depends more on rarity and demand rather than spot price movements. Explore the nuances of spot price impacts on these fund types to make informed investment decisions.

Source and External Links

Commodities ETFs - Commodities ETFs are funds that invest in specific commodities like precious metals, oil, or coffee, or across a range of commodities, offering exposure to these markets through exchange-traded funds.

Why and How to Invest in Commodities - Commodity funds can be specific to individual commodities or diversified across many, involving futures investments and carrying risks like price fluctuations, regulatory changes, and credit risk, suitable only for investors who can tolerate potential total loss.

Commodities Strategy - A Class - Overview - This mutual fund seeks to match the performance of the S&P GSCI Commodity Index with a net expense ratio of 1.66%, providing exposure to a broad basket of commodities through an actively managed strategy.

dowidth.com

dowidth.com