Virtual land real estate offers investors digital ownership in metaverse platforms, providing unique opportunities for asset appreciation and immersive brand engagement. Hedge funds diversify portfolios with actively managed investments across stocks, bonds, and derivatives, targeting high returns through strategic asset allocation. Explore the distinct advantages of virtual land versus hedge funds to make informed investment decisions.

Why it is important

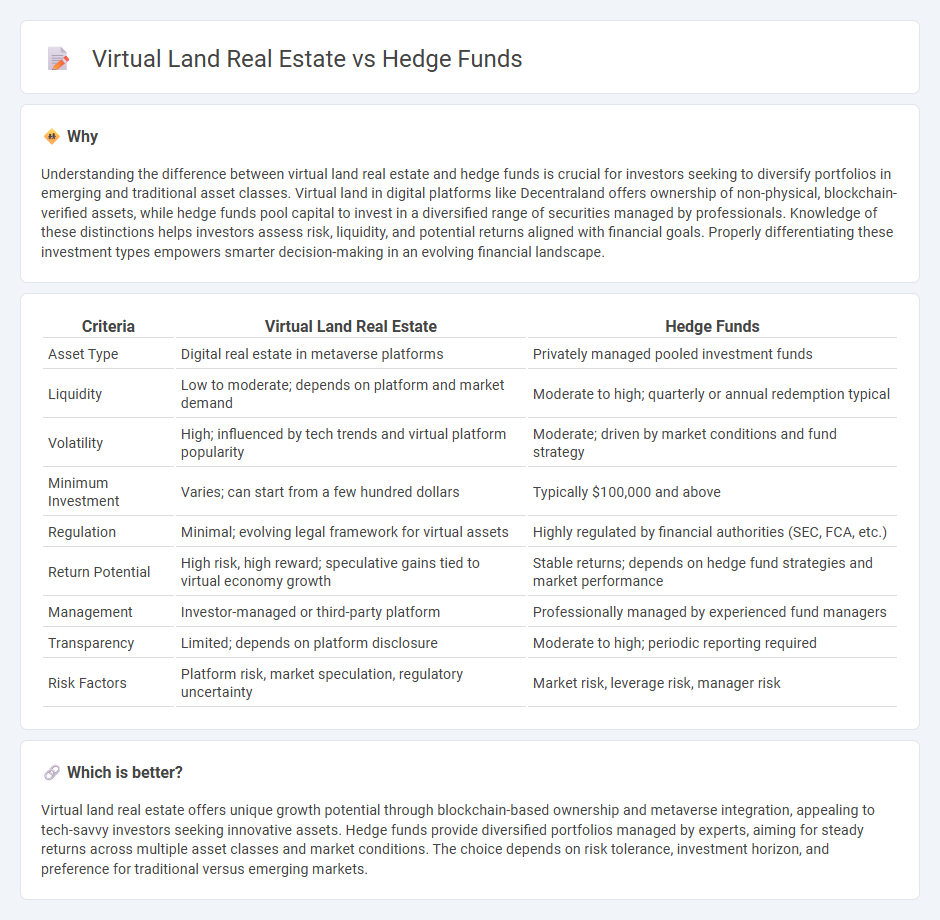

Understanding the difference between virtual land real estate and hedge funds is crucial for investors seeking to diversify portfolios in emerging and traditional asset classes. Virtual land in digital platforms like Decentraland offers ownership of non-physical, blockchain-verified assets, while hedge funds pool capital to invest in a diversified range of securities managed by professionals. Knowledge of these distinctions helps investors assess risk, liquidity, and potential returns aligned with financial goals. Properly differentiating these investment types empowers smarter decision-making in an evolving financial landscape.

Comparison Table

| Criteria | Virtual Land Real Estate | Hedge Funds |

|---|---|---|

| Asset Type | Digital real estate in metaverse platforms | Privately managed pooled investment funds |

| Liquidity | Low to moderate; depends on platform and market demand | Moderate to high; quarterly or annual redemption typical |

| Volatility | High; influenced by tech trends and virtual platform popularity | Moderate; driven by market conditions and fund strategy |

| Minimum Investment | Varies; can start from a few hundred dollars | Typically $100,000 and above |

| Regulation | Minimal; evolving legal framework for virtual assets | Highly regulated by financial authorities (SEC, FCA, etc.) |

| Return Potential | High risk, high reward; speculative gains tied to virtual economy growth | Stable returns; depends on hedge fund strategies and market performance |

| Management | Investor-managed or third-party platform | Professionally managed by experienced fund managers |

| Transparency | Limited; depends on platform disclosure | Moderate to high; periodic reporting required |

| Risk Factors | Platform risk, market speculation, regulatory uncertainty | Market risk, leverage risk, manager risk |

Which is better?

Virtual land real estate offers unique growth potential through blockchain-based ownership and metaverse integration, appealing to tech-savvy investors seeking innovative assets. Hedge funds provide diversified portfolios managed by experts, aiming for steady returns across multiple asset classes and market conditions. The choice depends on risk tolerance, investment horizon, and preference for traditional versus emerging markets.

Connection

Virtual land real estate and hedge funds are increasingly interconnected as hedge funds diversify portfolios by investing in digital assets like virtual real estate on blockchain-based platforms such as Decentraland and The Sandbox. These investments leverage the rising value of NFTs and metaverse properties, offering hedge funds exposure to emerging digital economies and alternative asset classes. Hedge funds use advanced data analytics and risk management strategies to capitalize on the price volatility and speculative potential of virtual land, integrating it into broader investment frameworks.

Key Terms

Leverage

Hedge funds typically utilize high financial leverage by borrowing capital to amplify returns, often achieving ratios of 2:1 to 5:1, which increases both potential gains and risks. Virtual land real estate investments, especially in metaverse platforms like Decentraland or The Sandbox, generally involve lower or no leverage, relying on direct asset purchases with cryptocurrency or fiat, minimizing debt-related risks. Explore deeper insights on leverage strategies to optimize your investment portfolio across these dynamic asset classes.

Liquidity

Hedge funds offer high liquidity through frequent trading and easy entry or exit, allowing investors to quickly adjust their portfolios in response to market conditions. Virtual land real estate, often found on blockchain platforms, tends to have lower liquidity due to limited buyers and longer transaction times, posing challenges for rapid asset liquidation. Explore the detailed comparison of liquidity dynamics between hedge funds and virtual land investments to enhance your portfolio strategy.

Asset Valuation

Hedge funds use sophisticated financial models and market analysis to assess asset valuation, relying heavily on liquidity, volatility, and historical performance data for accurate pricing. In contrast, virtual land real estate valuation depends on factors such as platform popularity, scarcity of land parcels, digital infrastructure, and user engagement within virtual environments, often influenced by speculative demand and technological trends. Explore deeper insights into how asset valuation strategies evolve in traditional finance versus emerging virtual real estate markets.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are private investment firms that pool capital from institutional and accredited investors to pursue alternative strategies aiming for absolute returns, often using techniques like short selling, derivatives, and event-driven investing to beat the market or reduce risks.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment funds that use more flexible and sometimes riskier strategies than mutual funds, typically restricted to sophisticated individual or institutional investors and not subject to the regulatory protections applying to mutual funds.

Hedge fund - Wikipedia - Hedge funds are pooled investment funds employing complex trading and risk management techniques, charging management and performance fees, and their strategies have evolved beyond hedging to include a wide array of investment approaches which can contribute to systemic risk in stressed market conditions.

dowidth.com

dowidth.com