Patent monetization leverages intellectual property assets to generate revenue through licensing or selling patents, providing a strategic alternative to traditional investment routes. Mergers and acquisitions involve combining companies to boost market share, diversify portfolios, or achieve economies of scale. Explore the distinct advantages and risks of patent monetization versus mergers and acquisitions to optimize your investment strategy.

Why it is important

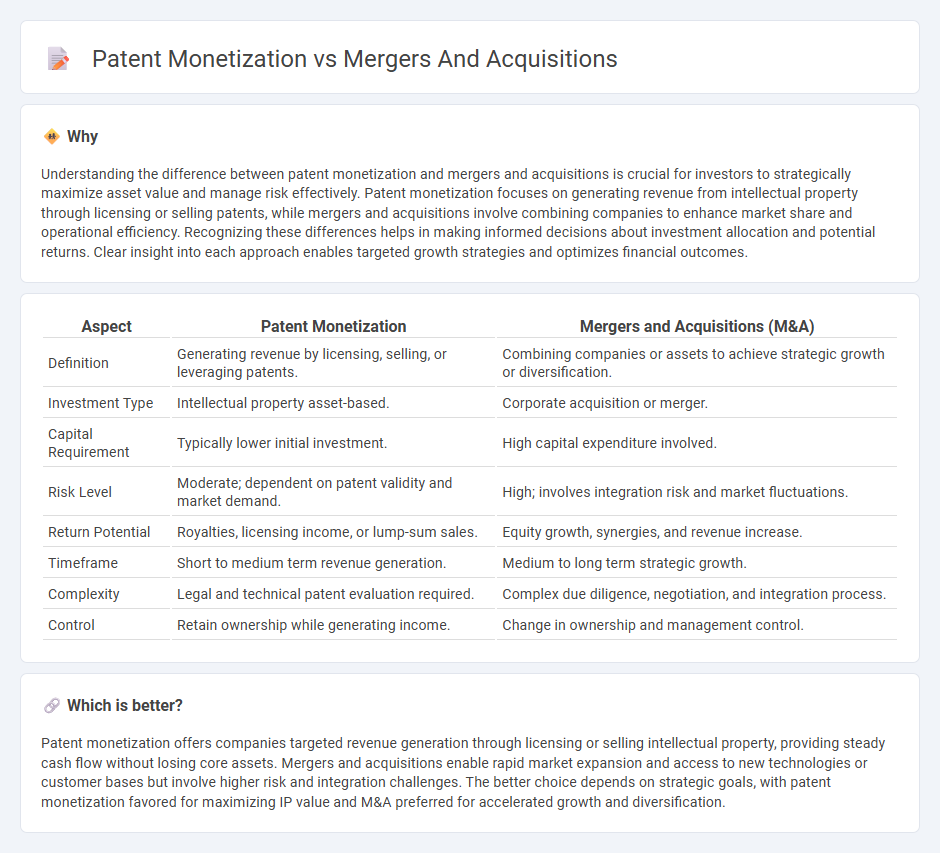

Understanding the difference between patent monetization and mergers and acquisitions is crucial for investors to strategically maximize asset value and manage risk effectively. Patent monetization focuses on generating revenue from intellectual property through licensing or selling patents, while mergers and acquisitions involve combining companies to enhance market share and operational efficiency. Recognizing these differences helps in making informed decisions about investment allocation and potential returns. Clear insight into each approach enables targeted growth strategies and optimizes financial outcomes.

Comparison Table

| Aspect | Patent Monetization | Mergers and Acquisitions (M&A) |

|---|---|---|

| Definition | Generating revenue by licensing, selling, or leveraging patents. | Combining companies or assets to achieve strategic growth or diversification. |

| Investment Type | Intellectual property asset-based. | Corporate acquisition or merger. |

| Capital Requirement | Typically lower initial investment. | High capital expenditure involved. |

| Risk Level | Moderate; dependent on patent validity and market demand. | High; involves integration risk and market fluctuations. |

| Return Potential | Royalties, licensing income, or lump-sum sales. | Equity growth, synergies, and revenue increase. |

| Timeframe | Short to medium term revenue generation. | Medium to long term strategic growth. |

| Complexity | Legal and technical patent evaluation required. | Complex due diligence, negotiation, and integration process. |

| Control | Retain ownership while generating income. | Change in ownership and management control. |

Which is better?

Patent monetization offers companies targeted revenue generation through licensing or selling intellectual property, providing steady cash flow without losing core assets. Mergers and acquisitions enable rapid market expansion and access to new technologies or customer bases but involve higher risk and integration challenges. The better choice depends on strategic goals, with patent monetization favored for maximizing IP value and M&A preferred for accelerated growth and diversification.

Connection

Patent monetization enhances a company's valuation by transforming intellectual property into revenue streams through licensing or selling patents, which attracts potential acquirers in mergers and acquisitions (M&A). The integration of valuable patents in M&A deals provides competitive advantages and market control, increasing negotiation leverage and deal value. Efficient patent monetization signals strong innovation capabilities, making companies more attractive targets or partners in strategic acquisitions.

Key Terms

**Mergers and Acquisitions:**

Mergers and acquisitions (M&A) involve the strategic consolidation of companies to enhance market share, diversify product portfolios, and achieve operational synergies. Key metrics in M&A include valuation multiples, due diligence processes, and integration planning to maximize shareholder value. Explore the nuances of M&A strategies, financing options, and industry-specific trends to optimize your corporate growth approach.

Due Diligence

Mergers and acquisitions (M&A) due diligence involves comprehensive evaluation of financials, legal risks, and intellectual property (IP) assets to ensure accurate valuation and risk management. Patent monetization due diligence prioritizes assessment of patent portfolios, including patent validity, enforceability, and licensing potential to maximize revenue streams. Explore the distinct due diligence strategies to optimize outcomes in M&A and patent monetization processes.

Synergy

Mergers and acquisitions (M&A) create synergy by combining complementary assets, enhancing market reach, and achieving operational efficiencies, leading to increased shareholder value. Patent monetization leverages intellectual property to generate revenue through licensing, sales, or litigation, optimizing innovation assets without altering company structure. Explore how strategic synergy from M&A contrasts with targeted value extraction in patent monetization to optimize business growth.

Source and External Links

Mergers and acquisitions - Wikipedia - M&A are business transactions involving the combination of companies, with mergers creating new entities from similarly sized firms and acquisitions involving one company absorbing another, often seen in technology sectors as talent-driven "acqui-hire" transactions.

Mergers & Acquisitions (M&A) - Corporate Finance Institute - M&A transactions involve companies combining through mergers (similar-sized companies forming a new entity) or acquisitions (larger companies absorbing smaller ones), with types including horizontal, vertical, and statutory mergers for strategic business reasons.

Merge and acquire businesses | U.S. Small Business Administration - The SBA explains mergers combine two businesses into one new legal entity, while acquisitions absorb one company into another without forming a new company, stressing the importance of business valuation and formal agreements in the process.

dowidth.com

dowidth.com