Virtual land real estate offers tangible, digital assets within metaverse platforms, providing users ownership and development rights in immersive 3D environments, while cryptocurrencies function as decentralized digital currencies primarily used for transactions and investment purposes. Both asset classes present unique volatility profiles, liquidity considerations, and regulatory challenges, attracting diverse investor profiles interested in blockchain-based innovation. Explore the distinct investment opportunities and risks associated with virtual land and cryptocurrencies to make informed decisions.

Why it is important

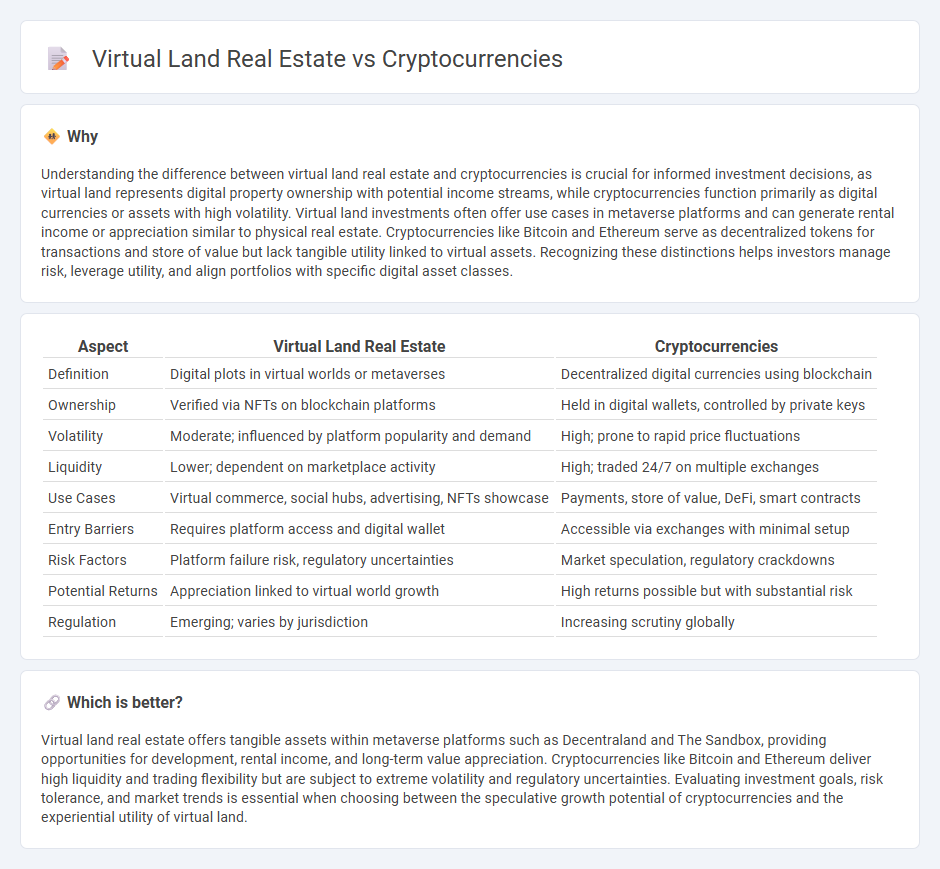

Understanding the difference between virtual land real estate and cryptocurrencies is crucial for informed investment decisions, as virtual land represents digital property ownership with potential income streams, while cryptocurrencies function primarily as digital currencies or assets with high volatility. Virtual land investments often offer use cases in metaverse platforms and can generate rental income or appreciation similar to physical real estate. Cryptocurrencies like Bitcoin and Ethereum serve as decentralized tokens for transactions and store of value but lack tangible utility linked to virtual assets. Recognizing these distinctions helps investors manage risk, leverage utility, and align portfolios with specific digital asset classes.

