Investment communities, comprising individual and institutional investors, focus on diverse portfolios including stocks, bonds, and real estate to maximize returns through market participation. Sovereign wealth funds, state-owned investment entities, manage national reserves with long-term stability and economic growth objectives, often investing in infrastructure, technology, and global assets. Explore the distinct strategies and impacts of these investment powerhouses to understand their roles in the global financial landscape.

Why it is important

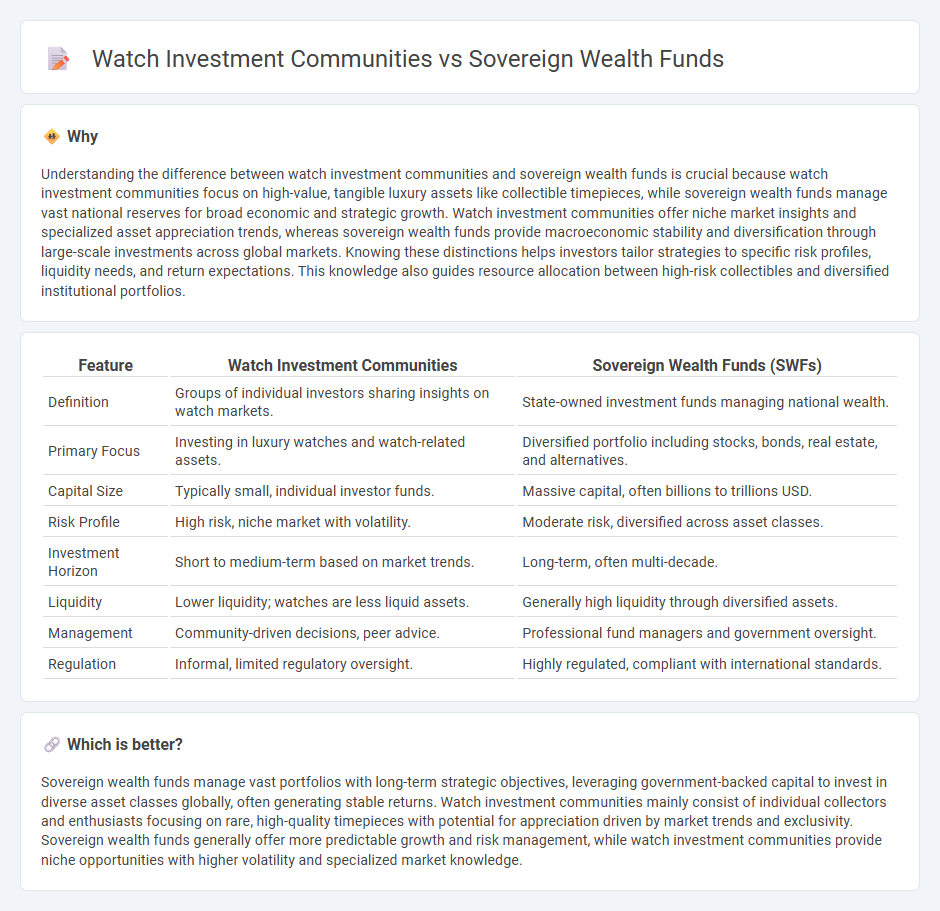

Understanding the difference between watch investment communities and sovereign wealth funds is crucial because watch investment communities focus on high-value, tangible luxury assets like collectible timepieces, while sovereign wealth funds manage vast national reserves for broad economic and strategic growth. Watch investment communities offer niche market insights and specialized asset appreciation trends, whereas sovereign wealth funds provide macroeconomic stability and diversification through large-scale investments across global markets. Knowing these distinctions helps investors tailor strategies to specific risk profiles, liquidity needs, and return expectations. This knowledge also guides resource allocation between high-risk collectibles and diversified institutional portfolios.

Comparison Table

| Feature | Watch Investment Communities | Sovereign Wealth Funds (SWFs) |

|---|---|---|

| Definition | Groups of individual investors sharing insights on watch markets. | State-owned investment funds managing national wealth. |

| Primary Focus | Investing in luxury watches and watch-related assets. | Diversified portfolio including stocks, bonds, real estate, and alternatives. |

| Capital Size | Typically small, individual investor funds. | Massive capital, often billions to trillions USD. |

| Risk Profile | High risk, niche market with volatility. | Moderate risk, diversified across asset classes. |

| Investment Horizon | Short to medium-term based on market trends. | Long-term, often multi-decade. |

| Liquidity | Lower liquidity; watches are less liquid assets. | Generally high liquidity through diversified assets. |

| Management | Community-driven decisions, peer advice. | Professional fund managers and government oversight. |

| Regulation | Informal, limited regulatory oversight. | Highly regulated, compliant with international standards. |

Which is better?

Sovereign wealth funds manage vast portfolios with long-term strategic objectives, leveraging government-backed capital to invest in diverse asset classes globally, often generating stable returns. Watch investment communities mainly consist of individual collectors and enthusiasts focusing on rare, high-quality timepieces with potential for appreciation driven by market trends and exclusivity. Sovereign wealth funds generally offer more predictable growth and risk management, while watch investment communities provide niche opportunities with higher volatility and specialized market knowledge.

Connection

Investment communities leverage insights from sovereign wealth funds to identify stable, long-term asset opportunities globally. Sovereign wealth funds influence market trends through their significant allocations in infrastructure, technology, and real estate sectors. The collaboration between these entities enhances portfolio diversification and drives sustainable economic growth.

Key Terms

**Sovereign Wealth Funds:**

Sovereign wealth funds (SWFs) manage vast pools of state-owned assets, investing globally to stabilize national economies and generate long-term returns. They typically hold diversified portfolios across equities, bonds, real estate, and alternative assets, influencing global financial markets through strategic asset allocation. Discover more about how sovereign wealth funds shape investment landscapes and economic stability worldwide.

Asset Allocation

Sovereign wealth funds prioritize long-term asset allocation strategies driven by national economic goals, often diversifying across equities, fixed income, real estate, and alternative investments to stabilize fiscal reserves. Watch investment communities tend to emphasize more agile, market-responsive asset allocation, frequently shifting exposure to capitalize on emerging trends and short-term opportunities within equities and cryptocurrencies. Explore the detailed differences in asset allocation approaches between sovereign wealth funds and investment communities for better portfolio strategy insights.

Government Ownership

Sovereign wealth funds (SWFs) represent state-owned investment entities managing vast portfolios derived from national reserves, often prioritizing long-term economic stability and strategic assets. In contrast, watch investment communities typically comprise private investors focused on niche markets and short-term gains without direct government backing. Explore how government ownership in SWFs influences global markets and investment strategies.

Source and External Links

Chapter 1 Demystifying Sovereign Wealth Funds in - IMF eLibrary - Sovereign wealth funds (SWFs) are state-owned investment funds that have grown rapidly, investing state-owned profits from fiscal surpluses and commodity exports, holding $3.2 trillion in assets at the end of 2008 and playing a major role in global capital markets with diverse investment goals and approaches.

What is a Sovereign Wealth Fund? - IFSWF - A sovereign wealth fund is a government-owned investment vehicle investing mainly in foreign financial assets for financial objectives, with common mandates being saving funds, stabilization funds, strategic funds, or combinations thereof to manage national wealth, budget volatility, or economic development.

Sovereign wealth fund - Wikipedia - Sovereign wealth funds are state-owned investment funds investing in a range of real and financial assets worldwide, typically funded by commodity exports or central bank reserves, aiming for long-term returns distinct from short-term central bank foreign exchange reserves.

dowidth.com

dowidth.com