Investing in music royalties offers a unique revenue stream driven by song performance and intellectual property rights, differing significantly from stock market investing, which relies on company equity growth and dividends. Music royalties provide passive income linked to streaming platforms, radio plays, and licensing deals, while stocks expose investors to market volatility and broader economic trends. Discover more about how these distinct investment options compare and complement each other.

Why it is important

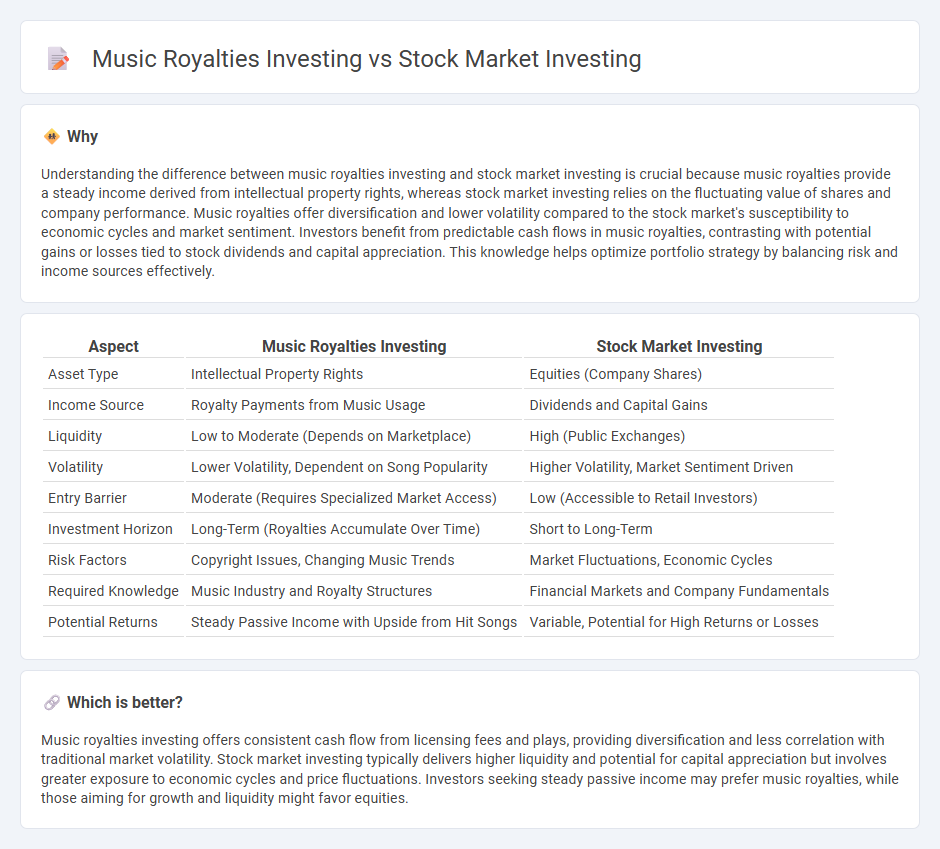

Understanding the difference between music royalties investing and stock market investing is crucial because music royalties provide a steady income derived from intellectual property rights, whereas stock market investing relies on the fluctuating value of shares and company performance. Music royalties offer diversification and lower volatility compared to the stock market's susceptibility to economic cycles and market sentiment. Investors benefit from predictable cash flows in music royalties, contrasting with potential gains or losses tied to stock dividends and capital appreciation. This knowledge helps optimize portfolio strategy by balancing risk and income sources effectively.

Comparison Table

| Aspect | Music Royalties Investing | Stock Market Investing |

|---|---|---|

| Asset Type | Intellectual Property Rights | Equities (Company Shares) |

| Income Source | Royalty Payments from Music Usage | Dividends and Capital Gains |

| Liquidity | Low to Moderate (Depends on Marketplace) | High (Public Exchanges) |

| Volatility | Lower Volatility, Dependent on Song Popularity | Higher Volatility, Market Sentiment Driven |

| Entry Barrier | Moderate (Requires Specialized Market Access) | Low (Accessible to Retail Investors) |

| Investment Horizon | Long-Term (Royalties Accumulate Over Time) | Short to Long-Term |

| Risk Factors | Copyright Issues, Changing Music Trends | Market Fluctuations, Economic Cycles |

| Required Knowledge | Music Industry and Royalty Structures | Financial Markets and Company Fundamentals |

| Potential Returns | Steady Passive Income with Upside from Hit Songs | Variable, Potential for High Returns or Losses |

Which is better?

Music royalties investing offers consistent cash flow from licensing fees and plays, providing diversification and less correlation with traditional market volatility. Stock market investing typically delivers higher liquidity and potential for capital appreciation but involves greater exposure to economic cycles and price fluctuations. Investors seeking steady passive income may prefer music royalties, while those aiming for growth and liquidity might favor equities.

Connection

Music royalties investing and stock market investing both offer alternative income streams and portfolio diversification, as investors acquire rights or equity shares that generate passive income over time. Both markets rely on valuation metrics, risk assessment, and market trends, where music royalty rights represent intellectual property assets while stocks symbolize ownership in companies. These investment strategies enable participants to capitalize on economic shifts and consumer behavior, balancing potential returns with volatility in entertainment and financial sectors.

Key Terms

Equity (Stock market)

Equity investing in the stock market offers ownership in publicly traded companies, providing potential dividends and capital appreciation based on company performance and market conditions. Unlike music royalties, which generate income from intellectual property rights, stock investments are subject to market volatility and economic cycles, impacting share prices and returns. Explore detailed comparisons to understand risk, liquidity, and income stability between these asset classes.

Dividends (Stock market)

Stock market investing offers dividends as a form of passive income, typically distributed quarterly by stable, dividend-paying companies with histories of consistent earnings and cash flow. Music royalties investing generates income through mechanical and performance royalties, which can provide ongoing payments tied to the popularity and usage of the music catalog. Explore the distinct dividend models and revenue streams to determine which investment aligns best with your financial goals.

Royalty Payments (Music royalties)

Stock market investing offers variable dividend payments influenced by company performance and market fluctuations, while music royalties provide more consistent royalty payments derived from copyright ownership and licensing agreements. Royalty payments in music investing are tied to the usage and popularity of songs across streaming platforms, broadcasts, and public performances, offering a relatively stable income stream independent of economic cycles. Explore how music royalties can diversify your investment portfolio and generate passive income over time.

Source and External Links

Stocks | Investor.gov - Stocks represent ownership shares in a company and can be bought through direct stock plans, dividend reinvestment plans, brokers, or stock funds, which are mutual funds focusing on equities.

How to Invest in Stocks: 2025 Beginner's Guide - NerdWallet - Beginners can start investing in stocks with a brokerage account, even with small amounts or fractional shares, and should consider diversifying investments using stock funds like ETFs or mutual funds.

The Basics of Investing In Stocks - Common ways to buy stocks include direct stock plans through companies, dividend reinvestment plans, brokers who charge commissions, and stock funds, providing various options depending on investor needs.

dowidth.com

dowidth.com