Comparison Table

| Aspect | Virtual Land Real Estate | Cryptocurrencies |

|---|---|---|

| Definition | Digital plots in virtual worlds or metaverses | Decentralized digital currencies using blockchain |

| Ownership | Verified via NFTs on blockchain platforms | Held in digital wallets, controlled by private keys |

| Volatility | Moderate; influenced by platform popularity and demand | High; prone to rapid price fluctuations |

| Liquidity | Lower; dependent on marketplace activity | High; traded 24/7 on multiple exchanges |

| Use Cases | Virtual commerce, social hubs, advertising, NFTs showcase | Payments, store of value, DeFi, smart contracts |

| Entry Barriers | Requires platform access and digital wallet | Accessible via exchanges with minimal setup |

| Risk Factors | Platform failure risk, regulatory uncertainties | Market speculation, regulatory crackdowns |

| Potential Returns | Appreciation linked to virtual world growth | High returns possible but with substantial risk |

| Regulation | Emerging; varies by jurisdiction | Increasing scrutiny globally |

Which is better?

Virtual land real estate offers tangible assets within metaverse platforms such as Decentraland and The Sandbox, providing opportunities for development, rental income, and long-term value appreciation. Cryptocurrencies like Bitcoin and Ethereum deliver high liquidity and trading flexibility but are subject to extreme volatility and regulatory uncertainties. Evaluating investment goals, risk tolerance, and market trends is essential when choosing between the speculative growth potential of cryptocurrencies and the experiential utility of virtual land.

Connection

Virtual land real estate and cryptocurrencies are interconnected through blockchain technology, which ensures secure, transparent transactions and ownership verification in digital environments. Cryptocurrencies serve as the primary medium of exchange for purchasing virtual land within metaverse platforms like Decentraland and The Sandbox. The rising market value of virtual real estate is largely driven by the growing adoption of crypto assets, enabling investors to diversify portfolios by integrating digital asset classes with decentralized finance mechanisms.

Key Terms

Blockchain

Blockchain technology underpins both cryptocurrencies and virtual land real estate, ensuring secure, transparent transactions and ownership verification in decentralized digital environments. Cryptocurrencies like Bitcoin and Ethereum facilitate value exchange, while virtual land platforms such as Decentraland and The Sandbox leverage blockchain to enable users to buy, sell, and develop digital property with verifiable scarcity. Explore the evolving intersection of blockchain with digital assets to understand the future of decentralized ownership.

Digital Ownership

Cryptocurrencies provide decentralized financial assets secured by blockchain technology, enabling transparent and immutable ownership records. Virtual land real estate represents digital parcels within metaverse platforms where users can buy, sell, and develop properties, offering unique ownership experiences backed by NFTs. Explore how these digital ownership models redefine asset management and investment opportunities in the evolving digital economy.

Tokenization

Tokenization revolutionizes both cryptocurrencies and virtual land real estate by converting assets into digital tokens on a blockchain, enabling fractional ownership, enhanced liquidity, and transparent transactions. Cryptocurrencies primarily serve as decentralized digital currencies, while tokenized virtual land provides investors with verifiable rights to digital property within metaverse platforms. Explore how tokenization bridges finance and digital real assets to unlock new investment opportunities and reshape the future of asset ownership.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a decentralized digital currency secured by cryptography, operating on a peer-to-peer blockchain system without central banks or intermediaries, with Bitcoin as the first and best-known example.

Cryptocurrency - Wikipedia - Cryptocurrencies are digital currencies managed via blockchain computer networks independent of central authorities, using consensus mechanisms like proof of work or proof of stake, with over 25,000 types existing as of 2023 and a market capitalization estimated at $2.76 trillion in 2025.

How Does Cryptocurrency Work? A Beginner's Guide - Coursera - Cryptocurrencies use blockchain and cryptographic techniques to securely issue and verify transactions, allowing fast, low-cost, peer-to-peer global payments without government backing, stored in digital wallets accessed by private keys.

dowidth.com

dowidth.com