Blue economy funds target sustainable investments in marine industries, driving growth in sectors like fisheries, renewable ocean energy, and coastal tourism, while fixed income funds focus on providing steady returns through bonds and debt securities with lower risk. Blue economy funds offer potential for high impact and diversification but come with higher volatility compared to the stable income generated by fixed income investments. Explore how each fund type aligns with your investment goals and environmental values.

Why it is important

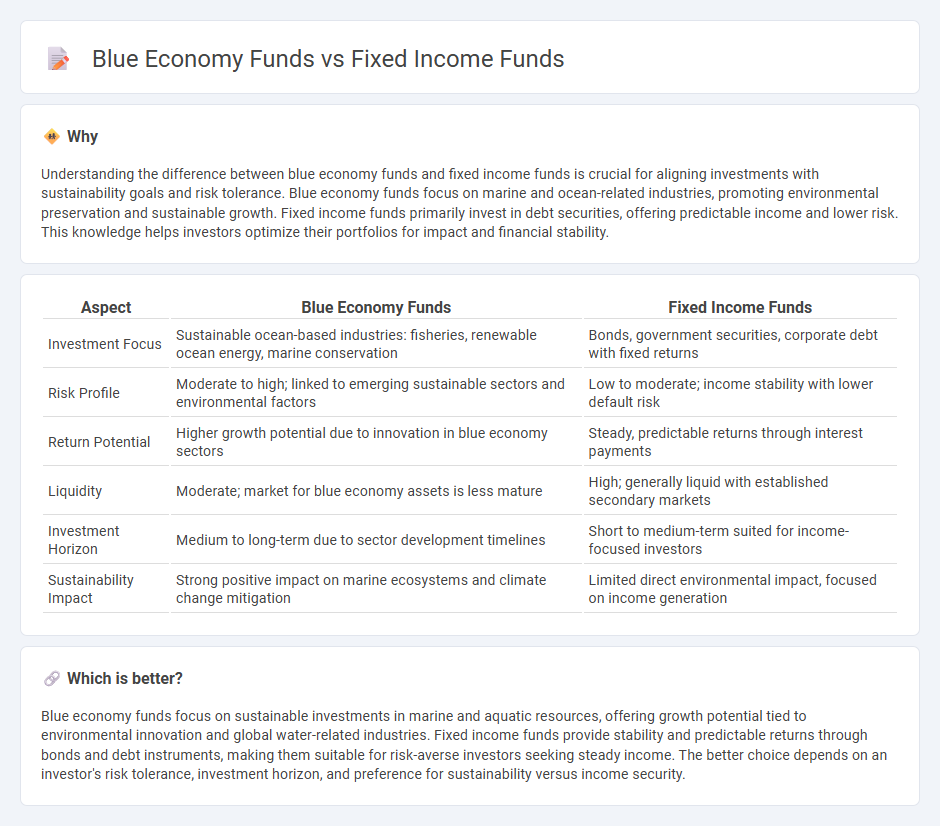

Understanding the difference between blue economy funds and fixed income funds is crucial for aligning investments with sustainability goals and risk tolerance. Blue economy funds focus on marine and ocean-related industries, promoting environmental preservation and sustainable growth. Fixed income funds primarily invest in debt securities, offering predictable income and lower risk. This knowledge helps investors optimize their portfolios for impact and financial stability.

Comparison Table

| Aspect | Blue Economy Funds | Fixed Income Funds |

|---|---|---|

| Investment Focus | Sustainable ocean-based industries: fisheries, renewable ocean energy, marine conservation | Bonds, government securities, corporate debt with fixed returns |

| Risk Profile | Moderate to high; linked to emerging sustainable sectors and environmental factors | Low to moderate; income stability with lower default risk |

| Return Potential | Higher growth potential due to innovation in blue economy sectors | Steady, predictable returns through interest payments |

| Liquidity | Moderate; market for blue economy assets is less mature | High; generally liquid with established secondary markets |

| Investment Horizon | Medium to long-term due to sector development timelines | Short to medium-term suited for income-focused investors |

| Sustainability Impact | Strong positive impact on marine ecosystems and climate change mitigation | Limited direct environmental impact, focused on income generation |

Which is better?

Blue economy funds focus on sustainable investments in marine and aquatic resources, offering growth potential tied to environmental innovation and global water-related industries. Fixed income funds provide stability and predictable returns through bonds and debt instruments, making them suitable for risk-averse investors seeking steady income. The better choice depends on an investor's risk tolerance, investment horizon, and preference for sustainability versus income security.

Connection

Blue economy funds and fixed income funds intersect through their focus on sustainable investments that generate steady returns while supporting marine and ocean-based economic activities. Blue economy funds often allocate capital to projects like renewable marine energy, sustainable fisheries, and ocean conservation, which can be financed through fixed income instruments such as green bonds and impact bonds. This integration enables investors to benefit from predictable income streams while promoting environmental sustainability in the maritime sector.

Key Terms

Yield (Fixed Income Funds)

Fixed income funds primarily generate consistent yield through investments in bonds, government securities, and corporate debt, offering predictable income streams with comparatively lower risk. Blue economy funds invest in ocean-related industries such as sustainable fisheries, marine biotechnology, and clean energy, emphasizing long-term environmental impact rather than immediate yield. Explore the distinct benefits and performance metrics of fixed income versus blue economy funds to optimize your investment portfolio.

Marine Conservation (Blue Economy Funds)

Blue Economy Funds specifically target investments in sustainable marine industries, promoting marine conservation while generating returns by supporting sectors like fisheries, renewable ocean energy, and marine biotechnology. Fixed income funds, by contrast, prioritize steady income through bonds and debt instruments, often lacking a dedicated focus on environmental or conservation goals. Explore how aligning investments with marine conservation objectives can create both financial value and ecological impact.

Risk Profile

Fixed income funds primarily invest in government and corporate bonds, offering lower risk and more stable returns suitable for conservative investors seeking predictable income. Blue economy funds focus on sustainable marine and ocean-related industries, presenting higher growth potential but increased volatility due to sector-specific risks and environmental factors. Explore detailed risk assessments and performance metrics to make informed investment choices in these fund types.

Source and External Links

What Are Fixed-Income Investments - This webpage provides information on fixed-income investments, including their role in diversified portfolios and available products such as municipal bonds and treasury bonds.

Fixed Income Investments - This webpage discusses the benefits and risks of fixed-income investments, including their ability to generate income and provide diversification in portfolios.

Fixed income & bonds - It offers access to a wide range of fixed-income investment options, including CDs, bond funds, individual bonds, and professionally managed portfolios.

dowidth.com

dowidth.com