Hedge fund replication strategies aim to mimic the risk and return profile of traditional hedge funds while offering lower fees and greater transparency compared to direct hedge fund investments. Index funds track market benchmarks, providing broad diversification with minimal management costs and predictable performance linked to the underlying index. Explore the key differences and benefits of hedge fund replication versus index funds to enhance your investment strategy.

Why it is important

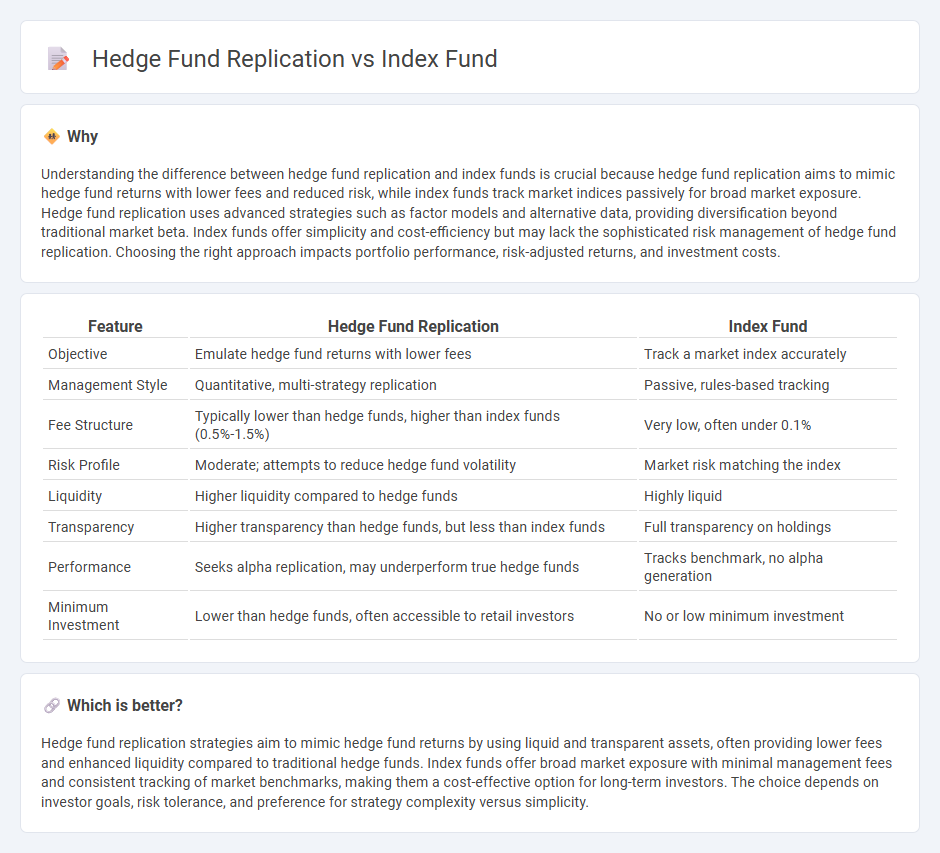

Understanding the difference between hedge fund replication and index funds is crucial because hedge fund replication aims to mimic hedge fund returns with lower fees and reduced risk, while index funds track market indices passively for broad market exposure. Hedge fund replication uses advanced strategies such as factor models and alternative data, providing diversification beyond traditional market beta. Index funds offer simplicity and cost-efficiency but may lack the sophisticated risk management of hedge fund replication. Choosing the right approach impacts portfolio performance, risk-adjusted returns, and investment costs.

Comparison Table

| Feature | Hedge Fund Replication | Index Fund |

|---|---|---|

| Objective | Emulate hedge fund returns with lower fees | Track a market index accurately |

| Management Style | Quantitative, multi-strategy replication | Passive, rules-based tracking |

| Fee Structure | Typically lower than hedge funds, higher than index funds (0.5%-1.5%) | Very low, often under 0.1% |

| Risk Profile | Moderate; attempts to reduce hedge fund volatility | Market risk matching the index |

| Liquidity | Higher liquidity compared to hedge funds | Highly liquid |

| Transparency | Higher transparency than hedge funds, but less than index funds | Full transparency on holdings |

| Performance | Seeks alpha replication, may underperform true hedge funds | Tracks benchmark, no alpha generation |

| Minimum Investment | Lower than hedge funds, often accessible to retail investors | No or low minimum investment |

Which is better?

Hedge fund replication strategies aim to mimic hedge fund returns by using liquid and transparent assets, often providing lower fees and enhanced liquidity compared to traditional hedge funds. Index funds offer broad market exposure with minimal management fees and consistent tracking of market benchmarks, making them a cost-effective option for long-term investors. The choice depends on investor goals, risk tolerance, and preference for strategy complexity versus simplicity.

Connection

Hedge fund replication strategies aim to mimic the risk-return profile of hedge funds using liquid, transparent, and low-cost instruments commonly found in index funds. By analyzing hedge fund holdings and factor exposures, replication models construct portfolios that closely track hedge fund performance without high fees or illiquidity. Index funds provide the essential building blocks for these replication techniques, enabling investors to access hedge fund-like returns through diversified, passive investment vehicles.

Key Terms

Passive management

Index fund replication involves passively tracking a market index using a fixed portfolio of securities, minimizing costs and reducing active decision-making. Hedge fund replication employs quantitative models to mimic hedge fund strategies while maintaining lower fees and improved transparency. Explore in-depth comparisons to understand which passive management approach aligns with your investment goals.

Tracking error

Index funds aim to replicate the performance of a specific benchmark with minimal tracking error, typically achieved through full or sampling replication methods. Hedge fund replication seeks to mimic hedge fund returns using systematic strategies, often resulting in higher tracking error due to the complexity and non-transparent nature of underlying assets. Explore the nuances of tracking error in different fund replication strategies to optimize portfolio performance.

Leverage

Index funds use minimal leverage to track market benchmarks passively, aiming for steady returns aligned with overall market performance. Hedge fund replication strategies incorporate controlled leverage to mimic hedge fund risk-return profiles while reducing fees and complexity. Discover how varying leverage levels impact portfolio risk management and performance by exploring detailed comparative analyses.

Source and External Links

What is an index fund? - Vanguard - An index fund tracks the performance of a specific benchmark like the S&P 500 or the Dow Jones Industrial Average by investing in all or a representative sample of the securities in the index.

Index Funds - Investor.gov - An index fund is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index, providing indirect investment in a market index.

Index fund - Wikipedia - An index fund is a mutual fund or exchange-traded fund designed to replicate the performance of a specified basket of underlying securities, often a market index like the S&P 500.

dowidth.com

dowidth.com