Wine funds offer investors exposure to the alternative asset class of fine wines, known for their historical value appreciation and low correlation with traditional markets. Shipping funds focus on the maritime transport sector, typically investing in vessel ownership and chartering, which are influenced by global trade dynamics and freight rates. Explore our detailed comparison to understand which fund aligns best with your investment goals.

Why it is important

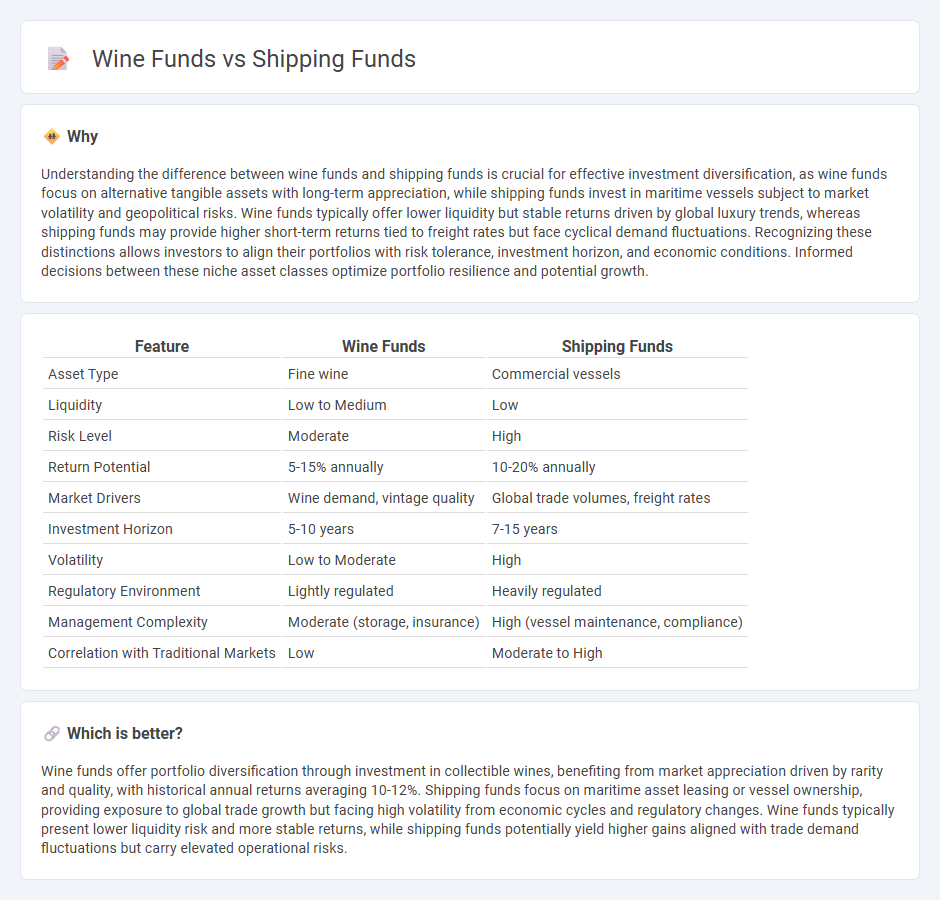

Understanding the difference between wine funds and shipping funds is crucial for effective investment diversification, as wine funds focus on alternative tangible assets with long-term appreciation, while shipping funds invest in maritime vessels subject to market volatility and geopolitical risks. Wine funds typically offer lower liquidity but stable returns driven by global luxury trends, whereas shipping funds may provide higher short-term returns tied to freight rates but face cyclical demand fluctuations. Recognizing these distinctions allows investors to align their portfolios with risk tolerance, investment horizon, and economic conditions. Informed decisions between these niche asset classes optimize portfolio resilience and potential growth.

Comparison Table

| Feature | Wine Funds | Shipping Funds |

|---|---|---|

| Asset Type | Fine wine | Commercial vessels |

| Liquidity | Low to Medium | Low |

| Risk Level | Moderate | High |

| Return Potential | 5-15% annually | 10-20% annually |

| Market Drivers | Wine demand, vintage quality | Global trade volumes, freight rates |

| Investment Horizon | 5-10 years | 7-15 years |

| Volatility | Low to Moderate | High |

| Regulatory Environment | Lightly regulated | Heavily regulated |

| Management Complexity | Moderate (storage, insurance) | High (vessel maintenance, compliance) |

| Correlation with Traditional Markets | Low | Moderate to High |

Which is better?

Wine funds offer portfolio diversification through investment in collectible wines, benefiting from market appreciation driven by rarity and quality, with historical annual returns averaging 10-12%. Shipping funds focus on maritime asset leasing or vessel ownership, providing exposure to global trade growth but facing high volatility from economic cycles and regulatory changes. Wine funds typically present lower liquidity risk and more stable returns, while shipping funds potentially yield higher gains aligned with trade demand fluctuations but carry elevated operational risks.

Connection

Wine funds and shipping funds both offer niche investment opportunities by leveraging alternative asset classes with potential for high returns and portfolio diversification. Wine funds capitalize on the appreciation of rare vintage wines, driven by factors such as limited supply and increasing demand among collectors. Shipping funds focus on maritime assets, including freight vessels and shipping contracts, benefiting from global trade fluctuations and long-term shipping demand.

Key Terms

Shipping Funds:

Shipping funds specialize in investments related to maritime transportation, including shipping companies, freight operators, and vessel leasing firms. These funds leverage global trade dynamics and fluctuating shipping rates to generate returns, often influenced by factors such as fuel prices, port congestion, and international trade policies. Explore in-depth insights on the performance and strategic advantages of shipping funds to enhance your investment portfolio.

Vessel Acquisition

Shipping funds specialize in vessel acquisition by investing in various types of ships, including container ships, tankers, and bulk carriers, aiming to generate returns through leasing or chartering these vessels. In contrast, wine funds allocate capital to purchasing and managing fine wine collections, focusing on value appreciation and market trends rather than physical asset acquisition like vessels. Explore the distinct advantages and strategies behind vessel acquisition in shipping funds to better understand their investment potential.

Charter Rates

Charter rates in shipping funds fluctuate based on vessel availability, fuel costs, and global trade demand, significantly impacting returns in maritime investments. Wine funds, contrastingly, are influenced by factors like vineyard yield, vintage quality, and market trends, showing minimal sensitivity to charter rates. Explore the detailed dynamics of how charter rates affect shipping funds versus the stability seen in wine investment portfolios.

Source and External Links

Maritime Finance: Key Investment Opportunities in Shipping - This article discusses the various sources of capital in maritime finance, including bank loans, equity financing, and private equity funds.

Private Equity & Shipping Funds - Moore provides services and advice for private equity funds investing in shipping, which is becoming increasingly attractive as an alternative investment.

Hanzevast Launches New Shipping Fund - Hanzevast, a Dutch investment company, has introduced a new shipping fund to support the maritime industry's sustainability needs.

dowidth.com

dowidth.com