Royalty streaming offers investors a share of revenue generated by an asset, providing ongoing income without ownership dilution, while debt financing involves borrowing funds with a fixed repayment schedule and interest obligations. Investors often prefer royalty streaming for its potential upside linked to asset performance, contrasting with the predictable but limited returns from debt instruments. Explore more to understand which investment strategy aligns with your financial goals.

Why it is important

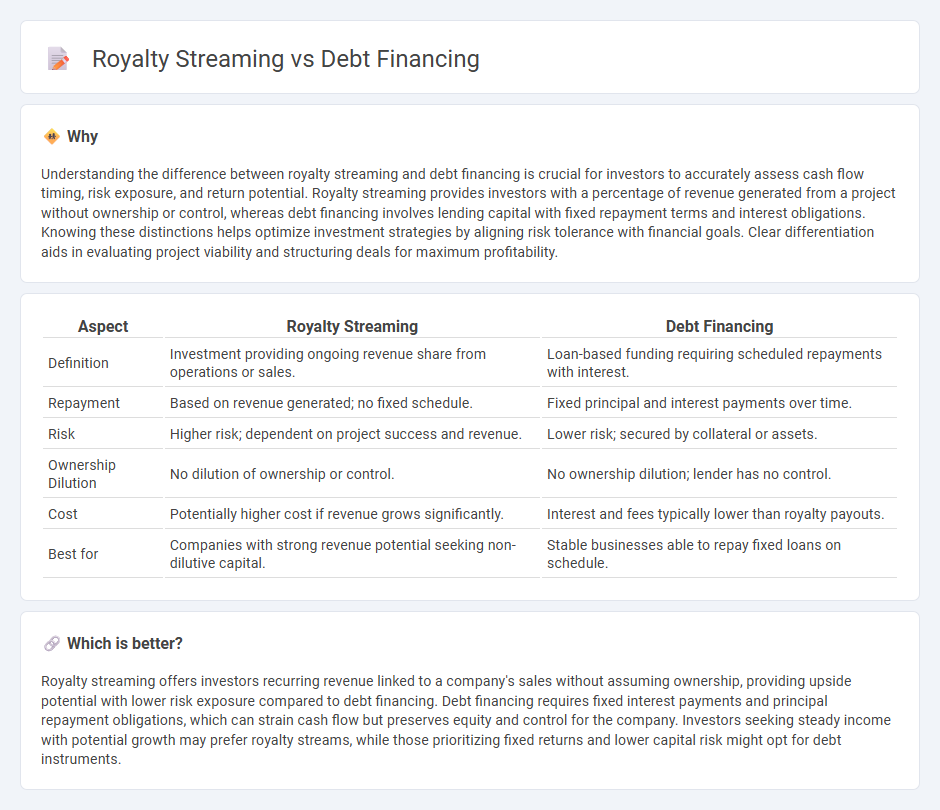

Understanding the difference between royalty streaming and debt financing is crucial for investors to accurately assess cash flow timing, risk exposure, and return potential. Royalty streaming provides investors with a percentage of revenue generated from a project without ownership or control, whereas debt financing involves lending capital with fixed repayment terms and interest obligations. Knowing these distinctions helps optimize investment strategies by aligning risk tolerance with financial goals. Clear differentiation aids in evaluating project viability and structuring deals for maximum profitability.

Comparison Table

| Aspect | Royalty Streaming | Debt Financing |

|---|---|---|

| Definition | Investment providing ongoing revenue share from operations or sales. | Loan-based funding requiring scheduled repayments with interest. |

| Repayment | Based on revenue generated; no fixed schedule. | Fixed principal and interest payments over time. |

| Risk | Higher risk; dependent on project success and revenue. | Lower risk; secured by collateral or assets. |

| Ownership Dilution | No dilution of ownership or control. | No ownership dilution; lender has no control. |

| Cost | Potentially higher cost if revenue grows significantly. | Interest and fees typically lower than royalty payouts. |

| Best for | Companies with strong revenue potential seeking non-dilutive capital. | Stable businesses able to repay fixed loans on schedule. |

Which is better?

Royalty streaming offers investors recurring revenue linked to a company's sales without assuming ownership, providing upside potential with lower risk exposure compared to debt financing. Debt financing requires fixed interest payments and principal repayment obligations, which can strain cash flow but preserves equity and control for the company. Investors seeking steady income with potential growth may prefer royalty streams, while those prioritizing fixed returns and lower capital risk might opt for debt instruments.

Connection

Royalty streaming and debt financing are connected through their role in providing alternative capital structures for companies, especially in resource-based industries. Royalty streaming involves investors funding operations in exchange for a percentage of future revenues, while debt financing requires repayment of borrowed capital with interest. Both methods enable firms to access liquidity without immediately diluting equity, aligning investor returns with business cash flows.

Key Terms

Principal Repayment

Debt financing requires fixed principal repayments according to a predetermined schedule, ensuring predictable cash outflows for borrowers. Royalty streaming involves no principal repayment, as investors receive a percentage of revenue generated, linking returns directly to production performance. Explore more to understand how these differences impact financial strategies and risk profiles.

Interest Rate

Debt financing typically involves fixed or variable interest rates ranging from 4% to 12%, depending on credit risk and market conditions. Royalty streaming structures often feature lower effective interest costs as repayments are tied to revenue shares without traditional interest, reducing the burden during revenue downturns. Explore the nuances of interest rate implications in both financing models to better understand strategic investment decisions.

Revenue Sharing

Debt financing typically involves borrowing capital that must be repaid with interest, offering lenders fixed returns without ownership stakes. Royalty streaming provides investors with a percentage of revenue from a project's future sales, aligning returns with performance and offering long-term income potential. Explore further to understand which model best suits your financial goals and risk tolerance.

Source and External Links

Debt Financing - Overview, Options, Pros and Cons - Debt financing occurs when a company raises money by selling debt instruments like bank loans or bonds, agreeing to repay the principal plus interest, and is commonly used by established businesses with steady cash flow.

Debt Financing: Definition & How It Works - Carta - Companies can obtain debt financing through bank loans, credit lines, bonds, or private credit, with startups often using venture debt alongside equity rounds to avoid further ownership dilution.

What is debt financing? | Definition & Meaning - Taulia - Common forms of debt financing include business loans, invoice financing (borrowing against receivables), and asset-based lending (using company assets as collateral), offering flexibility for operational or expansion needs.

dowidth.com

dowidth.com