Fractionalized art investment allows individuals to own shares of valuable artworks, providing access to the high-value art market with lower capital requirements and potential appreciation linked to cultural demand. Index funds represent a diversified portfolio of stocks or bonds, offering stability and broad market exposure with generally lower risk and fees. Explore how these distinct investment vehicles can align with your financial goals and risk tolerance.

Why it is important

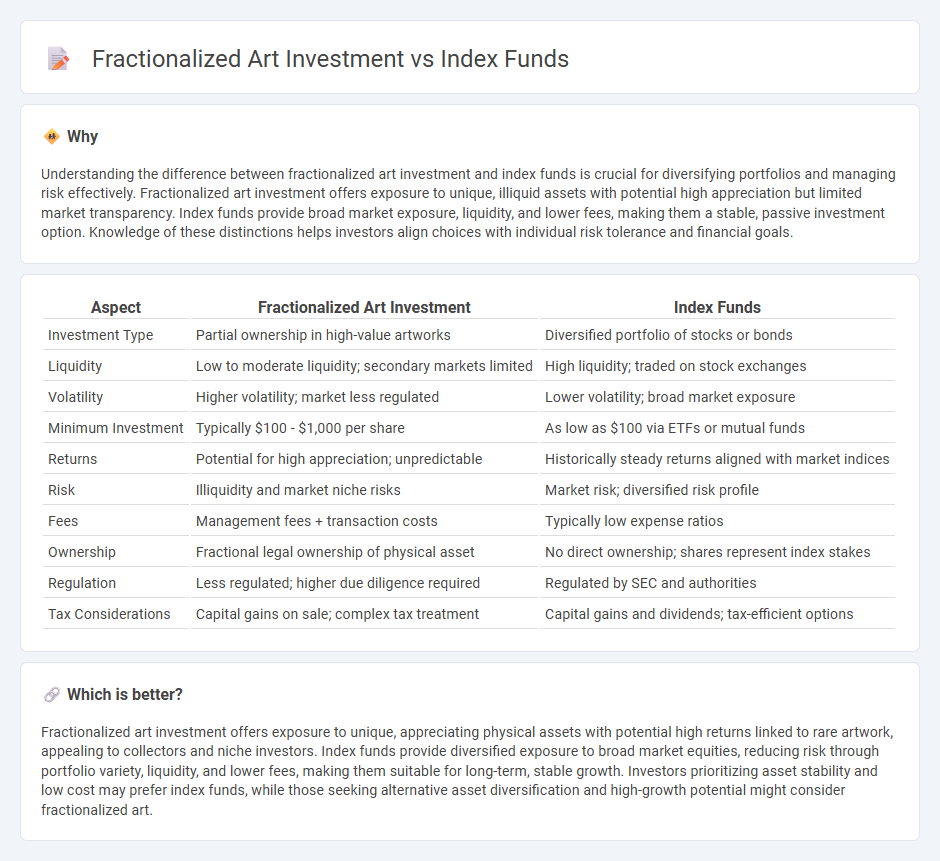

Understanding the difference between fractionalized art investment and index funds is crucial for diversifying portfolios and managing risk effectively. Fractionalized art investment offers exposure to unique, illiquid assets with potential high appreciation but limited market transparency. Index funds provide broad market exposure, liquidity, and lower fees, making them a stable, passive investment option. Knowledge of these distinctions helps investors align choices with individual risk tolerance and financial goals.

Comparison Table

| Aspect | Fractionalized Art Investment | Index Funds |

|---|---|---|

| Investment Type | Partial ownership in high-value artworks | Diversified portfolio of stocks or bonds |

| Liquidity | Low to moderate liquidity; secondary markets limited | High liquidity; traded on stock exchanges |

| Volatility | Higher volatility; market less regulated | Lower volatility; broad market exposure |

| Minimum Investment | Typically $100 - $1,000 per share | As low as $100 via ETFs or mutual funds |

| Returns | Potential for high appreciation; unpredictable | Historically steady returns aligned with market indices |

| Risk | Illiquidity and market niche risks | Market risk; diversified risk profile |

| Fees | Management fees + transaction costs | Typically low expense ratios |

| Ownership | Fractional legal ownership of physical asset | No direct ownership; shares represent index stakes |

| Regulation | Less regulated; higher due diligence required | Regulated by SEC and authorities |

| Tax Considerations | Capital gains on sale; complex tax treatment | Capital gains and dividends; tax-efficient options |

Which is better?

Fractionalized art investment offers exposure to unique, appreciating physical assets with potential high returns linked to rare artwork, appealing to collectors and niche investors. Index funds provide diversified exposure to broad market equities, reducing risk through portfolio variety, liquidity, and lower fees, making them suitable for long-term, stable growth. Investors prioritizing asset stability and low cost may prefer index funds, while those seeking alternative asset diversification and high-growth potential might consider fractionalized art.

Connection

Fractionalized art investment allows multiple investors to own shares in high-value artworks, enhancing accessibility and liquidity in the art market. Index funds, which pool capital to invest in a diversified set of assets, share this principle of fractional ownership by enabling investments in a broad portfolio with lower individual capital requirements. Both methods democratize investment opportunities, reduce risk through diversification, and provide scalable participation in traditionally exclusive markets.

Key Terms

Diversification

Index funds offer broad market exposure by pooling assets across various sectors, ensuring diversified risk through ownership of numerous stocks. Fractionalized art investment enables participation in high-value artworks by owning partial shares, potentially diversifying portfolios beyond traditional financial assets. Explore the benefits and risks of each approach to enhance your investment strategy.

Liquidity

Index funds offer high liquidity with shares easily bought and sold on stock exchanges at transparent prices, enabling quick portfolio adjustments. Fractionalized art investment provides limited liquidity as shares are traded less frequently in niche markets, often requiring longer holding periods and potentially higher transaction costs. Explore the detailed liquidity dynamics between these investment options to optimize your portfolio strategy.

Risk profile

Index funds typically offer lower risk through diversified exposure to broad market indices like the S&P 500, reducing volatility and potential losses. Fractionalized art investment carries higher risk due to market illiquidity, valuation subjectivity, and limited historical data, making returns less predictable. Explore the risk profiles of both options to determine the best fit for your investment strategy.

Source and External Links

Index Funds | Investor.gov - An overview of index funds, which are mutual funds or exchange-traded funds that track the returns of a market index.

What is an index fund? - Vanguard - Explanation of index funds as investments that track specific benchmarks like the S&P 500 or Dow Jones Industrial Average.

The Best Index Funds | Morningstar - A list of top-rated index funds that closely track their indexes, minimize costs, and follow sensible rules-based indexes.

dowidth.com

dowidth.com