Song catalog purchases offer a unique investment opportunity by generating consistent royalty income from music rights, often providing higher returns relative to initial costs and market volatility. Farmland investments, meanwhile, deliver stable long-term value through crop production and land appreciation, influenced by factors such as climate change and agricultural demand. Explore the benefits and risks of both options to make an informed investment decision.

Why it is important

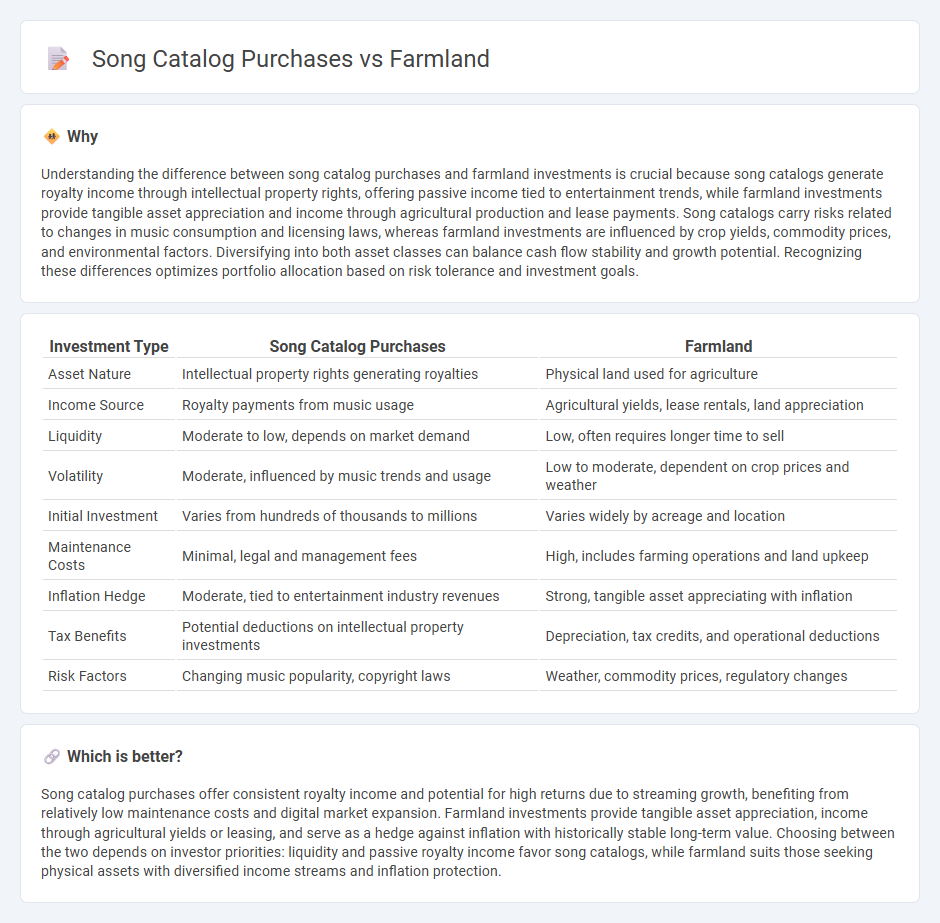

Understanding the difference between song catalog purchases and farmland investments is crucial because song catalogs generate royalty income through intellectual property rights, offering passive income tied to entertainment trends, while farmland investments provide tangible asset appreciation and income through agricultural production and lease payments. Song catalogs carry risks related to changes in music consumption and licensing laws, whereas farmland investments are influenced by crop yields, commodity prices, and environmental factors. Diversifying into both asset classes can balance cash flow stability and growth potential. Recognizing these differences optimizes portfolio allocation based on risk tolerance and investment goals.

Comparison Table

| Investment Type | Song Catalog Purchases | Farmland |

|---|---|---|

| Asset Nature | Intellectual property rights generating royalties | Physical land used for agriculture |

| Income Source | Royalty payments from music usage | Agricultural yields, lease rentals, land appreciation |

| Liquidity | Moderate to low, depends on market demand | Low, often requires longer time to sell |

| Volatility | Moderate, influenced by music trends and usage | Low to moderate, dependent on crop prices and weather |

| Initial Investment | Varies from hundreds of thousands to millions | Varies widely by acreage and location |

| Maintenance Costs | Minimal, legal and management fees | High, includes farming operations and land upkeep |

| Inflation Hedge | Moderate, tied to entertainment industry revenues | Strong, tangible asset appreciating with inflation |

| Tax Benefits | Potential deductions on intellectual property investments | Depreciation, tax credits, and operational deductions |

| Risk Factors | Changing music popularity, copyright laws | Weather, commodity prices, regulatory changes |

Which is better?

Song catalog purchases offer consistent royalty income and potential for high returns due to streaming growth, benefiting from relatively low maintenance costs and digital market expansion. Farmland investments provide tangible asset appreciation, income through agricultural yields or leasing, and serve as a hedge against inflation with historically stable long-term value. Choosing between the two depends on investor priorities: liquidity and passive royalty income favor song catalogs, while farmland suits those seeking physical assets with diversified income streams and inflation protection.

Connection

Song catalog purchases and farmland investments both serve as alternative asset classes that provide diversification beyond traditional stocks and bonds. These assets generate steady, long-term income streams through royalty payments and agricultural yields, respectively, making them attractive for investors seeking stable cash flow. Their tangible and intellectual property natures offer unique inflation hedges and portfolio risk mitigation opportunities.

Key Terms

Asset Class

Farmland and song catalog purchases represent distinct asset classes with unique risk and return profiles; farmland offers tangible, inflation-hedged real estate exposure with stable income from agricultural production, while song catalogs provide intellectual property rights yielding royalties that benefit from long-term streaming growth and licensing deals. Institutional investors increasingly diversify by integrating both, leveraging farmland's physical asset stability alongside the high-margin, digital cash flow streams of music royalties. Explore detailed comparisons and strategic insights to optimize asset allocation in your investment portfolio.

Cash Flow

Farmland investments generate steady cash flow through crop sales, government subsidies, and land appreciation, providing long-term financial stability. Song catalog purchases yield royalties from streaming services, licensing, and synchronization deals, offering potentially high but variable cash flow tied to music consumption trends. Explore detailed comparisons to determine the best cash flow strategy for your investment portfolio.

Valuation

Farmland investments often derive valuation from factors like land productivity, crop yield potential, and location, providing tangible asset security and inflation hedging. Song catalog purchases are valued based on royalty streams, streaming data, artist popularity, and future earning potential within the music industry. Explore the detailed valuation methodologies and market trends to optimize your investment strategy.

Source and External Links

Farm Land - A free and relaxing farming game where you grow crops, raise animals, and expand your farm island.

FarmLand - A farming simulation game where you restore an island farm to its former glory by cultivating and selling crops.

American Farmland Trust - An organization dedicated to protecting farmland, promoting sound farming practices, and keeping farmers on the land.

dowidth.com

dowidth.com